U.S. Household Appliances Industry Overview

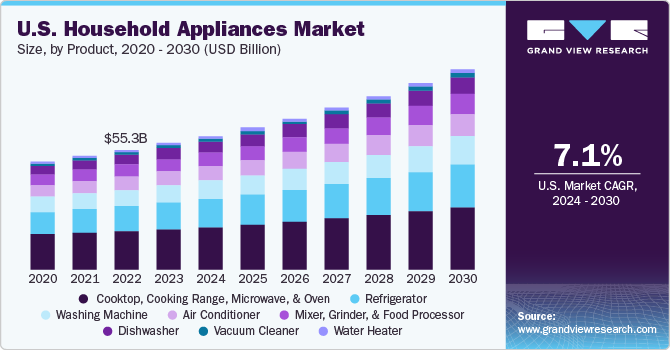

The U.S. household appliances market size is expected to reach USD 93.04 billion by 2030, according to a new report by Grand View Research, Inc. It is expected to expand at a CAGR of 6.5% from 2022 to 2030. Rising fuel prices, the increasing number of nuclear families, and the growth in induction cooking technology have increased the dependence of users on household appliances and hence are expected to have a significant impact on the U.S. market growth.

Other factors contributing to the growth of the U.S. market include the popularity of multi-functional and advanced products, which are capable of addressing more than one household application, thus giving good value for money. Vendors continually innovate to stay competitive, enhance customer satisfaction, expand the customer base, and generate demand for multi-functional household appliances to respond to the growing demand.

U.S. Household Appliances Market Segmentation

Grand View Research has segmented the U.S. household appliances market on the basis of product and distribution channel:

Based on the Product Insights, the market is segmented into Water Heater, Dishwasher, Refrigerator, Cooktop, Cooking Range, Microwave, and Oven, Vacuum Cleaner, Mixer, Grinder, and Food Processor, Washing Machine, and Air Conditioner

- The air conditioner segment is anticipated to expand at a CAGR of 7.3% from 2022 to 2030. Rising temperatures and growing middle-class income levels are expected to propel the air conditioner segment growth during the projected period.

- The cooktop, cooking range, microwave, and oven segment held the largest revenue share of over 30.0% in 2021.

- Furthermore, increased disposable income and improved living standards are some of the other factors that would drive the demand for cooktops, cooking ranges, microwaves, and ovens in the U.S. during the forecast period.

- The real estate market in the U.S. is expected to observe growth in demand for kitchen appliances owing to the desire to save time and effort.

Based on the Distribution Channel Insights, the market is segmented into Brick & Mortar and E-commerce

- The brick and mortar segment held the largest revenue share of over 65.0% in 2021. Most consumers prefer brick-and-mortar stores for buying household appliances due to the exclusive offerings by product specialists and after-sale services.

- The e-commerce segment is projected to register the fastest CAGR of 7.3% from 2022 to 2030.

- Rising internet penetration amongst consumers and target marketing done by companies to reach all customer touchpoints are likely to fuel the growth of this segment.

- The rapid expansion of e-commerce, along with the growing digitalization, especially among the young and millennial population at a global level, is driving the online sales of household appliances in the U.S.

- Additionally, easy payment transactions and the busy lifestyles of consumers are driving the online sales of the products.

Key Companies Profile & Market Share Insights

The market includes both international and domestic participants. Key market players focus on strategies such as innovation and new product launches to enhance their portfolio offering in the market. For instance, in February 2021, Wolf Appliance, Inc. launched four new innovations such as the Wolf induction range, wolf dual fuel range, Wolf E-series built-in Ovens, and under-counter refrigeration in a virtual showcase.

Some prominent players in the U.S. Household Appliances market include:

- Dongbu Daewoo Electronics

- Electrolux

- Fisher & Paykel Appliances Holdings Ltd.

- Frigidaire

- GE Appliances

- Haier Group Corporation

- LG Electronics

- Panasonic Corporation

- Philips Electronics

- Robert Bosch GmbH

- SAMSUNG

- SMEG

- Whirlpool Corporation

Order a free sample PDF of the U.S. Household Appliances Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment