U.S. Automotive Wrap Films Industry Overview

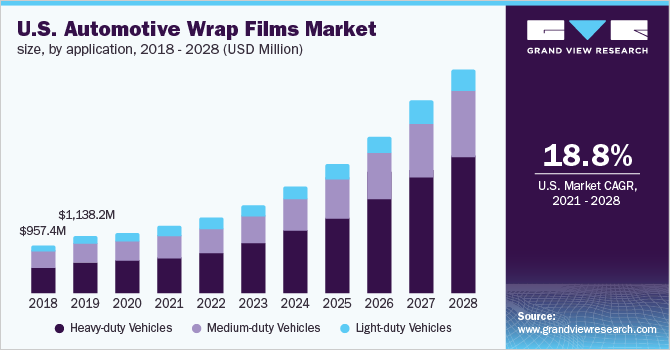

The U.S. automotive wrap films market size is anticipated to reach USD 4.32 billion by 2028, according to a new report by Grand View Research, Inc. The market is projected to register a CAGR of 18.8% from 2021 to 2028. The growing trend of company spending on automobile advertising and offering sponsorships to the automotive race teams to increase the visibility of the company is expected to drive the demand for automotive wrap films in the U.S.

Companies operating in consumer goods, food and beverages, tourism, electrical and electronics, and various other industries are using vehicles with automotive wraps for showcasing and advertising their product offerings. Companies operating in these industries hire vehicles from fleet owners and use customized wraps with company names and logos imprinted on them. Additionally, an automotive wrap film is a cost-effective solution, which maintains the original paint job and provides a high resale value for the vehicles. The minimum service life for good quality automotive wrap ranges from 5 to 6 years. The rising trend of hydro dipping poses a challenge in the growth of the U.S. market for automotive wrap films.

U.S. Automotive Wrap Films Market Segmentation

Grand View Research has segmented the U.S. automotive wrap films market based on application and location:

Based on the Application Insights, the market is segmented into Heavy-duty Vehicles, Medium-duty Vehicles, and Light-duty Vehicles.

- The light-duty vehicles application segment led the market and accounted for more than 53.8% of the revenue share in 2020. This high share is attributable to the rising demand for wrap films as a cost-effective solution compared to vehicle paint, especially for high-end vehicles such as Audi, Mercedes, Porsche, Volkswagen, and BMW.

- Heavy-duty vehicles with graphics attract commuters’ interest and allow easy access to advertised information. Moreover, heavy-duty vehicles travel a long distance allowing access to millions of untapped people for the promotion of the company’s products and services. Different types of vinyl films are available for vehicle bodies and windows.

- For instance, in buses, the body is covered with opaque vinyl film while windows are covered with perforated and special quality films for maintaining visibility.

Based on the Location Insights, the market is segmented into Exterior and Interior.

- The exterior location segment led the U.S. automotive wrap films market and accounted for more than 90.0% share of the revenue in 2020. This high share is attributable to the fact that automotive wrap films are primarily utilized on hoods, doors, bumpers, bonnets, and other components.

- Automotive wrap films protect the original paint job and easy cleaning of vehicles. Various automobile enthusiasts change wrap films frequently to give a new surface finish and color to the vehicles. Typically, automotive wrap films have a service life of 5 to 6 years.

Key Companies Profile & Market Share Insights

Companies operating in the U.S. market for automotive wrap films lay high emphasis on expanding their footprint in an attempt to drive their revenues and increase market shares. Companies are expanding their services in countries, such as Argentina, Colombia, Ecuador, Bolivia, French Guiana, El-Salvador, Brazil, and Chile, to cater to the rising demand for automotive wrap materials for commercial fleets in these economies.

Strategic partnerships, capacity expansions, and new product developments are the popular strategies adopted by a majority of players operating in the market. For instance, in June 2020, ORAFOL Europe GmbH introduced ORALITE VC 612 primarily used for fleet vehicles for marketing & advertising purpose and has a service life of 5 years. This product innovation will cater to fleet owners with high services of vehicle wraps.

Some of the prominent players operating in the U.S. automotive wrap films market are:

- Avery Dennison Corporation

- Arlon Graphics, LLC

- 3M

- VViViD Vinyl

- Hexis S.A.

Order a free sample PDF of the U.S. Automotive Wrap Films Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment