Europe Reusable Water Bottle Industry Overview

The Europe reusable water bottle market size was valued at USD 1.72 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 4.1% from 2021 to 2028. Rising awareness regarding plastic pollution levels across the region is influencing consumers to disregard bottled water, thereby driving the market for the reusable water bottle. In addition, the adoption of a healthier lifestyle among consumers to keep themselves hydrated is expected to boost the sales of the product in the forecast period. The widespread home isolation guidelines have spurred the demand for various kitchen products, including reusable bottles, during the Covid-19 pandemic. According to a blog post by Klarna, millennials and Generation X used a large portion of their income on home and garden products during the lockdown. These items included drinkware, kitchenware, and other household products. Before the pandemic, 42% of people purchased bottled water for consumption at home despite easy access to tap or filtered water, which fell to 32% during the lockdown, according to YouGov’s report in July 2020.

Plastic beverage bottles are among the most dangerous pollutants present on the Earth and are posing a serious threat to human and marine life. A large amount of non-biodegradable plastic waste is present in the oceans and landfills. Ocean plastic waste adversely affects marine life whereas that in landfills affects human life by contaminating underground water.

Gather more insights about the market drivers, restraints and growth of the Europe Reusable Water Bottle market

To restrict such pollutants, in 2019, the European Union approved a ban on certain single-use plastics. This ban will come into effect from July 2021 and be implemented in all EU member countries. It includes single-use plastic items most commonly found on beaches in Europe. Although the law does not fully ban plastic bottles, it includes a 90% collection target for those by 2029. Moreover, the EU mandates plastic bottles to be made with 30% by 2030. These initiatives are likely to automatically drive the need for reusable water bottles across the region.

Over the past few years, a significant increase in the demand for reusable water bottles, majorly at the workplace and for home use, owing to their eco-friendly nature and reusability has boosted market growth across the region. The rising adoption rate of these bottles can be attributed to their cost-effectiveness, environmental friendliness, and durability. Shifting consumer preferences, evolving lifestyles, and improved standards of living are contributing to reusable water bottles becoming more of a style statement at workplaces or colleges. These factors are expected to drive the European market for reusable water bottles over the foreseeable future.

Despite the positive outlook, reusable water bottles are characterized by high manufacturing costs as raw materials such as stainless steel and glass are more expensive than plastic. In addition, the production of water bottles from stainless steel, copper, or other metals involves high consumption of energy. Moreover, even though glass bottles are among the most preferred options to reduce plastic pollution, they are easily breakable and have fewer chances of lasting for a long duration as compared to plastic water bottles. These factors are likely to restrict the market growth up to some extent in the coming years.

Browse through Grand View Research's Consumer Goods Industry Related Reports

Reusable Water Bottle Market - The global reusable water bottle market size was valued at USD 8.64 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2022 to 2030.

Drinkware Market - The global drinkware market size was valued at USD 3.87 billion in 2018 and is expected to register a CAGR of 3.1% from 2019 to 2025.

Europe Reusable Water Bottle Industry Segmentation

Grand View Research has segmented the Europe reusable water bottle market on the basis of material, type, distribution channel, and country:

Europe Reusable Water Bottle Material Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2028)

- Glass

- Aluminum

- Plastic

- Silicone

- Steel

- Others (Copper, Brass)

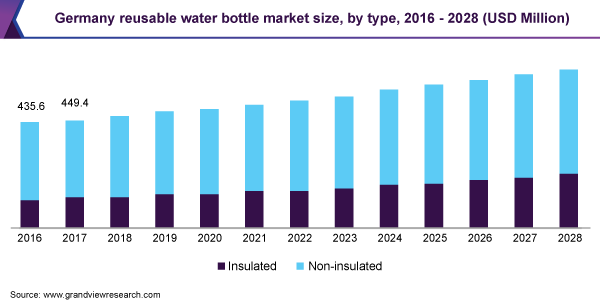

Europe Reusable Water Bottle Type Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2028)

- Insulated

- Non-insulated

Europe Reusable Water Bottle Distribution Channel Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2028)

- Online

- Offline

Europe Reusable Water Bottle Country Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2028)

- Germany

- Austria

- Switzerland

- France

- Great Britain

- Spain

- Italy

Key Companies profiled:

Some prominent players in the Europe Reusable Water Bottle Industry include

- Tupperware Brands Corporation

- SIGG Switzerland Bottles AG

- Hydaway

- 24 Bottles

- Hydro Flask

- Klean Kanteen

- Contigo

- CamelBak Products, LLC

- Laken

- Ball Corporation

- Thermos L.L.C.

- S’well

- Chilly’s Bottles Limited

Order a free sample PDF of the Europe Reusable Water Bottle Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment