Neurovascular Devices Industry Overview

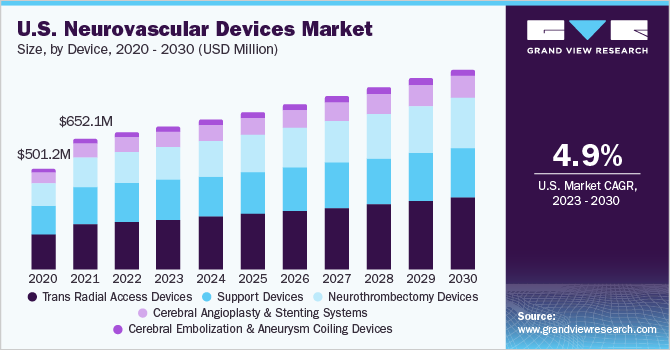

The global neurovascular devices market size was valued at USD 2.68 billion in 2021 and is anticipated to expand at a CAGR of 6.0% in the forecast period.

The increasing prevalence of neurological disorders, technological advancements and increasing demand for minimally invasive procedures are expected to drive the market. Interventional neurology devices are used for the diagnosis and treatment of vascular disease of the brain and central nervous system. Interventional neurology includes endovascular, catheter-based techniques, angiography, and fluoroscopy. Catheter angiography is one of the oldest primaries in-vivo brain vascular imaging modalities used for the diagnosis of several neurological conditions such as cerebral aneurysm, arteriovenous malformations, intracranial stenosis, arteriovenous fistula, and vasculitis.

The COVID-19 is expected to have a short-term and moderate impact on the market. The impact of the outbreak on the market varies per country, depending on the local state of health systems and the actions taken to combat the pandemic. Neurocare and neurosurgeons have been adversely impacted by the pandemic. To reduce the spread of the coronavirus, brain surgeries have frequently been postponed or even cancelled during this timeframe.

Gather more insights about the market drivers, restrains and growth of the Global Neurovascular Devices Market

In worst-affected nations, such as the U.S., Russia, India, Brazil, France, the U.K., Italy, and Spain, neurosurgical operations fell by 55%. However, according to a research study “COVID-19 and stroke: A review” published in Elsevier journal (International Hemorrhagic Stroke Association) (Jan 2021), up to 36% of hospitalized COVID-19 patients might exhibit neurological symptoms and there were several cases related to ischemic & hemorrhagic infarction.

A case study published in the Journal of Neurology, Neurosurgery & Psychiatry (BMJ Publishing Group Ltd.) has projected a possible link between COVID-19 infection and acute necrotizing encephalitis. These findings also suggest that COVID-19 might enhance sales in neurology industry, especially for catheters. Thus, these factors are expected to create lucrative opportunities for the market to grow in the near future, providing profitable opportunities for key players post COVID-19.

Increase in incidence of neurological disorders such as brain/ cerebral aneurysm, strokes, epilepsy amongst many others in several countries is expected to drive the market growth. According to the NHS England, around 1 in 12,500 people in England have ruptured brain aneurysm every year. Furthermore, around 3% of the adults in the U.K. have a cerebral aneurysm. Increasing prevalence of hypertension, alcohol consumption and smoking results in brain aneurysm.

According to the Brain Aneurysm Foundation, an estimated 6 million Americans are affected by cerebral aneurysms each year. Every year, the disease kills half a million people globally. Approximately 40% of ruptures result in death, and approximately 66% of those who survive have some permanent brain damage. Thus, the vast and rapidly growing patient population base for target diseases across the key markets is primarily responsible for the significant volume consumption of neurovascular devices, leading to market growth.

A slew of potential new technologies for the neurointerventional field are on the horizon. For instance, in Oct 2020, BENDIT Technologies, leader in the development of steerable microcatheters, announced the successful results of the BENDIT neuro microcatheter, in Sheba Medical Center, Israel. Also, Replicator by Mentice is a latest neurovascular-specialized flow system that generates an extraordinarily realistic hemodynamic environment for the application of medical devices. This technology is explicitly suitable for neurovascular devices for the treatment of aneurysm and strokes.

The innovative technologies will continue to broaden the range of neuroendovascular tools available for treating a wide range of aneurysm types with greater safety and efficacy. It is fair to say that intracranial aneurysm management is constantly evolving, with sophisticated technology at the forefront of innovation. Thereby, the availability of new treatment options will significantly increase demand for neurovascular devices in the years ahead.

Stroke is the most common cause of death, followed by heart and cancer diseases worldwide. For instance, according to CDC, in 2018, 15.2 million deaths of the 56.9 million deaths worldwide were due to stroke. Acute Ischemic Stroke (AIS) is the most common form of stroke, caused due to reduced blood supply to the brain, making brain cells to die. For instance, according to the U.S. CDC, 87.0% of strokes are classified as ischemic strokes, with the U.S. being the most affected country.

According to the Southwestern Medical Center, about 795,000 people in the U.S. suffer from a stroke every year. Furthermore, according to the National Center for Biotechnology Information (NCBI), strokes occur more commonly in women than men, especially in elderly population (aged 55 to 65). Therefore, such high prevalence of acute ischemic stroke is anticipated to boost the market growth over the forecast period.

There are various other technologies used in the development of neurothrombectomy devices for the treatment of AIS and its associated symptoms. For instance, in April 2019, Medtronic announced the launch of its fourth-generation Solitaire X revascularization device, which is designed for the treatment of AIS. Furthermore, In May 2019, Vesalio received CE mark approval for NeVa—an advanced neurothrombectomy device, featuring an optimized delivery system for efficient results. These devices expand on Drop Zone and Smart Maker technologies, introducing features such as distal filter.

In August 2020, an Israel based company, Rapid Medical, has been granted European regulatory clearance to launch and commercialize its ‘TIGERTRIEVER XL device for removing large ischemic stroke-causing clots from intracranial vessels. Thus, the introduction of technologically advanced products and rapid product approval process are factors expected to fuel market growth.

Browse through Grand View Research's Medical Devices Industry Related Reports

- Neurothrombectomy Devices Market - The global neurothrombectomy devices market size was valued at USD 617.28 million in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 6.7% during the forecast period. Increasing incidences of acute ischemic stroke on the global scale are majorly driving the market.

- Neurovascular Catheters Market - The global neurovascular catheters market size was valued at USD 2.88 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.7% from 2021 to 2028. The increasing prevalence of neurological conditions such as brain aneurysm and stroke, increasing disposable income, and new product launch by the key market players are some of the prime factors driving the market.

Market Share Insights

December 2020: Terumo Corporation launched the WEB Embolization System (Product name in Japan: Woven EndoBridge Device), an intrasaccular aneurysm treatment device. The device is a first-of-its-kind intrasaccular flow disruptor device available for the Japanese market.

August 2020: Stryker Corporation launched the Surpass Evolve Flow Diverter following approval from the U.S. FDA. It is the first 64-wire cobalt-chromium flow diverter in the United States, and it is intended to aid aneurysms heal.

Key Companies profiled:

Some prominent players in the global Neurovascular Devices market include

- Medtronic

- Johnson and Johnson Services Inc.

- Penumbra, Inc.

- Microport Scientific Corporation

- Stryker

- Microvention Inc (Terumo Corporation)

- Codman Neuro (Integra Lifesciences)

Order a free sample PDF of the Neurovascular Devices Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment