U.S. Wine Industry Overview

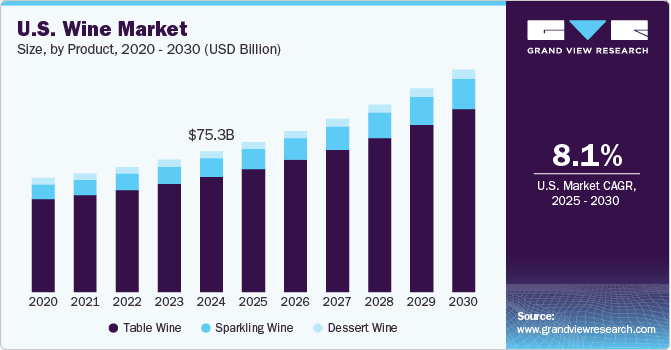

The U.S. wine market size is expected to reach USD 115.03 billion by 2030, according to a new report by Grand View Research, Inc. It is expected to expand at a CAGR of 6.8% from 2022 to 2030. The rising worldwide supply of grapes, increasing consolidation among producers, distributors, and retailers, and a shift in consumers’ drinking patterns are acting as major drivers for the market. Increasing penetration and adoption of the product in developing countries are also acting as a major catalyst for market growth.

The U.S. has been producing wines for centuries, and wine products have become a popular dinner addition in the country. Wine sales have surged across the country as a result of fresh innovation in flavor, color, and packaging adaptations. Nonetheless, to meet the high demand, a significant amount of land has been transformed into vineyards to meet the need for grapes that would be prohibitively expensive if acquired from outside the U.S.

U.S. Wine Market Segmentation

Grand View Research has segmented the U.S. wine market based on product and distribution channel:

Based on the Product Insights, the market is segmented into Table Wine, Dessert Wine, and Sparkling Wine

- The table wine segment led the market and accounted for a revenue share of over 80.0% in 2021. It is one of the oldest and most common types of alcohol consumed in the U.S.

- The sparkling wine segment is anticipated to expand at the fastest CAGR of 7.7% from 2022 to 2030. The market is likely to be driven by a rise in the consumption of champagne and prosecco.

- In addition, manufacturers have offered a diverse selection of low-cost items in the sector category, which has played a significant role in driving the segment.

- Furthermore, sparkling wine is expected to grow fast due to the benefits it provides to the heart and skin. It also helps to improve gut health and digestion as it contains polyphenols from red grapes, which promotes the growth of good gut bacteria.

Based on the Distribution Channel Insights, the market is segmented into On-trade and Off-trade

- The off-trade segment held the largest revenue share of over 80.0% in 2021. Offering a variety of products at lower prices as compared to on-trade channels has increased the popularity of retail counters across the U.S.

- The on-trade channel is projected to register the fastest CAGR of 10.0% from 2022 to 2030. The demand through on-trade channels was severely impacted during the COVID-19 outbreak as pubs, bars, and clubs were closed owing to the fear of the spread of the virus.

- Further, there was a significant drop in international tourism caused by the strict lockdown measures. However, as the economy is opening, consumption of wine is increasing and is likely to grow at a faster rate than off-trade channels.

- Millennials and youth have started to socialize like before and tourism is also gaining pace, which is likely to positively impact the segment growth.

Key Companies Profile & Market Share Insights

The market includes both international and domestic participants. Key market players focus on strategies such as innovation and new product launches to enhance their portfolio offerings in the market. For instance, in March 2021, Constellation Brands announced that it has awarded Southern Glazer’s Wine & Spirits distribution of 70% of its wine and spirits portfolio in the United States. The agreement came into effect on April 1, 2021.

Some prominent players in the U.S. Wine market include:

- & J. Gallo Winery

- Pernod Ricard

- Deutsch Family Wine & Spirits

- Trinchero Family Estates

- Constellation Brands, Inc.

- Accolade Wine

- Bronco Wine Company

- Castel Frères

- The Wine Group

- Casella Family Brands

Order a free sample PDF of the U.S. Wine Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment