Anti-money Laundering Industry Overview

The global anti-money laundering market size is expected to reach USD 3.19 billion by 2028, according to a new report by Grand View Research, Inc. It is projected to register a CAGR of 15.6% from 2021 to 2028. The growth can be attributed to the growing volume of non-cash transactions, coupled with a rise in technological developments in the fintech sector. In recent years, banks have increased their IT expenditure toward the adoption of advanced solutions and technologies to improve the security of their services and products.

The rapid developments in artificial intelligence, big data, machine learning, and other technologies are creating new opportunities for the market. The rising risk of financial crimes and fraudulent transactions, arising from factors such as the vulnerabilities inherent to digitization and automation, is compelling financial institutions to employ technologies such as machine learning for identifying suspicious transactions on a real-time basis. As a result, various companies are making efforts to deploy machine learning capabilities in anti money laundering solutions.

Anti Money Laundering Market Segmentation

Grand View Research has segmented the global anti-money laundering market on the basis of component, product type, deployment, end-use, and region:

Based on the Component Insights, the market is segmented into Software and Services.

- The software segment dominated the market in 2020 and accounted for more than 60% share of the global revenue.

- Anti-money laundering software helps organizations ensure that the legal requirements framed by government bodies are met.

- The services segment is anticipated to register the highest growth over the forecast period.

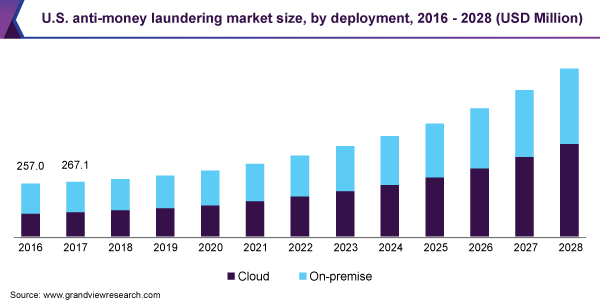

Based on the Deployment Insights, the market is segmented into Cloud and On-premise.

- The on-premise segment dominated the market in 2020 and accounted for more than 50.0% share of the global revenue.

- The cloud segment is anticipated to register the highest growth over the forecast period. The cloud-based deployment of anti-money laundering solutions helps organizations in reducing the cost of establishing the required IT infrastructure.

- Moreover, other benefits of cloud-based deployment, including flexibility and a steady improvement in security features, are expected to drive the adoption of cloud solutions in the near future.

- The use of security features such as multi-factor authentication to access stored data grants cloud computing additional security from the risk of laundering.

Based on the Product Type Insights, the market is segmented into Compliance Management, Currency Transaction Reporting, Customer Identity Management, and Transaction Monitoring.

- The transaction monitoring segment dominated the market in 2020 and accounted for more than a 30% share of the global revenue.

- Anti-money transaction monitoring software enables financial institutes to conduct customer transactions on a real-time basis.

- The customer identity management segment is expected to register the highest growth over the forecast period.

Based on the End-use Insights, the market is segmented into BFSI, Government, Healthcare, IT & Telecom, and Others.

- The BFSI segment dominated the market in 2020 and accounted for more than 33% share of the global revenue.

- The IT and telecom segment is anticipated to register significant growth over the forecast period.

- The increased focus on anti-money laundering compliance by IT organizations is expected to drive market growth.

Anti-money Laundering Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The competitive landscape of the market is highly fragmented in nature. Market players are focused on strategies such as partnerships, joint ventures, product innovation, research & development, and geographical expansion to strengthen their market positions. Businesses are focusing on providing on-premise software solutions to enterprises due to security-related benefits. The on-premise anti-laundering solutions help enterprises enhance their security level and thereby enhance the level of customer satisfaction.

Market players are focused on enhancing their product offerings to better cater to the changing needs of users and stay competitive. For instance, in January 2019, NICE Actimize launched IFM-X, an integrated fraud management platform that leverages machine learning and automation technologies to optimize proficiency while reducing the entire cost of implementing and operating a risk management system. In May 2019, Tata Consultancy Services Limited launched TCS BaNCS for Payments solution in Canada, which supports real-time payment processing. The new solution is expected to encourage financial institutions and banks to speed up the adoption of modernization initiatives by Payments Canada.

Some of the prominent players operating in the anti-money laundering market are:

- NICE Actimize

- Tata Consultancy Services Limited

- Trulioo

- Cognizant Technology Solutions Corporation

- ACI Worldwide, Inc.

- SAS Institute Inc.

- Fiserv, Inc.

- Oracle Corporation

- BAE Systems

- Accenture

Order a free sample PDF of the Anti-money Laundering Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment