U.S. Knife Sharpening Service Industry Overview

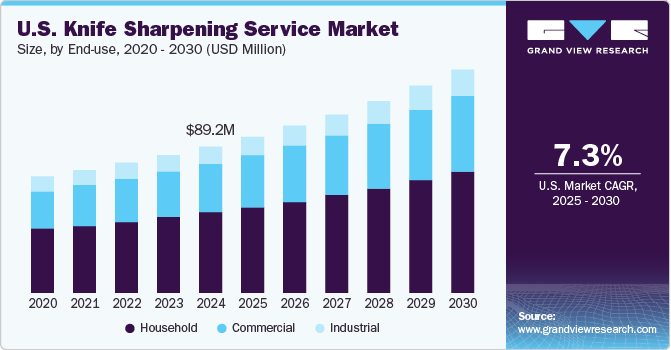

The U.S. knife sharpening service market size is expected to reach USD 117.1 million by 2028, according to a new report by Grand View Research, Inc. It is expected to expand at a CAGR of 6.5% from 2021 to 2028. The rapid development of urban areas, coupled with consumer preference for a wide variety of cuisines, has led to an increase in the number of cafes, specialty coffee shops, and quick-service restaurants (QSRs) in the U.S. The trend of dining in restaurants and cafes offers lucrative growth opportunities for knife sharpening service providers.

The increasing influence of culinary arts on consumers, coupled with the growing number of luxury hotels and high-end restaurants, supports the demand for kitchen knife sharpening services in the commercial segment. The growing trend of tourism, coupled with the growing consumer willingness to spend on exploring exotic destinations, luxury hotels, and culinary travels, is also expected to drive the demand for kitchen knives and knife sharpening services in the country.

One of the major factors affecting purchasing decisions is the turnaround time of knives in the market. Moreover, the durability and quality of sharpening are key in influencing consumers’ decisions on whether or not to visit again. Word-of-mouth marketing also significantly affects the purchasing decisions of consumers. In addition, the growing presence of service offerings via social media and e-commerce platforms is influencing and changing the way consumers opt for such services. Several players in the market choose to mail-order services to increase their reach among consumers. New entrants offering various innovative solutions and practices also influence the purchasing decisions of consumers.

U.S. Knife Sharpening Service Market Segmentation

Grand View Research has segmented the U.S. knife sharpening service market on the basis of end-user and region:

Based on the End-user Insights, the market is segmented into Household, Commercial, and Industrial.

- The household segment dominated the market with a share of nearly 55.0% in 2020. This is attributed to the increasing urbanization as a result of population growth and migration.

- It is imperative to keep kitchen knives sharp so that they easily cut through food with minimum slippage.

- The commercial segment is expected to witness the fastest growth over the forecast period.

- The rapid expansion of commercial spaces, like hotels, resorts, and large food joints, is propelling the demand for kitchen tools, such as knives, which is likely to bode well for the commercial segment over the forecast period.

- The growing trend of food away from home has been presenting lucrative growth opportunities for restaurants and eating joints, which subsequently drives the demand for knives and knife sharpening services in the commercial segment.

U.S. Knife Sharpening Service Regional Outlook

- Northeast

- Southwest

- Midwest

- West

- Southeast

Key Companies Profile & Market Share Insights

The market is characterized by the presence of several established players. These players account for a considerable market share and have a strong presence across the U.S. The market also comprises small to midsized players, which offer selected sharpening services and mostly serve local customers. The impact of established players on the market is quite high as a majority of them have vast networks across the U.S. to reach out to their large customer base. Key players operating in the market are focusing on offering excellent sharpening services and experiences in order to boost revenue growth and reinforce their position in the market.

Some prominent players in the U.S. knife sharpening service market include:

- Carter Cutlery

- American Cutting Edge, Inc.

- Cozzini Bros, Inc.

- Florida Knife Company

- Town Cutler

- Eversharp Knives

- John’s Sharpening Service & Cutlery

- Market Grinding Inc.

- National Sharpening Company

- Rod’s Sharpening Service

Order a free sample PDF of the U.S. Knife Sharpening Service Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment