Energy Drinks Industry Overview

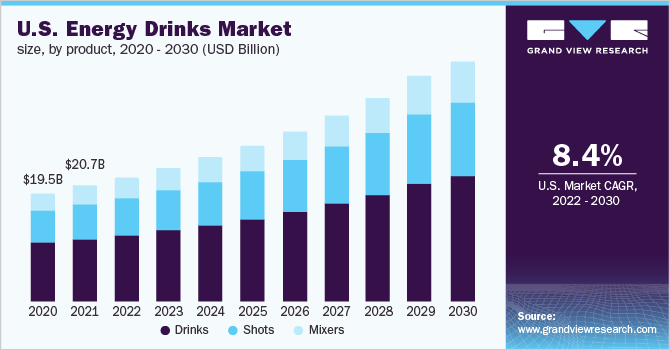

The global energy drinks market size is expected to reach USD 177.58 billion by 2030, according to a new report by Grand View Research, Inc. It is expected to expand at a CAGR of 8.3% from 2022 to 2030. Consumption of energy drinks has been increasing drastically in recent years, particularly among adolescents and young adults, as they remain one of the most popular functional beverages in the market that offer consumers more physical and mental energy, through ingredients such as caffeine, taurine, guarana, ginseng, and B vitamins.

Manufacturers recently have shifted their target consumer focus from athletes to young people, which has been driving the product consumption. According to the National Library of Medicine, in the U.S., energy drinks are the second most common dietary supplement used by young people; about 30% consume energy drinks on a regular basis. Such trends are expected to drive the market demand.

Energy Drinks Market Segmentation

Grand View Research has segmented the global energy drinks market on the basis of product, type, packaging, distribution channel, and region:

Based on the Product Insights, the market is segmented into Drinks, Shots, and Mixers

- The drinks segment held the largest revenue share of over 50.0% in 2021 and is expected to maintain its lead over the forecast period.

- Consumers have the liberty to drink these beverages at work, after exercising, and during leisure activities, as they are functional in nature, which drives the product demand.

- The mixers segment is anticipated to witness considerable growth over the forecast period. The growing availability of the product as a mixer has been driving the segment. Furthermore, consumers are opting for mixers to make premium cocktails and alcoholic drinks.

Based on the Type Insights, the market is segmented into Conventional and Organic

- The conventional segment held the largest revenue share of over 60.0% in 2021 and is expected to maintain its lead over the forecast period.

- Lack of consumer awareness regarding organic products is expected to favor the growth of the conventional segment over the forecast period.

- The organic segment is anticipated to expand at a higher CAGR over the forecast period as organic drinks are generally perceived to contain more nutrients and antioxidants than conventional ones.

- The COVID-19 pandemic has further led to a surge in interest and raised consumer awareness regarding the consumption of organic drinks as they are viewed as healthier and safer than conventional ones, which is likely to have a positive influence on the segment growth in the upcoming years.

Based on the Packaging Insights, the market is segmented into Cans, Bottles, and Others

- The cans segment held the largest revenue share of over 50.0% in 2021 and is expected to maintain its lead over the forecast period. Consumers have become more sophisticated with their choices and taste and are hence increasingly opting for these beverages over canned wine and other alcoholic drinks. Young consumers prefer metal cans as they are more portable and do not break like glass.

- The bottles segment is anticipated to expand at the second-highest CAGR over the forecast period. Furthermore, the rise in awareness regarding water and land pollution caused by beverages packaged in plastic bottles has led to an increased demand for the product in glass bottles.

- The demand for the product in glass bottles is increasing owing to the convenience they offer and rising awareness among consumers regarding the adverse impact of plastic bottles on the environment. This has also led to the introduction of the product in glass bottles, which is expected to gain popularity and help increase product demand.

Based on the Distribution Channel Insights, the market is segmented into On-trade and Off-trade

- The off-trade segment accounted for the largest revenue share of over 70.0% in 2021 and remains the primary source of consumption of the product. The increase in product sales is driven by the rise in the consumption of energy beverages.

- The on-trade channel is expected to register a considerable growth rate from 2022 to 2030. An increasing number of bars, pubs, resorts, cafés, restaurants, and clubs are offering a wide range of these beverages, which is driving the segment.

Energy Drinks Regional Outlook

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The market is characterized by the presence of a few well-established players and several small and medium players. The majority of the market share is captured by key players. These manufacturers are adopting various strategies, including new product launches, the expansion of product portfolios, and mergers & acquisitions.

Some prominent players in the global Energy Drinks market include:

- Red Bull

- Taisho Pharmaceutical Co. Ltd.

- Inc.

- Monster Energy

- Lucozade

- The Coco-Cola Company

- Amway

- AriZona Beverages USA

- Living Essentials LLC

- Xyience Energy

Order a free sample PDF of the Energy Drinks Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment