Flooring Adhesive Industry Overview

The global flooring adhesive market size is expected to reach USD 7.7 billion by 2028, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 6.8% from 2021 to 2028. The market is projected to be driven by a growing emphasis on luxury homes and increasing investments in the construction sector.

Flooring is an integral part of residential or commercial buildings as there is no other part that is exposed to more wear and tear. As a result, it needs to be durable and should match the décor. Wooden and resilient floorings have gained significant prominence in luxury construction. Growing investments in luxury construction are anticipated to augment the demand for flooring, which, in turn, is expected to increase the need for adhesives over the forecast period.

Flooring Adhesives Market Segmentation

Grand View Research has segmented the global flooring adhesive market on the basis of resin, application, end-use, and region:

Based on the Resin Insights, the market is segmented into Acrylic, Polyurethane, Polyvinyl Acetate, and Others.

- The acrylic segment dominated the market for flooring adhesive and held the largest revenue share of 41.0% in 2020.

- The large share is attributed to the characteristics of acrylic resins, which provide fast-setting time and increased adhesion to substrates that are difficult to bond.

- Polyurethane is another vital segment of the market for flooring adhesive. Rising demand for polyurethane adhesives has led raw material suppliers to enhance their production capacity.

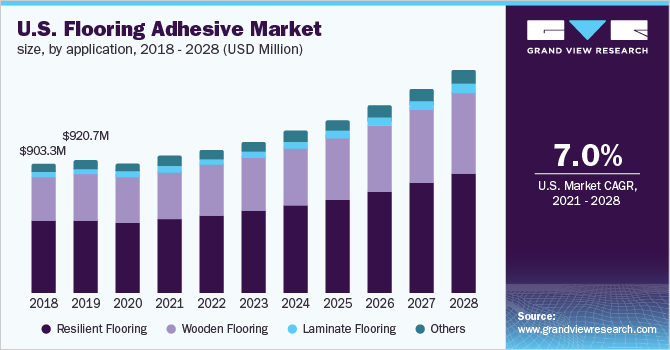

Based on the Application Insights, the market is segmented into Resilient Flooring, Wooden Flooring, Laminate Flooring, and Others.

- The resilient flooring segment held the largest revenue share of 53.0% in 2020. This flooring is a mixture of color, binders, and fillers.

- Wooden flooring is anticipated to emerge as the fastest-growing segment over the forecast period owing to its rising significance in luxury construction in both residential and commercial areas.

- It offers numerous advantages including strength, durability, easy maintenance, aesthetics, high monetary value of a house, steady appearance, an option of refinishing, improved acoustics, and improved air quality.

Based on the End-use Insights, the market is segmented into Residential, Commercial, and Industrial.

- The commercial segment dominated the market for flooring adhesive and held the largest revenue share of more than 34.0% in 2020.

- Increasing construction of commercial buildings, such as drugstores, grocery, and big-box stores, over the past few years, is expected to benefit the segment growth over the coming years.

- The residential segment is growing fluently as the subsidies from governments for first-time homebuyers in developing and developed economies have positively affected the growth of the residential sector.

Flooring Adhesives Regional Outlook

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The market is highly competitive owing to the presence of various players, both emerging and established. All manufacturers faced major consequences in 2020 owing to the emergence of the COVID-19 pandemic, which impacted the demand-supply scenario and led to negative sales for companies in the first half of 2020. As the economies turn toward recovery, manufacturers are expanding their presence and market share through initiatives such as capacity expansions and mergers & acquisitions.

Some of the prominent players in the flooring adhesive market include:

- Bostik

- Dow

- Forbo Holdings AG

- B. Fuller Company

- Henkel AG & Co. KGaA

- LATICRETE International, Inc.

- MAPEI S.p.A

- PARKER HANNIFIN CORP

- Pidilite Industries

- Sika AG

Order a free sample PDF of the Flooring Adhesives Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment