U.S. Frozen Food Industry Overview

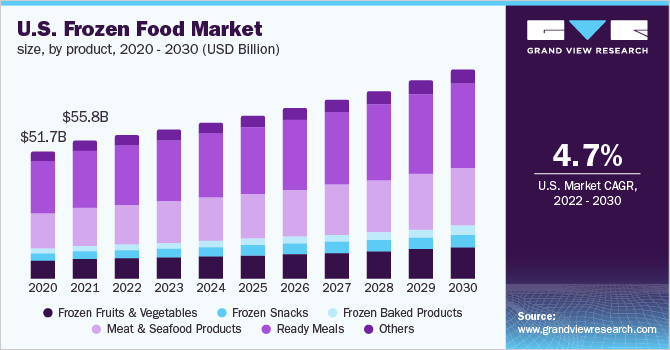

The U.S. frozen food market is expected to reach USD 84.58 billion by 2030, registering a CAGR of 4.7% during the forecast period 2022 to 2030 according to a new report by Grand View Research, Inc. Growth in the number of the millennial opting for the convenience foods is giving rise to the acceptance of frozen food in the U.S. These foods do not require any preservatives as microorganism do not grow when the temperature is low. Hence, making it a good option for the eatable between consumers.

Major food manufacturers have been ramping up their production capacity due to increased demand for frozen foods among consumers owing to safety and hygiene concerns. These products are packed well in containers, boxes, and bags hence making them a safe option for consumption. According to an article published in Food Dive, April 2020, four categories of frozen food section witnessed unprecedented growth including frozen meat (101%), frozen snacks (82.3%), and frozen beverages (94.6%) due to their convenience to cook as most of the restaurants were shut down during the pandemic due to safety protocols in the country.

U.S. Frozen Food Market Segmentation

Grand View Research has segmented the U.S. frozen food market based on the product, and distribution channel.

Based on the Product Insights, the market is segmented into Frozen Fruits & Vegetables, Frozen Snacks, Frozen Baked Products, Meat & Seafood Products, Ready Meals, and Others

- The ready meals segment held the largest market share of 40.7% in 2021 and is expected to maintain dominance in the forecast period.

- The segment for ready meals is developing rapidly due to the factors such as the prevalence of a fast-paced lifestyle, especially in urban areas, which is leading to increased demand for precooked foods including frigid foods, among consumers, to save time.

- However, frozen baked products are projected to register the fastest growth during the forecast period with a CAGR of 5.8% from 2022 to 2030.

- Moreover, product launches in this segment are likely to bode well with future segment growth. For instance, in September 2020 Levain’s-NewYork-based bakery shop announced the launch of frozen cookies in supermarkets. The product line includes Levain’s signature chocolate-walnut, variations of its two-chip and dark chocolate chip.

Based on the Distribution Channel Insights, the market is segmented into Offline and Online

- Offline was a larger distribution channel with a market share of around 87.2% in the regional revenue during 2021. This distribution channel includes supermarket/hypermarkets, convenience stores, grocery stores, and local shops.

- The availability of a wide range of chilled foods such as peas, chips, fish fillets, bread, pizza sausages, and chicken in such stores also plays a key role in driving this segment’s growth.

- The online distribution channel is anticipated to register faster growth during forecast years with a CAGR of 5.1% from 2022 to 2030. The rising preference of consumers toward online grocery shopping and demand for user-friendly interfaces and additional discounts has been fueling the demand for this segment.

Key Companies Profile & Market Share Insights

The U.S. frozen food market is highly fragmented with the presence of a large number of regional and local players. Companies have been implementing various expansion strategies, such as partnerships and new product launches, to stay ahead in the game.

Some prominent players in the U.S. Frozen Food market include:

- Cargill, Incorporated

- Nestlé S.A.

- Kraft Heinz Company

- General Mills, Inc.

- ConAgra Foods, Inc.

- Ajinomoto Co., Inc.

- McCain Foods

- Nomad Foods Ltd.

- Bellisio Foods

- Wawona Frozen Foods

Order a free sample PDF of the U.S. Frozen Food Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment