Natural Oil Polyols Industry Overview

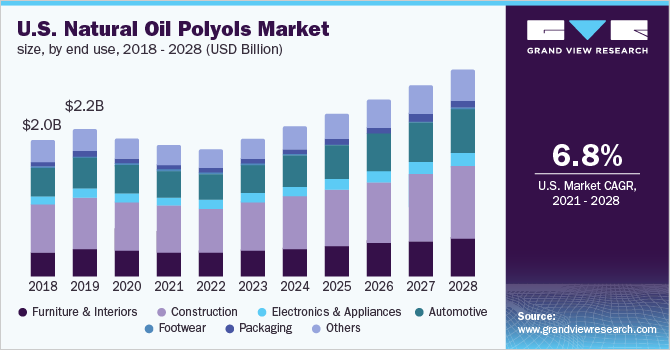

The global natural oil polyols market size is expected to reach USD 10.10 billion by 2028, according to a new study by Grand View Research, Inc. The market is expected to expand at a CAGR of 6.6% from 2021 to 2028. The market demand is driven by the increasing demand for lightweight and highly durable products in industries, including automotive, construction, and electronics, especially in emerging economies such as China, India, and Indonesia.

The growth of the market is likely to be propelled by the increasing consumption of bio-based polyurethane foams in automotive, construction, electrical and electronics, and other sectors. Regular efforts to reduce vehicle weight to enhance fuel efficiency and reduce carbon emissions have propelled the automotive OEMs to embrace the use of polyurethane foams obtained from natural oils polyol in different automotive components, such as seat covers and interiors.

Natural Oil Polyols Market Segmentation

Grand View Research has segmented the global natural oil polyols market on the basis of product, end-use, and region:

Based on the Product Insights, the market is segmented into Soy Oil Polyols, Castor Oil Polyols, Palm Oil Polyols, Canola Oil Polyols, and Sunflower Oil Polyols.

- The soy oil polyols segment dominated the market with a revenue share of over 35.0% in 2020. The surging demand for soy oil polyols for use in food and animal feed is estimated to fuel the growth of this segment.

- Castor oil is one of the commercially available products produced directly from oilseeds. It is used to manufacture a variety of polyurethane products such as foams and coatings.

- Growing R&D expenditure for developing alternate vegetable polyol sources, along with increasing palm oil extraction for industrial purposes, is estimated to have a positive impact on the growth of the palm oil polyol segment over the forecast period.

Based on the End-use Insights, the market is segmented into Furniture & Interiors, Construction, Electronics & Electrical Appliances, Automotive, Footwear, Packaging, and Others.

- The construction segment dominated the market with a revenue share of more than 30.0% in 2020. This is attributed to the growing use of polyurethanes in the construction of roofs and walls of buildings.

- The global construction industry is projected to witness rapid growth in the coming years with the U.S. construction market growing at a faster rate than the market in China.

- The furniture and interiors segment held the second-largest revenue share in 2020.

- Polyurethanes are used in the automotive industry to develop numerous parts of automobiles, including bumpers, spoilers, vehicle bodies, interior ceiling sections, windows, and doors.

- The demand for high-strength but lightweight materials for use in automobiles is increasing across the world owing to the overall structural blends, weight benefits, and crash performance offered by them.

Natural Oil Polyols Regional Outlook

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The market is highly competitive due to the presence of a large number of multinationals that are engaged in constant research & development activities. The global companies are also focusing on capacity expansions, signing partnership agreements with advanced biotechnology companies, and various other operational strategies to gain an edge in the competitive market space. For instance, companies such as Cargill, Incorporated purchased Agrol, a product line of natural oil polyols, from BioBased Technologies LLC. These competitive strategies are likely to reflect higher rivalry in the coming years.

Some prominent players in the global natural oil polyols market include:

- Stepan Company

- BASF SE

- Emery Oleochemicals

- Cargill Inc.

- Biobased Technologies

- Vertellus

Order a free sample PDF of the Natural Oil Polyols Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment