North America Electric Vehicles Industry Overview

The North America electric vehicles market size to be valued at USD 147.60 billion by 2028 and is expected to grow at a compound annual growth rate (CAGR) of 37.2% during the forecast period. Favorable government initiatives, subsidies, and tax rebate programs to promote EV adoption will drive market growth. Additionally, several advantages of electric vehicles over conventional vehicles in terms of cost will also favor market growth over the forecast period. A decline in battery pack prices is also another factor expected to create significant growth opportunities for players operating in the market. According to a research paper published by the international council on clean transportation, battery pack prices in the U.S. are expected to drop from USD 11,500 in 2018 to USD 8,000 in 2025.

Electric vehicles are amongst the most prominent technologies that contribute to reducing air pollution. Thus, governments across the globe have proposed tax rebate programs to promote the adoption of electric vehicles. For instance, in the U.S., under the Clean Vehicle Rebate Project (CVRP), qualified applicants would be provided a rebate from the State of California, effective for applicants received on or after April 23, 2021. After meeting the eligibility requirements, the applicants would be eligible to receive cashback on a new electric vehicle based on the type selected. The applicant will receive a cashback of USD 2,000 on the purchase of a new battery electric vehicle and USD 1,000 on the purchase of a new plug-in hybrid electric vehicle.

Gather more insights about the market drivers, restraints and growth of the North America Electric Vehicles market

The adoption of electric vehicles has gained traction in several regions/countries due to increasing fuel prices. Electric vehicles act as a substitute for petrol and diesel vehicles and are powered by lithium-ion batteries that offer a hybrid charging facility. These vehicles are eco-friendly and do not cause any pollution. They do not emit harmful greenhouse gases while operating. The cost of electricity is much lower than the cost of fossil fuels. This reduces the cost of operation of electric vehicles as compared to other petrol and diesel vehicles. Thus, the rising crude oil prices and depletion of fuel reserves are expected to drive electric vehicle demand.

The COVID-19 pandemic negatively impacted the North America EVs market growth in 2020. The electric passenger car and light truck sales in the U.S. totaled over 200K units in 2020, which was significantly lesser than units recorded in 2019, thus registering a year-on-year decline of over 5% primarily due to the pandemic. According to the data published by Electric Mobility Canada (EMC), the electric vehicle sales in Canada witnessed a decline in the second quarter of 2020, with only over 8,000 units sold between April and June. The results represent a drop of over 50% from the units sold during the same period in 2019. However, the overall sales of electric passenger cars and light trucks in Canada remained the same in 2020 compared to 2019.

Browse through Grand View Research's Technology Industry Related Reports

Electric Vehicle Market - The global electric vehicle market demand was estimated at 2,373.5 thousand units in 2019 and is expected to witness a CAGR of 41.5% 2020 to 2027.

Electric Scooters Market - The global electric scooters market size was estimated at USD 20.78 billion in 2021, and the market is expected to expand at a compound annual growth rate (CAGR) of 7.8% from 2022 to 2030.

North America Electric Vehicles Industry Segmentation

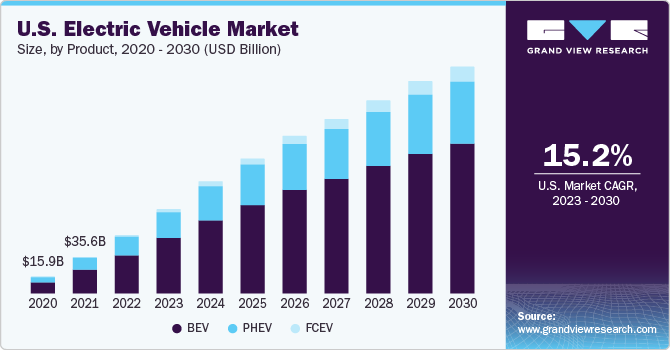

Grand View Research has segmented the North America electric vehicles market based on product, vehicle type, and region:

North America Electric Vehicles Product Outlook (Volume, Units; Revenue, USD Million, 2016 - 2028)

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

North America Electric Vehicles Type Outlook (Volume, Units; Revenue, USD Million, 2016 - 2028)

- PCLT

- Commercial Vehicles

Market Share Insights:

June 2022: Volkswagen AG announced the operation of its North American Battery engineering laboratory in Chattanooga. The company invested USD 22 million in developing and constructing the new flagship facility and its main purpose is to test EV batteries and high voltage engineering activities

March 2022: Tesla announced the opening of its Tesla Gigafactory Texas. Gigafactory Texas is located near Austin and will manufacture Tesla Cybertruck, Tesla Semi, Model 3, and Model Y for the eastern United State market.

Key Companies profiled:

Some prominent players in the North America Electric Vehicles Industry include

- BYD Company Ltd.

- Daimler AG

- Ford Motor Company

- General Motors Company

- Lucid

- Mitsubishi Motors Corporation

- Nissan Motor Company

- Tesla

- TOYOTA MOTOR CORPORATION

- Volkswagen AG

Order a free sample PDF of the North America Electric Vehicles Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment