Fraud Detection And Prevention Industry Overview

The global fraud detection and prevention market size is expected to reach USD 62.70 billion by 2028, registering a CAGR of 15.4% over the forecast period, according to a new report by Grand View Research, Inc. Rise in incidences of mobile payment frauds, phishing, and card frauds, and their subsequent impact on businesses and resultant financial losses are anticipated to drive market growth over the forecast period.

Digital transformation is the new buzzword, as businesses transform the way they interact with their customers. However, increased digitization has also exposed businesses to online frauds and scams. Thus, to mitigate these frauds, while securing customer as well as business data, the demand for fraud detection and prevention (FDP) solutions is anticipated to witness an upsurge over the forecast period. Digital platforms and online banking applications, wherein consumers directly interact with businesses, are complex. These applications require several risk-based security solutions to detect fraud at individual layers. Without implementing solutions and vulnerability testing, hacktivists and fraudsters can easily exploit gaps across these channels.

Fraud Detection And Prevention Market Segmentation

Grand View Research has segmented the global fraud detection and prevention market on the basis of component, solutions, services, application, organization, vertical, and region:

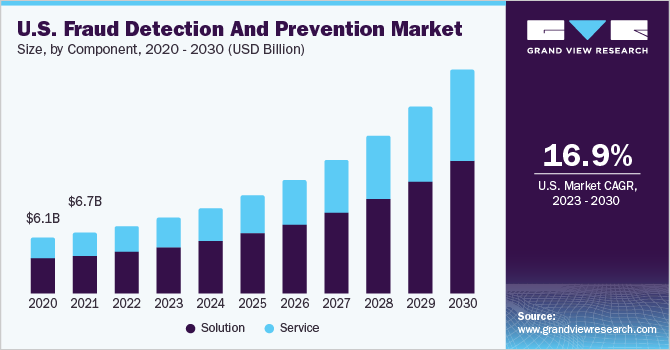

Based on the Component Insights, the market is segmented into Solutions, and Services.

- The solutions segment held the largest revenue share of more than 64.0% in 2020. The growing incidences of Account Take Overs (ATO) and phishing emails have compelled enterprises to adopt advanced tools and solutions to detect anomaly patterns of fraud at a preliminary stage.

- The services segment is estimated to register the fastest CAGR over the forecast period. Organizations in developing economies are increasingly implementing robust fraud prevention strategies.

Based on the Solutions Insights, the market is segmented into Fraud Analytics, Authentication, Governance, Risk, and Compliance.

- The authentication solutions segment dominated the market in 2020 and accounted for more than 43% of the overall revenue share in the same year.

- The fraud analytics solutions segment is anticipated to register the fastest CAGR over the forecast period.

- Digital technologies are on the rise, and data assimilation from these technologies transforms the business environment, creating new business growth opportunities.

Based on the Application Insights, the market is segmented into Identity Theft, Money Laundering, Payment Fraud, and Others.

- The payment fraud application accounted for the maximum revenue share of over 53% in 2020 and is expected to continue to grow at a steady CAGR over the forecast period.

- The growing demand for cashless payment modes and e-wallet among consumers has created avenues for fraudsters.

- The identity theft segment is anticipated to register the fastest CAGR over the forecast period.

Based on the Services Insights, the market is segmented into Professional Services, and Managed Services.

- The professional services segment held the largest revenue share of over 70% in 2020 and is expected to retain the leading position throughout the forecast period.

- The managed services segment is anticipated to grow at the fastest CAGR over the forecast period.

Based on the Organization Insights, the market is segmented into SMEs and Large Enterprises.

- The large enterprise segment accounted for the largest revenue share of more than 74% in 2020.

- SMEs segment is estimated to record the fastest CAGR over the forecast period. The segment growth is attributable to the increasing fraud cases in these organizations.

Based on the Vertical Insights, the market is segmented into BFSI, Government & Defense, Healthcare, IT & Telecom, Industrial & Manufacturing, Retail & E-commerce, and Others.

- The BFSI segment accounted for the highest revenue share of more than 30% in 2020. Rapid digitization and electronification of operations have made the incumbents of the banking and financial services industry a popular target among cybercriminals.

- The retail & e-commerce vertical segment is anticipated to register the fastest CAGR over the forecast period. Incumbents in the retail & e-commerce industry rely on electronic devices and digital platforms to improve customer experience.

Fraud Detection & Prevention Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The market is highly fragmented and characterized by several companies actively offering a wide range of products. Factors, such as advancement in fraud detection solutions and establishing strategic deals like partnerships and collaborations, intensify the market competition. Key players are involved in product innovation and collaboration strategies to expand their business growth.

Some of the prominent companies in the global fraud detection and prevention (FDP) market include:

- Total System Services, Inc.

- Software AG

- SAS Institute, Inc.

- SAP SE

- Oracle

- IBM

- Fiserv, Inc.

- Experian plc

- Equifax, Inc.

- BAE Systems

- ACI Worldwide, Inc.

Order a free sample PDF of the Fraud Detection & Prevention Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment