Drug Testing Industry Overview

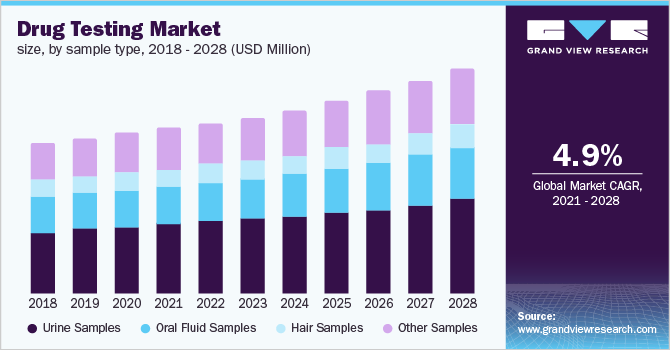

The global drug testing market size to be valued at USD 11.7 billion by 2028 and is expected to grow at a compound annual growth rate (CAGR) of 4.9% during the forecast period. Stringent regulations by government agencies mandating alcohol and drug testing for safety purposes and increasing initiatives to monitor and combat substance abuse are anticipated to support the market growth. Also, the growing incidence of substance abuse across the globe has led to an increase in the need for its screening, which has propelled the demand for drug testing. Moreover, the COVID-19 pandemic and resulting business closings, economic downturn, and job losses have adversely affected the mental health of people and have led to higher rates of substance abuse.

As per the CDC estimates, around 13.3% of Americans initiated or increased substance abuse to cope with anxiety or emotions related to COVID-19, thus, created a high demand for drug testing. However, a nationwide lockdown due to COVID-19 in major economies has slow down the demand for roadside and workplace testing in 2020, thus adversely affected the market growth to some extent.

Gather more insights about the market drivers, restraints and growth of the Global Drug Testing market

Enforcement of stringent laws by several government agencies mandating substance abuse screening for safety purposes has driven the demand for innovative products. For instance, after conducting a one-year roadside drug testing pilot program from 2017 to 2018 in five counties, in October 2019, the Michigan State Police (MSP) expanded Oral Fluid Roadside Analysis Pilot Program in all counties. Similarly, in August 2018, the Minister of Justice and Attorney General of Canada approved the use of roadside oral fluid screening equipment to detect drug-impaired drivers.

Various government initiatives to monitor and combat substance abuse are driving the market. The Health Canada's Substance Use and Addictions Program (SUAP) offers funding and contribution for projects that address substance abuse problems in Canada. This initiative supports substance use prevention, harm reduction, and treatment initiatives across Canada. Moreover, in April 2016, the New York City government launched a series of initiatives to train doctors and counselors treating substance abuse and increasing testing for synthetic opioids. The National Drug Control Budget requested USD 34.6 billion in FY 2020 across five drug control functional areas in the U.S.: Prevention, operation, treatment, law enforcement, and interdiction.

The right to privacy and prohibition of drug and alcohol testing in several countries are likely to be major factors hampering the market growth. In many European countries, such as Finland and Belgium, unlike the U.S., there are stringent privacy rights that cannot be ignored while screening for substance abuse. In the Netherlands, pre-employment substance abuse screening is illegal. Many European countries issue penalties for unjustified testing, with criminal fines. This is considered a breach of worker’s privacy. Hence, such stringent privacy rights are likely to limit testing at workplaces, impeding market growth.

Browse through Grand View Research's Healthcare Industry Related Reports

Drug Discovery Informatics Market - The global drug discovery informatics market size was valued at USD 2.39 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 11.3% from 2021 to 2028.

Drug And Gene Delivery Devices Market - The global drug and gene delivery devices market size to be valued at USD 786.9 Billion by 2025 and is expected to grow at a compound annual growth rate (CAGR) of 7.7% during the forecast period.

Drug Testing Industry Segmentation

Grand View Research has segmented the global drug testing market on the basis of product type, sample type, drug type, end use, and region:

Drug Testing Product Type Outlook (Revenue, USD Million, 2016 - 2028)

- Consumables

- Instruments

- Rapid Testing Devices

- Services

Drug Testing Sample Type Outlook (Revenue, USD Million, 2016 - 2028)

- Urine Samples

- Oral Fluid Samples

- Hair Samples

- Other Samples

Drug Testing Drug Type Outlook (Revenue, USD Million, 2016 - 2028)

- Alcohol

- Cannabis/Marijuana

- Cocaine

- Opioids

- Amphetamine & Methamphetamine

- LSD

- Others

Drug Testing End-use Outlook (Revenue, USD Million, 2016 - 2028)

- Drug Testing Laboratories

- Workplaces

- Hospitals

- Others

Drug Testing Regional Outlook (Revenue, USD Million, 2016 - 2028)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Market Share Insights:

April 2019: Thermo Fisher Scientific launched CEDIA Mitragynine (Kratom) Assay for criminal justice and forensic use.

Key Companies profiled:

Some prominent players in the global Drug Testing Industry include

- Quest Diagnostics Incorporated

- Abbott Laboratories

- Quidel Corporation

- Hoffmann-La Roche

- Thermo Fisher Scientific, Inc.

- Siemens Healthineers

- Bio-Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- LabCorp

Order a free sample PDF of the Drug Testing Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment