Viral Vector Production (Research-use) Industry Overview

The global viral vector production (research-use) market size was valued at USD 993.0 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 18.8% from 2021 to 2028. Rapid and extensive R&D in the advanced therapy arena has resulted in the growing employment of viral vectors in research settings. Also, the ongoing COVID-19 pandemic has encouraged investment in this space for vaccine development against SARS-CoV-2, thereby driving the market for viral vector production (research-use).

Viral vectors were being studied extensively by research communities well before the COVID-19 pandemic. This is because of their proven efficiency and successful application in gene and cell therapies. With the COVID-19 outbreak, applications of viral vectors were repurposed to manufacture vaccines. Moreover, the technology and platform developers are making significant attempts to simplify the production process, thereby addressing the process and scale-related challenges associated with viral vector manufacturing.

Gather more insights about the market drivers, restraints and growth of the Global Viral Vector Production (Research-use) Market

According to the U.S. FDA estimates, approval of 10 to 20 gene and cell therapy products is expected annually. This indicates the expansion of pipeline and R&D programs for advanced therapy products by key market entities. This is anticipated to spur demand for viral vectors by therapy developers and researchers. However, the currently available capacity is a major concern faced by the researchers.

Several manufacturers have invested a significant amount to expand their manufacturing capabilities to address the supply bottleneck in the space. For instance, on 12th February 2021, CDMO Vigene Biosciences signed a lease agreement for a new facility in Maryland to enhance its viral vector capacity by 50.0%. Similarly, Vibalogics has also initiated Phase I of its planned USD 150 million investment for capacity expansion. Such initiatives are anticipated to propel the growth of the market for viral vector production (research-use) in the coming years.

Furthermore, expensive and highly regulated processes have slowed down the vector production for large-scale clinical trials. The high cost of advanced therapies and technological challenges pertaining to financial sustainability is anticipated to hamper the manufacturing services. Despite several challenges, the market for viral vector production (research-use) is constantly growing owing to improved clinical outcomes and favorable regulatory bodies, thus witnessing considerable growth throughout the forecast period.

Browse through Grand View Research's Healthcare Industry Related Reports

Viral Vectors And Plasmid DNA Manufacturing Market - The global viral vectors and plasmid DNA manufacturing market size was valued at USD 2.87 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 14.71% from 2022 to 2030.

Gene Therapy Market - The global gene therapy market size was valued at USD 2.26 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 20.4% from 2021 to 2028.

Viral Vector Production (Research-use) Industry Segmentation

Grand View Research has segmented the global viral vector production (research-use) market on the basis of vector type, application, workflow, end-use, and region:

Viral Vector Production (Research-use) Vector Type Outlook (Revenue, USD Million, 2017 - 2028)

- Adeno-associated virus (AAV)

- Lentivirus

- Adenovirus

- Retrovirus

- Others

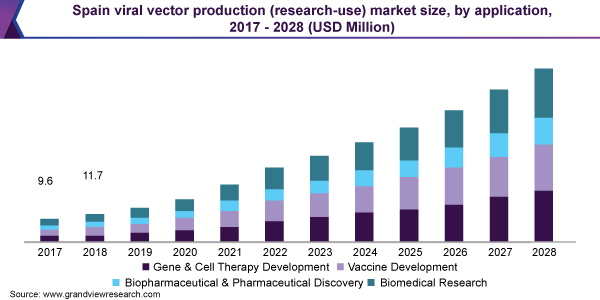

Viral Vector Production (Research-use) Application Outlook (Revenue, USD Million, 2017 - 2028)

- Cell & Gene Therapy Development

- Vaccine Development

- Biopharmaceutical and Pharmaceutical Discovery

- Biomedical Research

Viral Vector Production (Research-use) Workflow Outlook (Revenue, USD Million, 2017 - 2028)

- Upstream Processing

- Downstream Processing

Viral Vector Production (Research-use) End-use Outlook (Revenue, USD Million, 2017 - 2028)

- Pharmaceutical and Biopharmaceutical Companies

- Research Institutes

Viral Vector Production (Research-use) Regional Outlook (Revenue, USD Million, 2017 - 2028)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

January 2021: FUJIFILM Corporation invested USD 40 million to advance viral vector manufacturing capabilities.

Key Companies profiled:

Some prominent players in the global Viral Vector Production (Research-use) Industry include

- Merck KGaA

- Lonza

- FUJIFILM Diosynth Biotechnologies U.S.A., Inc.

- Cobra Biologics Ltd.

- Thermo Fisher Scientific

- Waisman Biomanufacturing

- Genezen

Order a free sample PDF of the Viral Vector Production (Research-use) Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment