Seam Tapes Market Growth & Trends

The global Seam Tapes Market size was estimated at USD 164.0 billion in 2023 and is expected to grow at a CAGR of 6.5% from 2024 to 2030. One of the primary reasons for the growth of the seam tape industry is the increased application in apparel manufacturing. The rise of high-performance sportswear and outdoor clothing has created a substantial demand for seam tapes that provide waterproofing and durability. As consumers become more health-conscious and engaged in outdoor activities, the need for protective clothing has surged. This trend is particularly evident among millennials who prioritize quality and functionality in their apparel choices. The growing awareness about best-fit intimate apparel further fuels this demand, making seam tapes essential in producing garments that meet these consumer expectations.

The expansion of the automotive industry, particularly in regions like China and India, is another significant contributor to the seam tape industry’s growth. Seam tapes play a crucial role in automotive manufacturing by ensuring moisture control, fixing wire connections, and providing waterproofing solutions. With projections indicating a rise in vehicle production in these countries, the demand for seam tapes is expected to increase correspondingly. Government initiatives further support this trend to boost domestic manufacturing capabilities, creating lucrative opportunities for seam tape manufacturers.

In addition to automotive applications, the growing aerospace sector drives demand for seam tapes. The aerospace industry requires lightweight materials to withstand extreme conditions while ensuring passenger comfort. Seam tapes are used extensively in various applications within this sector, including insulation blankets and ductwork. As air travel expands globally, the need for reliable and efficient sealing solutions will likely increase, further boosting the seam tape industry.

Moreover, emerging economies are becoming key market players due to their growing populations and rising disposable incomes. Countries like India, China, Vietnam, and Bangladesh are witnessing a surge in demand for high-end value-added clothing as urbanization progresses and consumer purchasing power increases. This trend creates a favorable environment for seam tape manufacturers to capitalize on new market opportunities as they cater to an expanding middle-class population eager for quality apparel.

Lastly, increased investments in sports and outdoor activities have led to a heightened focus on protective clothing and accessories. The sports industry has seen rapid growth, with more people participating in activities that require specialized gear equipped with seam tape technology. As participation rates rise in various sports, including surfing and snowshoeing, so does the demand for high-performance apparel featuring advanced seam sealing solutions. This growing interest drives sales and encourages innovation within the seam tape industry as manufacturers strive to meet evolving consumer needs.

Overall, combining technological advancements, expanding industries such as automotive and aerospace, emerging markets' growth potential, and increasing consumer awareness about quality apparel collectively contribute to the robust market growth. A key challenge for the seam tape industry is the environmental concerns associated with traditional seam tapes. Many conventional seam tapes contain harmful chemicals or non-biodegradable components, raising significant ecological red flags. As consumer awareness regarding sustainability increases, manufacturers are increasingly pressured to develop eco-friendly alternatives. Stricter regulations concerning ecological impacts may require substantial investment in research and development to create compliant products, which could strain resources for some companies.

Curious about the Seam Tapes Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Seam Tapes Market Report Highlights

- PU seam tapes were the most widely sold in the market and had a revenue of over 106.5 billion in 2023.

- Apparel & footwear were the most significant applications for seam tape and accounted for a market size of USD 60.12 billion in 2023.

- Waterproofing was the largest application for seam tape in 2023 and accounted for approximately 50% of the market share.

- The seam tape market in North America exceeded USD 30 million in 2023. One of the primary market drivers in North America is the rising demand for protective clothing and accessories.

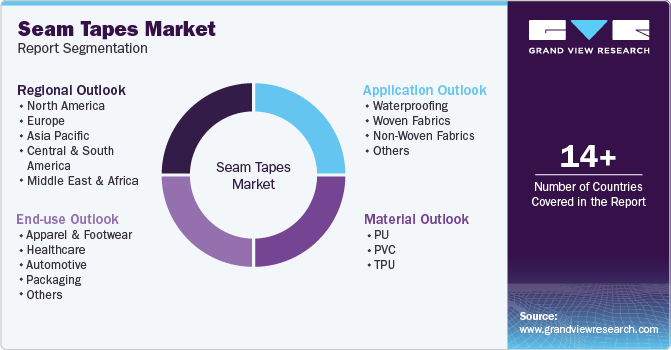

Seam Tapes Market Segmentation

Grand View Research has segmented the global seam tape market report based on product, packaging, and region:

- Material Outlook (Revenue, USD Billion, 2018 - 2030)

- PU

- PVC

- TPU

- Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Waterproofing

- Woven Fabrics

- Non-Woven Fabrics

- Others

- End Use Outlook (Revenue, USD Billion, 2018 - 2030)

- Apparel & Footwear

- Healthcare

- Automotive

- Packaging

- Others

- Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Vietnam

- Indonesia

- Bangladesh

- Central & South America

- Brazil

- Middle East & Africa

- South Africa

Download your FREE sample PDF copy of the Seam Tapes Market today and explore key data and trends.

No comments:

Post a Comment