Rear-view Mirror Industry Overview

The global rear-view mirror market size is expected to reach USD 11.51 billion by 2028, expanding at a CAGR of 4.1% from 2021 to 2028, according to a new report by Grand View Research, Inc. The COVID-19 pandemic has negatively impacted the demand for rear-view mirrors in 2020. The implementation of lockdowns and social distancing norms globally led to losses in the automotive industry. However, as governments begin to gradually relax lockdown norms and allow businesses to operate with mandates of social distancing, the market can expect a period of respite for the short term. Moreover, the increasing demand for luxury vehicles, coupled with the growing demand for enhanced comfort, is anticipated to drive market growth. Automotive OEMs are focused on integrating advanced safety features in rear-view mirrors to improve visibility and reduce accidents. The rapid rate of advancements in product features is anticipated to work in favor of market growth.

The rising demand for luxury vehicles, thanks to the increased spending capacity of consumers, especially in developing economies such as China and India, is also driving the market. According to the China Automobile Dealers Association, luxury car dealers sold 277,000 units in April 2020, an increase of 11.1% compared to the same time in 2019. Furthermore, the introduction of an increasing number of luxury Sport Utility Vehicles (SUVs) is also expected to help the market expand at a promising pace over the forecast period.

Rear-view Mirror Market Segmentation

Grand View Research has segmented the global rear-view mirror market based on feature type, mounting type, product type, type, vehicle type, and region:

Based on the Feature Type Insights, the market is segmented into Auto-dimming, Blind Spot Detection, Power Control, Automatic Folding, Heating Function, and Others.

- The heating function segment accounted for the largest revenue share of over 49% in 2020 and is anticipated to maintain its dominance over the forecast period, particularly in North America and Europe, due to its extensive usage in cold weather.

- The blind-spot detection segment is projected to register the highest CAGR of over 5% in terms of revenue over the forecast period. This growth can be attributed to the continuous strengthening of vehicle safety standards and growing awareness among people about vehicle safety.

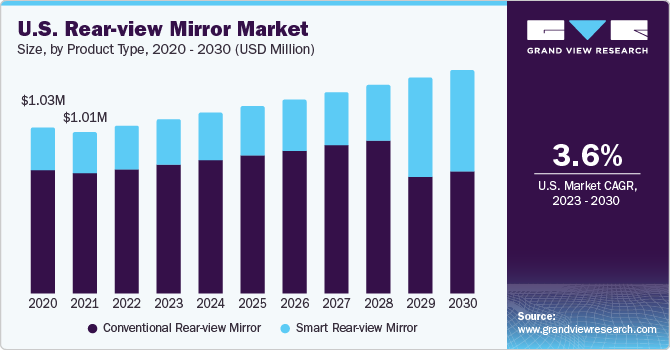

Based on the Product Type Insights, the market is segmented into Smart Rear-view Mirror, and Conventional Rear-view Mirror.

- The smart rear-view mirror segment accounted for the largest share of around 70% of the market in 2020. These products have an in-built camera and enable the driver to switch between a traditional rear-view mirror to an LCD monitor screen. These mirrors help provide enhanced visibility in bad weather conditions or if the view is blocked due to tall cargo and commercial vehicles.

- The conventional rear-view mirror segment is estimated to register a CAGR exceeding 2% from 2021 to 2028. The demand is increasing in commercial vehicles owing to their benefits, such as reduced blind spots and increased visibility. Conventional mirrors offer an enhanced left and right-side view to heavy commercial vehicles.

Based on the Mounting Location Insights, the market is segmented into Door Mounted, and Body Mounted.

- The door-mounted segment accounted for the largest revenue share of around 70% in 2020. Door-mounted mirrors are also known as side or wing mirrors and are largely used in luxury cars. The positioning allows the driver to adjust the mirror as per visibility.

- The body-mounted segment is projected to register a CAGR exceeding 3% from 2021 to 2028. Body-mounted mirrors are used in commercial vehicles where drivers need to keep a constant track of trailing vehicles.

Based on the Type Insights, the market is segmented into Exterior Mirror, and Interior Mirror.

- The exterior mirror segment accounted for the largest share of around 70% of the market in 2020. Exterior mirrors work as a replacement for side-view mirrors and offer help in lane changing and parking. Moreover, they also help avoid traffic accidents, driving fatigue, and traffic violations.

- The interior mirror segment is estimated to register a CAGR exceeding 3% from 2021 to 2028. Auto-dimming interior rear-view mirrors are finding increased demand in a range of vehicles as they improve driving safety by eliminating glare.

Based on the Vehicle Type Insights, the market is segmented into Passenger Car, and Commercial Vehicles.

- The passenger car segment accounted for the largest share of over 60% of the market in 2020. Passenger vehicles include all personal use transport vehicles, such as SUVs, luxury vehicles, and sedans, and are commonly designed to accommodate up to five individuals. The segment is estimated to expand at the highest CAGR during the forecast period, owing to the increasing vehicle fleet and vehicle per capita globally.

- The commercial vehicle segment is projected to register a CAGR of over 4.0% over the forecast period. Commercial vehicles include Light Commercial Vehicles (LCVs) and Heavy Commercial Vehicles (HCVs). The adoption of commercial vehicles is expected to increase over the next eight years owing to sustained economic activities, increased spending on the infrastructure sector, increasing e-commerce and mining activities, and lower interest rates on commercial vehicles.

Rear-view Mirror Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The key players in 2020 include Gentex Corporation, Continental AG, Valeo, Magna International, Inc., and Murakami Corporation. Most of these companies are focusing on offering technologically-driven and advanced products to strengthen their hold on the market. Companies are also undertaking strategic initiatives such as regional expansions, acquisitions, mergers, and collaborations to grow in the market. Organic growth remains the key strategy for the overall industry focusing on product launch to develop new and innovative products and expand product offerings. For instance, in November 2020, Magna International, Inc. announced the launch of its next-generation camera-based driver assistance system, the Magna Gen5 “one-box”. It is a Mobileye EyeQ5-based system that features the forward-facing camera system as well as the related software in a single unit.

Some of the prominent players operating in the global rear-view mirror market are:

- Continental AG

- Ficosa Internacional SA

- Gentex Corporation

- Ishizaki Honten Company Limited

- Magna International Inc.

- MITSUBA Corporation

- Murakami Corporation

- SL Corporation

- Tokairica Co, Ltd.

- Valeo

Order a free sample PDF of the Rear-view Mirror Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment