U.S. Tobacco Industry Overview

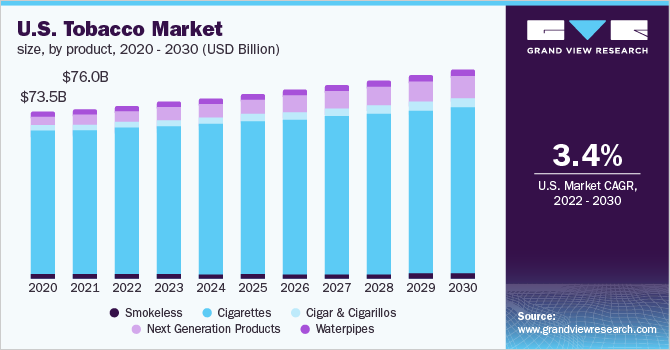

The U.S. tobacco market size is expected to reach USD 102.7 billion by 2030, registering a CAGR of 3.4%, according to a new report by Grand View Research, Inc. Factors such as stress, anxiety, and boredom resulting from the COVID-19 pandemic imposed restrictions on movement have driven the use of tobacco products and other related substances. Market players are developing new and improved product lines including flavored tobacco products such as clove cigarettes and menthol cigars to cater to changing smoking preferences. Such factors are expected to fuel the growth of the market in the U.S.

According to the Centers for Disease Control and Prevention (CDC), U.S., in 2019, some of the largest tobacco companies spent close to USD 8.2 billion on the marketing of cigarettes and smokeless tobacco in the U.S. This amount translates to about USD 22.5 million each day, or nearly USD 1 million every hour, which indicates the continued consumption of tobacco products across the country. Furthermore, the introduction of innovative tobacco products in varied taste options has become imperative, as consumers are gradually inclining toward smoking alternatives.

U.S. Tobacco Market Segmentation

Grand View Research has segmented the U.S. tobacco market based on product, distribution channel, and region:

Based on the Product Insights, the market is segmented into Smokeless, Cigarettes, Cigar & Cigarillos, Next Generation Products, and Waterpipes

- The cigarette segment held the largest market share of over 85.0% in 2021 and is expected to maintain dominance during the forecast period.

- The U.S. market consists of premium cigarettes, generally marketed under well-recognized brand names at higher retail prices to adult smokers who carry a strong preference for branded products.

- However, the segment is expected to expand at a lower CAGR of 2.5% owing to changes in underlying cigarette purchasing patterns.

- The next-generation products segment is anticipated to expand at a CAGR of over 10.0% owing to increased initiation among youth and young adults, as well as assisting adult smokers to switch to potentially less harmful forms of tobacco consumption, which is driving the demand for next-generation products.

- The growing availability of next-gen products such as e-cigarettes and heated tobacco in various flavors like menthol, & clove will influence the young population to try tobacco products further helping adult cigarette smokers reduce the use of cigarettes and switch to potentially less harmful products.

Based on the Distribution Channel Insights, the market is segmented into Online and Offline

- The offline channel accounted for a revenue share of over 85.0% of the market and is slated to remain the primary source for purchasing tobacco products in the U.S. Both small and large-scale companies sell their products through offline retail channels due to a large consumer base such as in grocery stores.

- The online channel is expected to register the fastest CAGR of around 4.7% from 2022 to 2030. Spending on advertising and promotion by leading players operating in the market is expected to offer significant growth to the segment in the forthcoming years.

- Growing online availability of flavored e-cigarettes like menthol and fruit is expected to boost the segment growth.

Key Companies Profile & Market Share Insights

The market is characterized by the presence of a few well-established players and several small and medium players. Mergers, acquisitions, and product launches remain some of the key strategic initiatives in the industry to gain a competitive edge.

Some prominent players in the U.S. Tobacco market include:

- Pyxus International, Inc.

- Swedish Match AB

- Altria Group, Inc.

- Korea Tobacco & Ginseng Corporation

- Imperial Brands

- Philip Morris International

- Universal Corporation

- Japan Tobacco Inc.

- Scandinavian Tobacco Group

- Vector Group LTD.

Order a free sample PDF of the U.S. Tobacco Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment