Baby Products Industry Overview

The global baby products market is expected to reach USD 352.65 billion by 2030, according to a new report by Grand View Research, Inc. The global market has been experiencing rapid growth as consumer preferences are ever-changing and diverting towards utility-driven, superior quality, and premium baby products. Additionally, there has an been increase in demand for vegan, paraben, gluten, and synthetic-free products owing to rising levels of awareness associated with the harmful effects of synthetic products.

The COVID-19 pandemic disrupted the supply chains and influenced consumer shopping patterns. According to the annual report published Kimberly-Clark (KCWW) witnessed an increase in the sales of its baby and child care products in 2020. Whereas, Johnson & Johnson Consumer Inc., the baby care segment reported a decline of 9.4% in 2020, in comparison to 2019. The company cited the decline owing to various factors such as COVID-19, SKU rationalization, and other factors.

Baby Products Market Segmentation

Grand View Research has segmented the global baby products market based on product and region:

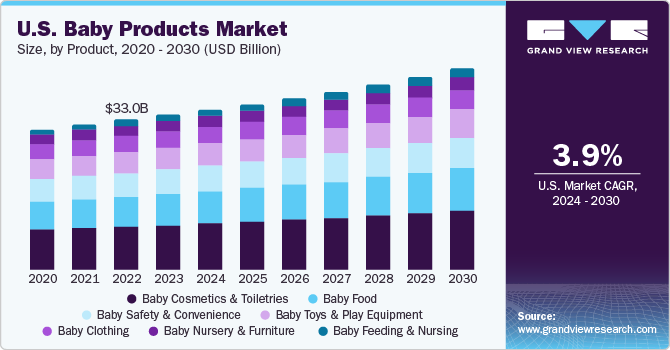

Based on the Product Insights, the market is segmented into Baby Cosmetics & Toiletries, Baby Food, and Baby Safety & Convenience

- The baby cosmetics & toiletries segment is further bifurcated into baby skincare, bath, baby hair care, and other cosmetics & toiletries products.

- Baby food is sub-segmented into baby milk, frozen baby food, baby juice, baby food snacks, and baby food cereals.

- Baby safety & convenience is further segmented into baby strollers and baby car seat market.

- The global baby food market size stood at USD 91.92 billion in 20201. It is anticipated to expand at 5.6% in terms of revenue during the forecast period.

- Rapidly growing urbanization, busy work schedules of the working class, and changing lifestyles are propelling demand for packaged foods for babies.

- An increase in parental concerns regarding baby’s nutrition has been a primary aspect to drive the growth of the segment.

- New food technologies have been enabling food product manufacturers to provide good quality products added with nutritional benefits. The increasing demand, particularly for infant formula, is triggering the growth of the market.

- Since, iron deficiency is the most common nutritional deficiency found amongst Indian children, manufacturers are introducing new products in the market that are rich in iron and folic acid for the baby’s physical and mental growth.

- The baby safety and convenience segment held a significant share of the market and is poised to grow at a steady pace over the next coming years.

- The baby cosmetics & toiletries segment contributed the second-largest share of the market and is projected to register the fastest CAGR from 2022 to 2030. Baby skincare accounted for more than 36.0% market share.

Baby Products Regional Outlook

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The market includes both international and domestic participants. Key market players focus on strategies such as innovation and new product launches in retail about natural products to enhance their portfolio offering in the market.

Some prominent players in the global Baby Products market include:

- Johnson & Johnson Services, Inc.

- Kimberly-Clark Corporation

- Procter & Gamble

- Unilever

- Britax

- Chicco

- Dorel Industries

- Beiersdorf AG

- Fujian Hengan Group

- Nestlé S.A.

Order a free sample PDF of the Baby Products Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment