Ferroalloys Industry Overview

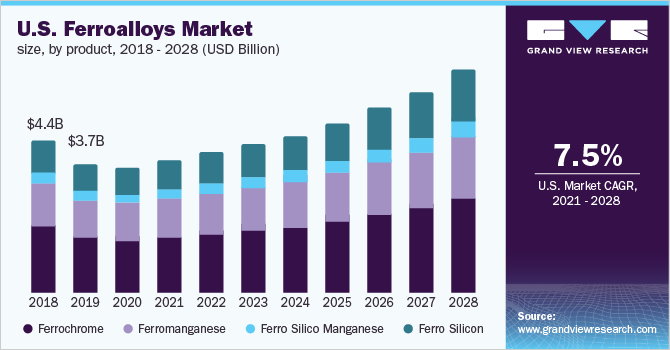

The global ferroalloys market size is expected to reach USD 73.9 billion by 2028, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 7.1% from 2021 to 2028. Products such as ferrochrome are projected to attract significant demand on the account of rising stainless steel usage in the building and construction sector.

Stainless steel facilitates strength and support to the building structure owing to its high durability. Adequate support structures such as lintels, wind posts, wall starters, and masonry are manufactured from stainless steel during the construction of a building. Primary stainless steel products used in the building and construction industry are plates, sheets and strips, and wires. In addition to its structural application, stainless steel imparts an aesthetic feel to the building to create a pleasing visual appearance.

Ferroalloys Market Segmentation

Grand View Research has segmented the global ferroalloys market on the basis of product, application, and region:

Based on the Product Insights, the market is segmented into Ferrochrome, Ferromanganese, Ferro Silico Manganese, and Ferrosilicon.

- The ferromanganese segment accounted for a share of over 17.0% in 2020, in terms of volume in the market for ferroalloys. The key driver for the demand for ferromanganese in steelmaking is its use as desulphurizing agent owing to properties such as sulfide and deoxidant former.

- The ferrosilicon segment is projected to witness a CAGR of 7.7% from 2021 to 2028 in terms of revenue. It is used to reduce the metals from their oxides such as the deoxidization of steel. It also provides corrosion resistance, improves the quality and strength of iron and steel products.

Based on the Application Insights, the market is segmented into Carbon & Low Alloy steel, Stainless Steel, Alloy Steel, Cast Iron, and Others.

- The stainless steel segment dominated the market and accounted for the largest revenue share of over 32.0% in 2020. The segment is projected to witness a lucrative CAGR over the forecast period.

- As per The International Stainless Steel Forum (ISSF), China was the largest stainless steel producing country with a share of around 59% in 2020.

- Cast iron is projected to remain the fastest-growing segment in the market over the forecast period.

- Advantages such as the low cost involved in the production of parts, good casting properties, higher compression strength, durability, and resistance to deformation are projected to contribute to the growth of the segment.

Ferroalloys Regional Outlook

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The market is competitive in nature and is likely to observe new investments from existing large players over the coming years. For instance, Zimasco, a subsidiary of Sinosteel Corporation has announced an investment of USD 35.0 million for ferrochrome production capacity addition. A new project is likely to start at the Kwekwe ferrochrome smelting complex with an additional capacity of 72 kilotons per year. Rising production capacities to meet the steel production are projected to increase the competition in the market. In April 2021, Tata Steel Mining (TSML) has confirmed its plans to double its ferrochrome capacity to 9 lakh tons per annum in India. TSML has already become the largest chrome ore mining company in India after the acquisition of Karmada, Saruabli, and Sukinda mines.

Some of the prominent players in the ferroalloys market include:

- Glencore

- Samancore Chrome

- Shanghai Shenjia Ferroalloys Co. Ltd

- Ferro Alloys Corporation Limited.

- C. Feral S.R.L

- Tata Steel Limited - Ferro Alloys & Minerals Division

- Arcelor Mittal

- China Minmetals

- SAIL

- Jindal Group

Order a free sample PDF of the Ferroalloys Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment