U.K. Imaging Services Industry Overview

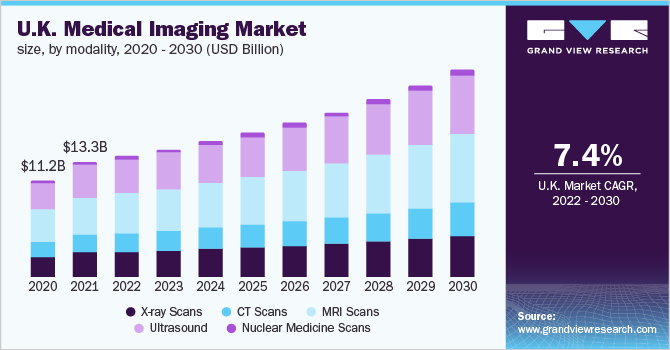

The U.K. imaging services market size was valued at USD 13.25 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.9% from 2022 to 2030. The rise in the adoption of advanced medical imaging devices for diagnostic imaging, coupled with the increasing incidences of targeted disorders, is expected to boost the market growth.

For instance, according to the International Agency for Research on Cancer, in 2020, around 457,960 new cancer cases were diagnosed in the U.K. with 179,648 deaths in the same year, the cancer cases are expected to reach 1,514,320 by 2030. Furthermore, growing awareness about medical imaging technologies is expected to contribute to market growth. According to the NHS England, in 2021 the total number of imaging procedures performed on NHS patients in England was around 42,582,245.

Gather more insights about the market drivers, restraints, and growth of the U.K. Imaging Services Market

Medical imaging has transformed health care by providing vital information in a timely, safe, and accurate manner. Imaging services include non-invasive imaging modalities such as x-rays, ultrasounds, nuclear medicine scans, MRIs, and CT scans, which are used to diagnose a variety of disorders. Furthermore, these imaging services aid in the early detection of disease, which assists in effective treatment. In the coming years, the U.K. imaging services market is expected to expand owing to the adoption of various advanced technologies by providers for improving medical imaging services and increasing the customer base. In May 2022, GE Healthcare and Alliance Medical signed an agreement to collaborate on a digital solution using data analytics and Al to improve productivity in hospital radiology departments in the U.K. Furthermore, due to rising NHS waiting times and referrals to the private sector, an increasing number of people are paying for private medical insurance, which is likely to enhance the market growth.

The U.K.'s imaging services had been poorly funded prior to the pandemic, with a lack of expertise in image acquisition and reporting. These were the result of substantial workforce and equipment limitations. The COVID-19 pandemic has highlighted the need for significant changes in diagnostic services, but it has also presented many opportunities. Many beneficial changes in diagnostic procedures are observed, such as increased use of virtual consultations and community services. Although imaging services are returning to normal after the pandemic, with capacity and patient confidence regained, it is evident that significant investment is needed to address chronic underfunding in radiologists, radiographers, and imaging equipment.

Browse through Grand View Research's Medical Imaging Industry Related Reports

Computed Tomography Market - The global computed tomography market size was valued at USD 4,045.6 million in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 7.3% from 2022 to 2030.

Magnetic Resonance Imaging Market - The global magnetic resonance imaging market size was valued at USD 4.8 billion in 2021 and is expected to expand at a CAGR of 7.1% from 2022 to 2030.

U.K. Imaging Services Market Segmentation

Grand View Research has segmented the U.K. imaging services market based on modality and end-use:

Modality Outlook (Revenue, USD Billion, 2018 - 2030)

- X-rays

- CT Scans

- MRI Scans

- Ultrasound

- Nuclear Medicine Scans

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Imaging Centers

- Others

Market Share Insights:

May 2022: InHealth Services received Quality Standard for Imaging (QSI) accreditation. It is the first Radiographer-led Reporting service to achieve such accreditation.

March 2021: Fortius Clinic, U.K.'s single largest orthopedic group with an international reputation in orthopedics and MSK, was acquired by Affidea Group, the leading European provider of diagnostic imaging, outpatient, and cancer care services.

Key Companies profiled:

Some prominent players in the U.K. Imaging Services market include

- Alliance Medical

- InHealth Group

- Neuromed Diagnostic Imaging Center

- UNILAB

- Medica Group

- TIC Health

- The radiology Clinic

- Affidea Group

- Vista Health

- Medical Imaging Partnership

- Rutherford Diagnostics

Order a free sample PDF of the U.K. Imaging Services Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment