North America Chocolate Industry Overview

The North America chocolate market is expected to reach USD 57.4 billion by 2030, according to a new report by Grand View Research, Inc. It is expected to expand at a CAGR of 4.3% from 2022 to 2030. The health advantages of dark chocolate intake, together with rising demand for this product in a variety of applications such as confectionery and flavored eatables, are expected to drive the growth of North America chocolate market. Chocolate is becoming more popular as moderate consumption of chocolate increases serotonin, which soothes the brain and functions as an antidepressant. It also causes the release of endorphins in the body, which rapidly improves mood. This, in turn, is propelling market expansion.

Rising demand from children as a result of enhanced marketing through social media and television commercial channels by confectionery firms is driving the market expansion. The growing popularity of chocolates as a token of love, appreciation, and happiness that are given as gifts during the holiday season, primarily attracts consumers. Further, packaging, ingredients, authenticity, and the are buying experience, is also expected to boost the chocolate demand. This, in turn, is propelling market expansion.

North America Chocolate Market Segmentation

Grand View Research has segmented the North America chocolate market based on type, distribution channel and country:

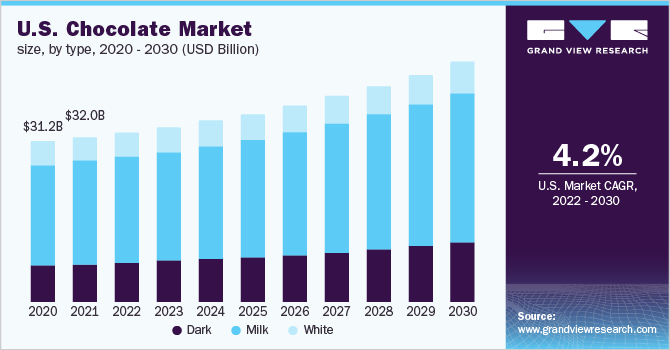

Based on the Type Insights, the market is segmented into Dark, Milk, and White

- The milk segment led the market and accounted for a 62.2% share of the revenue in 2021. Milk chocolates have a low cocoa concentration and a high milk content, making them sweet and creamy with a refined taste.

- Over the projected period, this is likely to emerge as a primary growth driver for the product. Growing demand for the product as an addition in frosting on cakes, cupcakes, puddings, and other sweets will also drive growth.

- The dark segment is anticipated to expand at the fastest CAGR of 5.1% from 2022 to 2030. Dark chocolate's demand is predicted to rise as its application in the confectionery and bread industries expands.

- Furthermore, the rising consumer desire for sugar-free and healthier baked products is likely to drive demand throughout the projection period.

- Also, growing health advantages associated with cocoa-rich dark chocolates, increasing online sales, players launching more limited-edition chocolates, and expanding marketing strategies are expected to boost the worldwide dark chocolate market over the projected period.

Based on the Distribution Channel Insights, the market is segmented into Offline and Online

- The offline segment made a larger contribution to the global market of over 61.1% in 2021.

- The success and growing acceptance of premium chocolates, are driven by both consumers' desire to indulge in this "affordable luxury".

- The influence of foodie culture, as well as the growth of chocolate retailers, both through franchise expansion and by successful independent shops looking to expand their footprints, are expected to drive the growth of chocolate sales in the offline distribution channel.

Key Companies Profile & Market Share Insights

The market includes both international and domestic participants. Key market players focus on strategies such as innovation and new product launches in retail about chocolate products to enhance their portfolio offering in the market.

Some prominent players in the North America Chocolate market include:

- The Hershey Company

- Mars Incorporated

- Nestlé

- Ferrero

- Chocoladefabriken Lindt & Sprüngli AG

- Godiva

- Ghirardelli Chocolate Company

- Mondelēz International

- General Mills Inc.

- Clif Bar & Company

Order a free sample PDF of the North America Chocolate Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment