Canned Wine Industry Overview

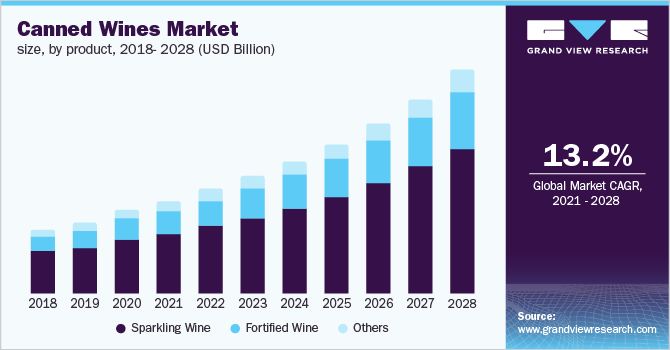

The global canned wine market size is expected to reach USD 571.8 million by 2028, registering a CAGR of 13.2%, according to a new report by Grand View Research, Inc. Shifting consumer preference for convenient, portable, and single-serve wine products is expected to be a key factor contributing to the growth of the market. Increasing spending by millennials and Gen Xers on canned wines in the U.S., the U.K., Germany, Japan, and Australia over the past few years has also fueled the market growth.

An increasing number of college students and working individuals have been shifting their preference for alcoholic beverages from high alcohol by volume (ABV) dark spirits, such as whiskey and rum, to low ABV drinks like wine and vermouth. Canned beverages are highly convenient due to the compact size of cans. Moreover, there has been a growing demand for portable and less fragile wine containers than glass. These factors are projected to support the market growth.

Canned Wine Market Segmentation

Grand View Research has segmented the global canned wine market on the basis of product, distribution channel, and region:

Based on the Product Insights, the market is segmented into Sparkling, Fortified, and Others.

- The sparkling product segment accounted for the largest revenue share of more than 66% in 2020 and is expected to maintain dominance over the forecast period.

- Key players are launching new products in this segment for customer retention as well as to attract new customers.

- The fortified product segment is projected to register the fastest CAGR during the forecast period.

- Customers are welcoming the new variants of fortified wines with various hard spirits as they get both the taste and flavor of the wine as well as spirit in one product.

Based on the Distribution Channel Insights, the market is segmented into Supermarket & Hypermarket, Online, and Other Stores.

- The supermarket & hypermarket distribution channel segment accounted for the largest revenue share of more than 64% in 2020.

- With the increasing number of supermarkets and hypermarkets across the globe, major product manufacturers are making their products available through offline sales channels.

- The online distribution channel segment is anticipated to register the fastest CAGR from 2021 to 2028.

- Online sales channels, such as official websites, are extremely helpful as they provide detailed information on outstanding wines or specific vintage collections, particularly to experts and connoisseurs, as well as basic information about wine and its consumption to amateur wine lovers.

Canned Wine Regional Outlook

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The market is still in its nascent stage where key players plan to launch their products as per the gradual shifting of consumer preferences. Wine manufacturers try to create products that address evolving consumer tastes and preferences or complement their food and health requirements. A differentiated brand that is relevant to and targeted at specific consumers and trends has more chances of achieving success than those that appear to be a mass product. For instance, in April 2020, Molson Coors Beverage Company announced the launch of its new line of canned wine spritzers under the brand name ‘Movo’ in the U.S. market. The product is available in three flavors including Blood Orange Sangria, Raspberry Rosé, and Peach White Blend. Such product launches increase brand visibility across the globe.

Some of the prominent players operating in this market include:

- E & J Gallo Winery

- Union Wine Company

- Integrated Beverage Group LLC

- SANS WINE CO

- Sula Vineyards Pvt. Ltd.

- The Family Coppola

- The Canned Wine Company

Order a free sample PDF of the Canned Wine Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment