U.S. Epigenetics Market Growth & Trends

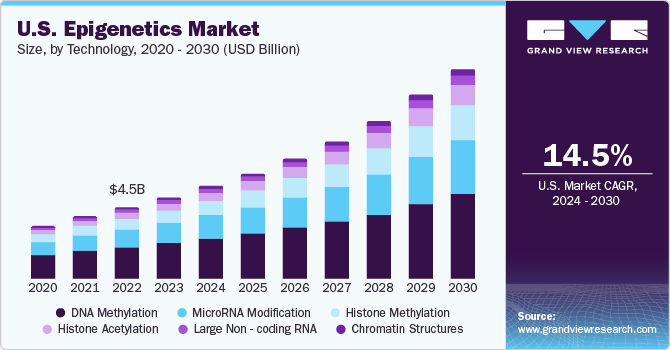

The U.S. Epigenetics Market size is anticipated to reach USD 13.10 billion by 2030, growing at a CAGR of 14.5% from 2024 to 2030, according to a new report by Grand View Research, Inc. The growing prevalence of cancer and chronic diseases, advancements in epigenetic research and technologies, rising investment in biomedical research, and increasing adoption of personalized medicine are anticipated to increase the demand for epigenetics over the forecast period.

The COVID-19 pandemic has had a positive impact on the market. The pandemic spurred a significant increase in research activities related to understanding the virus and its effects on human health. This included epigenetic research to study how COVID-19 affects gene expression and immune responses. Consequently, there was increased funding from both government and private sectors for epigenetic studies related to COVID-19.

Moreover, companies have increased investments in the development of epigenetics products. Many biotechnology and pharmaceutical companies have increased their research and development budgets to explore the role of epigenetics in disease mechanisms and treatment responses. This influx of funding has accelerated the pace of discoveries and innovations in the field. The transition from external funding to domestic investment in health systems underscores the need for innovative solutions. Epigenetics, embedded in advancing healthcare, is projected to transform the phase by offering solutions for improving health outcomes.

However, the growth of the market is constrained by a scarcity of skilled professionals. The complex nature of epigenetics demands a deep understanding of genetics, molecular biology, and data analysis. This shortage can decelerate research & technological progress, hinder complex data analysis crucial for insights, slow clinical translation, and hamper educational initiatives. This is anticipated to hamper the growth of the market to a certain extent.

Curious about the U.S. Epigenetics Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

U.S. Epigenetics Market Report Highlights

- Reagents dominated the product segment with the largest revenue share of 32.5% in 2023. Reagents are versatile and used in a wide range of applications, including basic research, clinical diagnostics, and drug development. On the other hand, services are expected to grow at the fastest CAGR over the forecast period.

- The DNA methylation held the largest market share in 2023 for the technology segment. DNA methylation is one of the key epigenetic modifications that plays a vital role in regulating gene expression. However, on the other hand, histone acetylation is expected to grow at the fastest CAGR over the forecast period.

- The oncology held the largest market share in 2023 for the application segment. This is attributed to the growing prevalence of cancer. However, on the other hand, non-oncology is expected to grow at the fastest CAGR over the forecast period.

- Based on end-use, academic research dominated the segment with the largest revenue share in 2023. This is attributed to the increasing number of clinical studies which are being conducted in academic institutes and the growing funding for research activities. On the other hand, clinical research is anticipated to grow at the fastest CAGR over the forecast period.

U.S. Epigenetics Market Segmentation

Grand View Research has segmented the U.S. epigenetics market based on product, technology, application, and end-use:

U.S. Epigenetics Product Outlook (Revenue, USD Million, 2018 - 2030)

- Reagents

- Kits

- ChIP Sequencing Kit

- Whole Genomic Amplification Kit

- Bisulfite Conversion Kit

- RNA Sequencing Kit

- Others

- Instruments

- Enzymes

- Services

U.S. Epigenetics Technology Outlook (Revenue, USD Million, 2018 - 2030)

- DNA Methylation

- Histone Methylation

- Histone Acetylation

- Large Non - coding RNA

- MicroRNA Modification

- Chromatin Structures

U.S. Epigenetics Application Outlook (Revenue, USD Million, 2018 - 2030)

- Oncology

- Solid Tumors

- Liquid Tumors

- Non – oncology

- Inflammatory Diseases

- Metabolic Diseases

- Infectious Diseases

- Cardiovascular Diseases

- Others

U.S. Epigenetics End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Academic Research

- Clinical Research

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Others

Download your FREE sample PDF copy of the U.S. Epigenetics Market today and explore key data and trends.

No comments:

Post a Comment