Circulating Tumor Cells Industry Overview

The global circulating tumor cells market size is expected to reach USD 18.3 billion by 2027, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 11.7% from 2021 to 2027. Many potential applications of CTCs in pre-diagnosis, pretreatment, and intra- and post-treatment provide lucrative growth opportunities to players involved in the development of CTC enrichment and isolation products Research organizations are engaged in endeavors aimed at developing CTC-based tests to improve cancer diagnosis in terms of efficiency and speed.

Furthermore, the growing demand for minimally invasive diagnostic procedures is anticipated to propel investments by key stakeholders in this area. CTC-based liquid biopsy tests lead to limited trauma and enable rapid recovery owing to their non-invasive nature. Moreover, it enables minimal invasive screening of tumors before opting for complex surgical procedures, such as radiotherapy, chemotherapy, and surgical removal of tumors, thus positively impacting the adoption.

Circulating Tumor Cells Market Segmentation

Grand View Research has segmented the global Circulating Tumor Cells market on the basis of technology, application, product, specimen, and region:

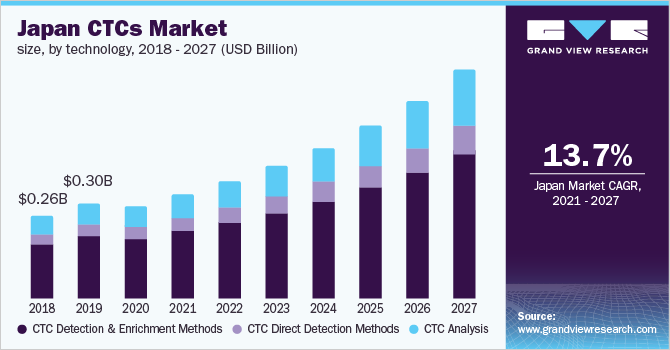

Based on the Technology Insights, the market is segmented into CTC Detection & Enrichment Methods, CTC Direct Detection Methods, and CTC Analysis.

- In 2020, the CTC detection and enrichment methods segment accounted for the largest revenue share of 65.8%.

- The availability of different methods for the enrichment of circulating tumor cells in cancer detection is expected to significantly impact segment growth over the forecast period.

- Moreover, positive or negative enrichment of circulating tumor cells based on biological properties is expected to hold significant potential for market growth.

- Advancements in technologies such as immunofluorescence, NGS, FISH, and qPCR are anticipated to drive the clinical utility of these cells, and thus accelerating revenue growth for CTC analyses.

- Several companies are investing in the development of products that help in CTC analysis and downstream assays. For instance, Vortex Biosciences offers various CTC analysis products, including immunofluorescence, cytopathology, cytogenetics (FISH), cell culture, and genomics.

Based on the Product Insights, the market is segmented into Kits & Reagents, Blood Collection Tubes, and Devices or Systems.

- The devices or systems segment dominated the market and accounted for the largest revenue share of 42.8% in 2020. This can be attributed to the presence of a wide portfolio under this category coupled with upcoming advances with regard to microfluidics technology.

- On the other hand, kits and reagents have also contributed significantly to the revenue due to the frequent purchase rate and high usage rate.

Based on the Specimen Insights, the market is segmented into Blood, Bone Marrow, and Other Body Fluids.

- The blood specimen segment dominated the market and accounted for the largest revenue share of 46.9% in 2020.

- A large concentration of these cells in blood samples as compared with other biospecimens is responsible for the largest penetration of this specimen type.

- Membrane clogging as a result of a high concentration of blood cells minimizes the applicability of whole blood samples in microfluidic-based circulating tumor cells enumeration. Devices with various pore shapes and sizes are anticipated to overcome this issue and drive segment growth in the coming years.

- The emergence of high throughput techniques has effectively accelerated the detection of genome variation among these cells, thereby driving the segment growth at a significant pace throughout the forecast period.

Based on the Application Insights, the market is segmented into Clinical/ Liquid Biopsy, and Research.

- The research segment dominated the market and captured the largest revenue share of 72.8% in 2020.

- Circulating tumor cells are regarded as a substrate of cancer metastasis. Circulating tumor cells enumeration remains largely a research tool.

- Recently, the focus has shifted toward circulating tumor cells characterization and isolation, which can provide significant opportunities in predictive testing research.

CTCs Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The market is consolidated with several emerging as well as established players. The market is witnessing high competition among both public and private firms. The players are adopting several measures to sustain market competition with the changing trends which exerts a positive impact on the overall market. The companies are collaborating with other market players to gain a competitive advantage in the space.

For instance, in November 2019, Biolidics Limited signed an agreement with Sysmex Corporation to develop a laboratory-developed test for the diagnosis of cancer. Since 2016, the companies collaborated for R&D of laboratory assays in this field by using ClearCell FX1 System along with Sysmex’s MI-FCM, a molecular imaging flow cytometer. This extension in collaboration helped the company expand its product portfolio.

Some of the prominent players in the Circulating Tumor Cells (CTCs) market include:

- QIAGEN

- Bio-Techne Corporation

- Precision for Medicine

- AVIVA Biosciences

- BIOCEPT, Inc.

- BioCEP Ltd.

- Fluxion Biosciences, Inc.

- Greiner Bio One International GmbH

Order a free sample PDF of the CTCs Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment