U.S. Biochar Industry Overview

The U.S. biochar market size was estimated at USD 125.3 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 16.8% from 2021 to 2028. This is attributed to growing requirements for the product to improve crop yields have resulted in increased utilization of fertilizers in the agricultural sector, thereby leading to increased acidity levels in the soil. In order to neutralize these soils, carbon-based additives such as compost and the product are gaining preference.

The product is a commercial product majorly used in livestock and animal feed industries. It is commonly produced by the thermal decomposition of plant-based biomass. While wood is the primary raw material used in the production of biochar, the other raw materials include woody debris, organic wastes, and manure litter.

Gather more insights about the market drivers, restraints, and growth of the U.S. Biochar market

The product is in the introduction stage of the product lifecycle in the U.S. With a rise in new farming systems and the proliferation of substitutes to conventional inorganic soil amendment products, some farmers are trying to become aware of various organic matters including biochar and their benefits. The U.S. government is also making efforts to promote the use of the product in agriculture.

According to an article published by Wiley, as of December 2018, the U.S. had a total number of 35 policies that directly or indirectly support and promote the use of biochar. Some of these policies are oriented toward energy and food production, environmental remediation and climate change management, and agricultural waste management. Among the 35 programs, 15 offer financial benefits, 8 have R&D funding, and the others help in generating financial awareness.

The U.S. EPA has released new rules for governing the production and consumption of biochar in the country. EPA is governing emissions of Commercial/Industrial Solid Waste Incinerators (CISWI) under the Resource Conservation and Recovery Act, which has generated norms for manufacturers regarding the disposal of waste produced during the manufacturing process.

As the major feedstock is woody biomass, the U.S. Forest Service is projected to have a deep interest to supply the raw material to local product manufacturers. The trees and vegetation destroyed due to fire salvage and wildlife reduction projects generate unsalable waste, which can be used for biochar production.

Browse through Grand View Research's Agrochemicals & Fertilizers Industry Research Reports.

Anticoagulant Rodenticides Market - The global anticoagulant rodenticides market size was valued at USD 680.4 million in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 3.3% from 2022 to 2030.

Nitric Acid Market - The global nitric acid market size was valued at USD 29.2 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 2.3% from 2022 to 2030.

U.S. Biochar Market Segmentation

Grand View Research has segmented the U.S. Biochar market on the basis of technology, application, and state:

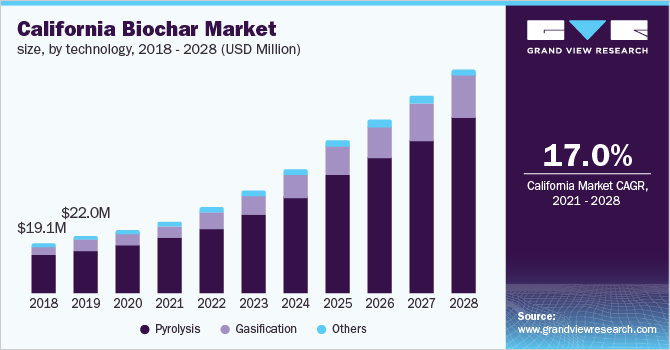

U.S. Biochar Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

- Pyrolysis

- Gasification

- Other

U.S. Biochar Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

- Agriculture

- Animal Feed

- Health & Beauty Products

- Others

U.S. Biochar State Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

- California

- Texas

- Kansas

- Oklahoma

- Idaho

- Arizona

- Other States

Key Companies profiled:

Some prominent players in the global U.S. Biochar market include

- BioCharWorks

- Biochar Supreme

- Avello Bioenergy

- Black Owl Biochar

- Aries Clean Energy LLC

- Pacific Biochar Benefit Corporation

Order a free sample PDF of the U.S. Biochar Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment