Diabetic Food Industry Overview

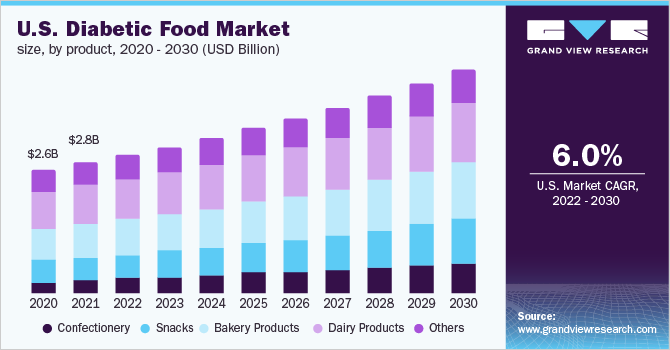

The global diabetic food market size is expected to reach USD 20.6 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 5.9% from 2022 to 2030. Growing awareness of diabetes coupled with preventive measures taken by consumers is anticipated to spur market growth. Increasing use of artificial sweeteners including acesulfame potassium, aspartame, and neo-tame as a substitute for sugar is expected to positively impact market growth.

Rising health concerns and an uptrend in the occurrence of diabetes among youngsters, and health issues such as obesity, diabetes, and digestive disorders have prompted consumers to opt for diabetic food solutions. Moreover, increasing cases of juvenile diabetes among children and youth owing to lack of physical activity is expected to fuel the demand. Moreover, some health-conscious consumers are also attracted towards diabetic food in order to maintain their general health and wellness.

Diabetic Food Market Segmentation

Grand View Research has segmented the global diabetic food market on the basis of product, distribution channel, and region:

Based on the Product Insights, the market is segmented into Confectionery, Snacks, Bakery Products, Dairy Products, and Others

- The dairy product segment dominated the market for diabetic food and held the largest revenue share of more than 25.0% in 2021.

- Greek yogurt, string cheese, and grass-fed dairy options are opted for by consumers suffering from diabetes. The increasing number of product launches in this segment bode well for future growth.

- However, the confectionery segment is projected to register the fastest growth during the forecast period. Product launches in the confectionery segment by key brands and startups around the globe have been supporting the overall growth.

Based on the Distribution Channel Insights, the market is segmented into Supermarkets/Hypermarkets, Specialty Stores, Online, and Others

- The supermarkets and hypermarkets segment led the market for diabetic food and accounted for the largest revenue share of more than 65.0% in 2021. The sheer volume of supermarkets and hypermarkets spread across the globe is the primary factor for its large value generation in 2021.

- Furthermore, new launches in the product segments such as bakery, dairy, and confectionery at supermarkets are likely to bode well with the future segment growth.

- The online delivery channel is however expected to show the fastest growth during the forecast. Major retailers such as Amazon, Walmart.com, and Target.com witnessing a significant shift toward online ordering is likely to favor the segment’s growth.

- Moreover, brands and companies operating in the market for diabetic food prefer launching products through third-party e-commerce retailers.

Diabetic Food Regional Outlook

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The market for diabetic food is fragmented with the presence of global and regional players. These players are engaging in major acquisitions and mergers, awareness campaigns, and product launches to increase their customer base and brand loyalty. Furthermore, these players are innovating new products including white oats, oat bran, barley porridge, and 100.0% natural ingredients with no chemical and harmful content in the diabetes foods.

Some prominent players in the global Diabetic Food market include:

- Nestlé

- Unilever

- The Kellogg Company

- Conagra Brands, Inc.

- Fifty 50 Foods, Inc.

- Mars Inc.

- Tyson Foods

- Sushma Gram Udyog

- The Hershey Company

- Hain Celestial Group

Order a free sample PDF of the Diabetic Food Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment