Metal Stamping Industry Overview

The global metal stamping market size was valued at USD 206.01 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 4.7% from 2022 to 2030.

The growing consumer electronics industry is likely to remain a key driving factor on account of the application of metal frames in mobile phones, headphones, speakers, and gamepads & controllers. In mobile phones, metal stamping is used in manufacturing antennas, chassis, and camera lens holders as it offers high tolerance, corrosion resistance, electrical conductivity, and a smooth finish. According to GSM Association, the global number of unique mobile subscribers was 5.31 billion in January 2021 and this number is growing at a rate of 1.8% per annum.

Gather more insights about the market drivers, restrains and growth of the Global Metal Stamping Market

This is likely to propel the demand for mobile phones and eventually metal stamping in the coming years. The U.S. is among the prominent players in the industry. However, the emergence of COVID-19 and subsequent temporary lockdown measures countrywide impacted the operations of the industry. The downstream demand from key sectors including automotive, aerospace, industrial machinery, and others was largely disrupted owing to the challenges in the supply chain and dried-up demand from end-use customers. The situation has normalized as the rate of vaccination has picked up pace. The growing demand for metal stamping in the U.S. has compelled manufacturers to expand their facilities.

For instance, in December 2020, General Motors Co. announced its plans about investing USD 6 million in its metal stamping facility in Parma, Ohio, U.S. The investment will be used to construct four new metal assembly cells to support the increasing production of Chevrolet Silverado and GMC Sierra pickup trucks. According to the International Energy Agency (IEA), global Electric Vehicle (EV) sales surpassed 3.4 million, out of which, China accounted for over 50% in 2021. Government initiatives, such as electric car subsidies to local manufacturers to support the growth of EVs are major factors responsible for the increased production. This is likely to boost the usage of sheet metal during the production of auto components.

These components include chassis, interior and exterior structural, and transmission components. This, in turn, is expected to drive market growth during the forecast period. The market growth can be hindered as automobile manufacturers are replacing metals with plastic and carbon fiber as they assist in the weight reduction of vehicles. A 10% reduction in the weight of the vehicle results in a 5% to 7% increase in fuel efficiency. The increasing production of lightweight vehicles owing to the stringent government regulations in various countries is anticipated to drive the demand for substitute products. For instance, in the U.S., developments in the Corporate Average Fuel Economy (CAFE) regulations to enhance fuel efficiency are encouraging the use of these substitute products in automobiles, which, in turn, is likely to hamper the market for metal stamping.

Browse through Grand View Research's Advanced Interior Materials Industry Related Reports

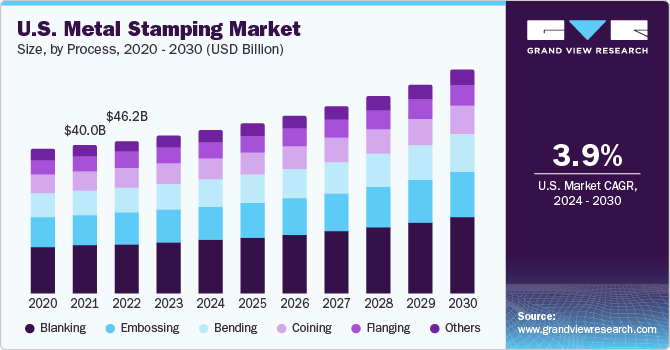

- U.S. And Mexico Metal Stamping Market - The U.S. and Mexico metal stamping market size was valued at USD 51.6 billion in 2021 and is expected to expand at a CAGR of 4.4% from 2022 to 2030. Growing demand from various industries such as Electric Vehicles (EVs), industrial machinery, and consumer appliances are the key growth drivers for the market.

- Automotive Metal Stamping Market - Automotive metal stamping market size was USD 70.42 billion in 2015. Automotive metal stamping is a process of converting sheet metal into shapes & sizes based on the end-user requirements. The industry is highly influenced by metal consumption patterns in all applications segments.

Market Share Insights

May 2020: Ford Motor Company had to pause its production at its Chicago Stamping Plant to complete enhanced cleaning and follow safety protocols for COVID-19.

March 2020: Apple asked its key manufacturing partners to explore options to shift 15-30% of its hardware products from China to India, South East Asia, or Vietnam.

Key Companies profiled:

Some prominent players in the global Metal Stamping market include

- Acro Metal Stamping

- Manor Tool & Manufacturing Company

- D&H Industries, Inc.

- Kenmode, Inc.

- Klesk Metal Stamping Co.

- Clow Stamping Company

- Goshen Stamping Company

- Tempco Manufacturing Company, Inc.

- Interplex Holdings Pte. Ltd.

- CAPARO

- Nissan Motor Co., Ltd.

- AAPICO Hitech Public Company Ltd.

- Gestamp

- Ford Motor Company

Order a free sample PDF of the Metal Stamping Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment