U.S. Surgical Pet Collar Industry Overview

The U.S. surgical pet collar market size was valued at USD 126.0 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 7.2% from 2021 to 2028. The surgical pet collar, also known as Elizabethan collar, e-collar, Buster collar, protective collar, or pet cone, has been gaining popularity among most pet owners in the U.S. This medical device has a hollow frustum shape and is used to keep an animal from biting, licking, or scratching itself. The medical collar is generally designed to be attached to the pet’s general collar using a variety of fasteners provided with the product. The growing usage of surgical pet collars has widened their availability in pet stores and veterinarian dispensaries.

The market has been booming over the past few years. However, in the wake of COVID-19, it has witnessed unprecedented challenges. The pandemic has impacted the supply chain, thereby causing stress on the workforce and the availability of key inputs. With respect to retail sales in the country, manufacturers are more inclined towards online channels as social distancing has significantly changed consumer buying habits. As a result, most veterinary clinics supplying these surgical pet collars have begun accepting online orders for clients and their furry animals in order to help them safely fight the spread of COVID-19.

Gather more insights about the market drivers, restraints and growth of the U.S. Surgical Pet Collar market

Over the last few years, the pet market worldwide has been growing at a significant rate, as many countries have experienced an overall rise in the number of pet adoptions and an increase in animal health spending. People are spending more on the welfare of their pets as they view them as family members. Thus, they are willing to invest money to keep their pets healthy, which has led to an increase in the health expenditure of pets.

Additionally, the growing prevalence of diseases, including the diseases that cause wounding or need surgery, among pet animals is majorly driving the U.S. surgical pet collar market. Moreover, the rising demand for pet insurance to help limit out-of-pocket expenditure for critical medical conditions, such as cancer and accidental injuries, among pets is anticipated to boost the adoption of clinical procedures on pets. Consumer spending on pet medical care has been consistently rising year on year. This is expected to drive demand for surgical pet collars in the U.S. over the forecast period.

The pet adoption rate in the U.S. is on the rise, according to Spots.com, a provider of information about pets and pet products in the U.S., in 2020, there were 3.2 million pets in shelters. Pets ease loneliness, increase sociability, and diminish stress. Thus, the rising rate of pet adoption in the U.S. for various reasons including companionship is expected to lead to the increasing adoption of surgical pet collars in the U.S.

Despite a positive outlook, several research studies have been confirming that surgical pet collars can damage the mental and physical health of more than three-quarters of pets. A research study published by the Sydney School of Veterinary Science in February 2020 concluded that the surgical pet collar negatively impacts animal welfare and the overall quality of life in a range of important domains for 77% of dogs and cats. These domains included nutrition (eating and drinking), environment (movement and navigation), health (skin irritation and new wounds), behavior, and mental status (stress and depression). This is likely to restraint the growth of the market to some extent in the coming year.

Browse through Grand View Research's Consumer Goods Industry Related Reports

Inflatable Pet Collars Market - The global inflatable pet collars market size to be valued at USD 107.2 million by 2027 and is expected to grow at a compound annual growth rate (CAGR) of 5.0% during the forecast period.

Pet Insurance Market - The pet insurance market size was valued at USD 8.3 billion in 2021 and is estimated to expand at a compound annual growth rate (CAGR) of 16.7% from 2022 to 2030.

U.S. Surgical Pet Collar Industry Segmentation

Grand View Research has segmented the U.S. surgical pet collar market on the basis of product and end-use:

U.S. Surgical Pet Collar Product Outlook (Revenue, USD Million, 2016 - 2028)

- Plastic Collar

- Soft Fabric

- Inflatable

- Cervical

- Avian Spherical

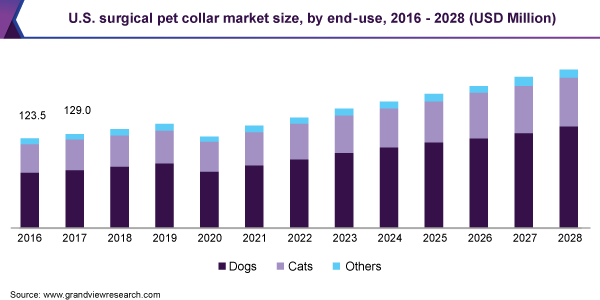

U.S. Surgical Pet Collar End-use Outlook (Revenue, USD Million, 2016 - 2028)

- Dogs

- Cats

- Others

Key Companies profiled:

Some prominent players in the U.S. Surgical Pet Collar Industry include

- KONG Company

- Acorn Pet Products LLC

- Remedy+Recovery

- ZenPet

- All Four Paws

- Campbell Pet Company

- Trimline Inc.

- KVP International, Inc.

- Génia USA Inc.

- Lomir Biomedical Inc.

Order a free sample PDF of the U.S. Surgical Pet Collar Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment