Germany Consumer Appliances Industry Overview

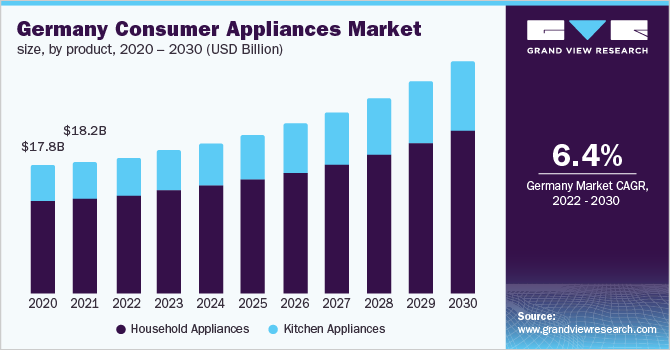

The Germany consumer appliances market size is expected to reach USD 31.86 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 6.4% from 2022 to 2030. Germany is considered a mature and developed market in the consumer appliances industry. Germany has been the focal point of development in the European region in terms of innovation and considering the requirements of the consumers.

The sales of household appliances in the German market depend upon the trade deals for the remodeling and renovation of houses or exchange and upgradation of older household appliances. The technical and mechanical advancements in home appliances products have contributed towards enhancing the way of life of individuals in Germany. A wave of change in the use of these products can be seen because of the increasing disposable income of German citizens and the fast urbanization patterns occurring in different parts of the world.

Germany Consumer Appliances Market Segmentation

Grand View Research has segmented the Germany consumer appliances market based on product and distribution channel:

Based on the Product Insights, the market is segmented into Household Appliances and Kitchen Appliances

- Household appliances held the largest revenue share of more than 70.0% in 2021.

- The most prominent products in the domestic household appliance industry are refrigerators, freezers, washing machines, air conditioners, vacuum cleaners, and dryers to name a few. These products are also known as white goods.

- Major household appliances have high demand in the market. Now with the increasing demand for major appliances, there is a growing demand for smart appliances coming into the picture as well.

- Consumers have now started utilizing modern and technically advanced devices and appliances due to the associated convenience and time-saving. There is a steady growth predicted in this segment for Germany.

- The factors responsible for this growth could be due to the improving lifestyles of consumers, improvement in the purchasing power, and migration of the rural population to the urban areas.

Based on the Distribution Channel Insights, the market is segmented into E-retailers, Discount, Variety Stores and General Merchandisers, Hypermarket, Supermarket and Discounters, Department Stores, and Others

- The e-retailers segment held the largest revenue share of over 45.0% in 2021. In Germany, there is a greater degree of concentration as large retailers like Metro (Media Markt and Saturn) hold large market shares, thus acting as a greater deterrent to new entrants.

- E-commerce is booming in the German market with Amazon and Otto being the top e-retailers in the market space.

- E-retailers are followed by departmental stores, which is the second-highest growing distribution channel in Germany.

- The German population has demonstrated an inclination towards retail offers and discounts, along with a high number of secured e-payment options. Thus, the German e-retail and departmental stores are expected to witness high growth during the forecast years.

Key Companies Profile & Market Share Insights

The market has been characterized by the presence of international and domestic participants. Key market players focus on strategies such as innovation and new product launches to enhance their portfolio offering in the market. For instance, in September 2021, BSH Appliances launched the new model of their pioneering Bosch Smart Indoor Gardening solutions. Additionally, in August 2021, Bosch Appliances lined up product launches across the world. The company plans to launch over 25 models of chimneys and hoods with premium features, such as auto cleaning, and various models of cooking and gas top burners.

Some prominent players in the Germany Consumer Appliances market include:

- Panasonic Corporation

- BSH Hausegrate GmbH

- Electrolux Group

- Gorenje

- Arcelik A.S.

- Bosch

- Miele

- Thermador

- Gaggenau

- Liebherr

Order a free sample PDF of the Germany Consumer Appliances Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment