North America Oxygen Concentrators Industry Overview

The North America oxygen concentrators market size was valued at USD 1.1 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 10.7% from 2021 to 2028. The ongoing COVID-19 pandemic is rapidly increasing demand for respiratory care products including concentrators. For instance, Invacare Corporation witnessed a 72.2% increase in sales of respiratory products in the fourth quarter of 2020 in North America owing to the COVID-19 pandemic. COVID-19 patients who do not require ventilator support can be treated with an oxygen concentrator. Moreover, COVID-19 patients can take oxygen therapy in the safety and comfort of their homes. The application of oxygen concentrators in the treatment of COVID-19 is a major reason for the sudden increase in demand in 2020.

An increasing number of cases of COPD is a major parameter driving the growth of the market. According to the American Lung Association, 14.9 million people were suffering from COPD in 2014 which increased to 16.4 million in 2018 in the U.S. Moreover, the geriatric population along with the burden of respiratory diseases is increasing rapidly. The geriatric population is prone to respiratory disorders including asthma, COPD, fibrosis, and pulmonary hypertension, which in turn is estimated to boost the market growth potential. As per the United Nations Department of Economic and Social Affairs (2015), the number of elderly people in Northern America is projected to grow by 41.0% over the next 15 years.

Gather more insights about the market drivers, restraints and growth of the North America Oxygen Concentrators market

According to the National Health Expenditure Accounts (NHEA), healthcare spending in the U.S. increased by 4.6% in 2019 and was estimated at US$ 3.8 trillion. The per-person expenditure in 2019 was USD 11,582 and contributed to 17.7% of the GDP. Moreover, the healthcare expenditure in Canada was US$ 265.5 billion, according to the Canadian Institute of Health Information. The rise in healthcare spending is estimated to trigger the need for effective diagnosis and treatment of respiratory diseases. This, in turn, is estimated to reinforce the demand for oxygen concentrators.

Supporting initiatives by the public and private authorities is driving the market. For instance, as of February 2021, the World Health Organization has distributed 30,000 oxygen concentrators globally. In February 2021, 3B Medical announced that it will donate Aer X portable concentrator each month for the next six months. In March 2021, the U.S. Food and Drug Administration granted 510(k) clearance and marketing authorization for the X-PLO2R portable oxygen concentrator of Belluscura. Moreover, various associations such as the American Lung Association, and the National Heart, Lung, and Blood Institute (NHLBI), among others, are working towards increasing awareness of respiratory diseases such as COPD.

Moreover, key stakeholders operating the market are adopting various strategies, including mergers and acquisitions to gain a competitive advantage. This in turn is estimated to drive the growth of the market. For instance, in October 2018, NGK SPARK PLUG CO., LTD. acquired CAIRE Inc. in the U.S. to strengthen its product portfolio in the respiratory care and oxygen products segment. In October 2016, DeVilbiss announced that it had acquired DME brands from AMG Medical, which includes Hugo, Profilio, Airgo, and AquaSense, to market it in North America.

Browse through Grand View Research's Healthcare Industry Related Reports

Oxygen Therapy Market - The global oxygen therapy market size was valued at USD 16.6 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.4% from 2022 to 2030.

Medical Oxygen Concentrators & Oxygen Cylinders Market - The global medical oxygen concentrators and oxygen cylinders market size was valued at USD 2.9 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 4.2% from 2020 to 2026.

North America Oxygen Concentrators Industry Segmentation

Grand View Research has segmented the North America oxygen concentrators market on the basis of product, application, technology, and region:

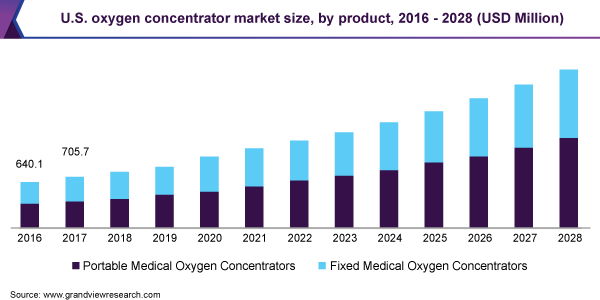

North America Oxygen Concentrator Product Outlook (Revenue, USD Million, 2016 - 2028)

- Portable

- Fixed

North America Oxygen Concentrator Application Outlook (Revenue, USD Million, 2016 - 2028)

- Homecare

- Non-Homecare

North America Oxygen Concentrator Technology Outlook (Revenue, USD Million, 2016 - 2028)

- Continuous Flow

- Pulse Flow

North America Oxygen Concentrator Regional Outlook (Revenue, USD Million, 2016 - 2028)

- North America

- U.S.

- Canada

Market Share Insights:

April 2019: Inogen launched Inogen One G5, a portable oxygen concentrator for home care settings or traveling.

Key Companies profiled:

Some prominent players in the North America Oxygen Concentrators Industry include

- Invacare Corporation

- Philips Healthcare

- AirSep Corporation

- DeVilbiss Healthcare

- Nidek Medical Products, Inc.

- Inogen, Inc.

- Inova Labs, Inc.

- O2 Concepts

Order a free sample PDF of the North America Oxygen Concentrators Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment