Egypt Ride Hailing Service Industry Overview

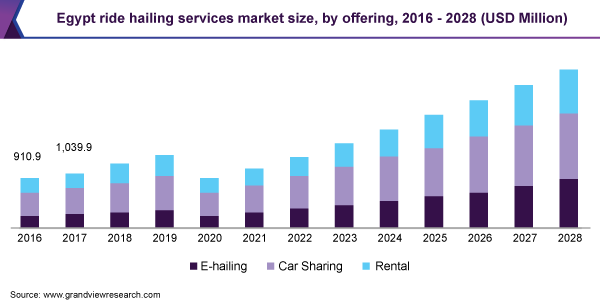

The Egypt ride hailing service market size was valued at USD 922.0 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 15.8% from 2021 to 2028. The increasing traffic congestion and the rising consumer preference for car-sharing services available at affordable rates and the desired comfort are the major factors driving the market growth. The growth is also attributed to the rising internet penetration and the use of smartphones to book rides. Ride-hailing services in Egypt have been hit hard by the COVID-19 pandemic. The service providers had the advantage of already operating several on-demand logistics services. Most companies allow their drivers to toggle between ride-hailing and on-demand delivery requests. That number now includes tens of thousands of new drivers who joined the platform to make up for lost earnings during the pandemic.

In Egypt, the growing urbanization and persistently low vehicle ownerships are likely to generate significant demand for ride hailing services in coming years. According to Urbanet, the country’s urban growth rate is over 2%. This shows that the Egyptian cities have to accommodate almost 1 million new citizens annually. Cairo alone saw half a million new inhabitants in 2017, making it the fastest-growing city in the world. This has been driving the need for commute services in these newly expanding cities.

Gather more insights about the market drivers, restraints and growth of the Egypt Ride Hailing Service market

Emerging ride-sharing companies in the country are focusing on unique strategies such as services focused on long road trips or lower overall rates and better safety. Furthermore, rising fuel prices, the growing popularity of ride-sharing services, and the increasing awareness about environmental conservation are resulting in the introduction of newer modes of transport. For instance, about 80% of the Electric Vehicles (EVs) imported in 2018 were sold outside of Cairo, which hints at the potential of electric vehicles in Egypt for ride-hailing.

An increasing number of ride-hailing service companies are opting for two-wheeler vehicles to curb the ongoing traffic emergencies in various cities across Egypt. The lower pricing of these vehicles has increased their traction in the online ride-hailing industry. For instance, Careem, which is active in 14 cities in Egypt, offers metered scooter rides starting from USD 0.38 (6 EGP). The cheapest ride costs USD 0.50 (8 EGP), which is approximately 50% lower than regular car rides.

Browse through Grand View Research's Consumer Goods Industry Related Reports

Shared Vehicles Market - The global shared vehicles market size was valued at USD 127.9 billion in 2021 and is expected to expand at a CAGR of 14.4% from 2022 to 2028.

Ride Hailing Services Market - The global ride hailing services market size was valued at USD 34.45 billion in 2018. The growing urban population in developing economies including China and India is expected to remain a favorable factor.

Egypt Ride Hailing Service Industry Segmentation

Grand View Research has segmented the Egypt ride hailing services market based on offering:

Egypt Ride Hailing Service Offering Outlook (Revenue, USD Million, 2016 - 2028)

- Car Sharing

- E-hailing

- Rental

Market Share Insights:

May 2019: SWVL Technologies Inc. and Ford announced a strategic partnership in which Swvl operators would use Ford transit minibus as the preferred vehicle of choice. The agreement will combine the brilliance of Transit, the world’s best-selling van brand, with an app-based mass transit system that enables commuters in Egypt’s major cities to enjoy affordable, convenient, safe, and reliable transportation services.

Key Companies profiled:

Some prominent players in the Egypt Ride Hailing Service Industry include

- Uber Technologies, Inc.

- Avis Rent a Car System, LLC

- Sixt SE

- Halan Inc.

- Wngo Technologies Inc.

- SWVL Technologies Inc.

- Dubci

- Fyonka

- FriendyCar

- M Car Egypt

Order a free sample PDF of the Egypt Ride Hailing Service Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment