Surfing Apparel And Accessory Industry Overview

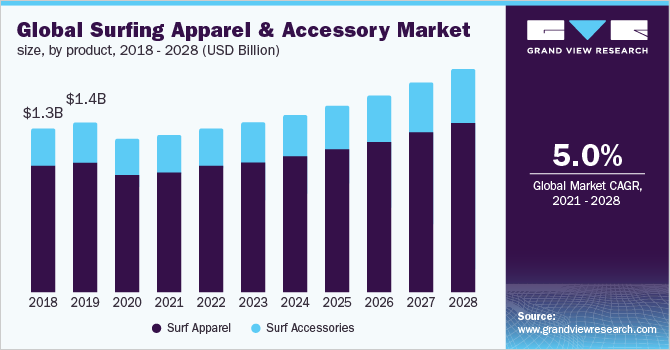

The global surfing apparel and accessory market size is expected to reach USD 1.82 billion by 2028, according to a new report by Grand View Research, Inc. It is expected to expand at a CAGR of 5.0% from 2021 to 2028. Surfing is gaining popularity among water adventurers as people could follow all the social distancing guidelines while surfing. Surfing clothes and accessories are also gaining popularity because surfing was one of the only sports that people could participate in during the pandemic.

In 2020, the surf apparel product segment held the largest market share, and this trend is likely to continue throughout the forecast period. The development of novel materials and technical textiles for the creation of fashionable and high-performance surfwear or apparel has aided market expansion. Furthermore, as the number of female surfers has increased, so does the demand for surfing-inspired clothing such as bikinis, swimsuits, shorts, t-shirts, short onesies, and vests made of water-resistant fabrics, such as polyester.

Surfing Apparel And Accessory Market Segmentation

Grand View Research has segmented the global surfing apparel and accessory market on the basis of product, distribution channel, and region:

Based on the Product Insights, the market is segmented into Surf Apparel and Surf Accessories.

- In terms of value, surf apparel dominated the market with a share of over 75.0% in 2020.

- Professional surfers' increased desire for accessories, such as wetsuit booties and reef socks, has fueled the segment expansion.

- Sustainable methods/materials are being used by surfing apparel businesses to create sustainable items, such as Barcelona-based allSisters, the brand creates high-end swimsuits with the highest quality recycled textiles and raises funds for the non-profit Surfers Against Sewage, which fights plastic waste.

- To boost their market position, most corporations are focusing on mergers and acquisitions, acquiring shares in regional companies to expand their geographical presence, broadening their product ranges, and expanding customer reach.

Based on the Distribution Channel Insights, the market is segmented into Offline and Online.

- The offline distribution channel segment dominated the market and held a share of over 80.0% in 2020.

- The online segment is estimated to expand at the highest CAGR of 6.5% from 2021 to 2028.

- The rise of the online category can be ascribed to technical improvements and the increasing importance given to online platforms for purchasing surfing apparel and accessories, particularly by consumers looking for bargains.

- The availability of a large range of worldwide brands, steep discounts, free delivery, and simple return policies are all enticing customers to shop for surfing clothes and accessories online.

- Online shops offer a diverse choice of surfing products at varied rates, making it easier to suit the needs of a wide range of customers, particularly those on a budget.

Surfing Apparel & Accessory Regional Outlook

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The market is fragmented owing to the presence of a large number of domestic as well as international players. However, a majority of the market share is captured by key players. These companies control a significant portion of the market and have a global presence. Small and medium-sized local firms compete in the surfing gear and accessories industry, offering a limited selection of products at significantly lower prices to primarily target regional customers. Because smaller players have a better grip and reach in the regional or country markets, global brands face stiff competition from local players.

The brands are also launching new products and entering mergers to expand their reach. For instance, Roxy, Inc. debuted their POP Surf collection, which includes eco-friendly swimwear and wetsuits. Econyl, a 100 percent regenerated polyamide fiber made from post-consumer materials, is used to make the surfwear. In another instance, Volcom, LLC, a California-based board-sports company, has teamed up with China Ting Group to increase its Chinese presence.

Some prominent players in the global surfing apparel and accessory market include:

- Billabong

- Hurley, Inc.

- O’Neill

- RVCA

- Volcom, LLC

- GLOBE INTERNATIONAL LIMITED

- REEF

- Roxy, Inc.

- Ltd.

- Quiksilver, Inc.

Order a free sample PDF of the Surfing Apparel & Accessory Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment