U.S. Wine Cooler Industry Overview

The U.S. wine cooler market size was valued at USD 326.5 million in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 6.4% from 2021 to 2028. The growth in product adoption can be attributed to the increasing consumption of wine in American households. Consumers can be seen buying these and storing the bottles at home, making wine coolers a basic necessity. Product launches have also been driving the growth of the market. For instance, Vinotemp, a Henderson, Nevada-based company building premium wine storage, launched Garage 300-Bottle Dual-Zone Wine Cooler in April 2021. It features enhanced insulation on both the cabinet and the door, added to resist the effects of changing temperatures. Consumers can monitor and set their temperature zones via a central control panel, as well as turn Vinotemp’s BioBlu LED lighting on and off.

The adoption of home appliances with multi-functional features is an upcoming trend in the residential sector. Moreover, along with alcohol, the consumption of non-alcoholic wines amongst millennials has been on the rise over the past few decades. One of the greatest functions of a wine cooler, which is driving its rapid deployment in the residential and commercial sectors, is its ability to protect wine collection from any natural elements that could potentially be damaging.

Gather more insights about the market drivers, restraints and growth of the U.S. Wine Cooler market

There has been significant growth in online shopping across all age groups in the U.S., with the most common users of online channels being younger, urban, and affluent consumers. This is also likely to support market growth.

Moreover, with recent stay-at-home orders and safer-at-home advisories across the country, consumers are becoming increasingly reliant on their household appliances. Several brick-and-mortar stores have taken a major hit owing to strict lockdowns and the need for maintaining social distancing in severely affected cities across the U.S. Thus, e-commerce has emerged as the preferred distribution channel since the COVID-19 outbreak.

Furthermore, according to the Wine Intelligence U.S. COVID-19 Impact Report, published in May 2020, the majority of respondents stated that the origin of wine they purchased was the same during the first half of 2020, but there was a notable shift in purchase preferences toward domestic wines and away from imports. Around 18% of respondents reported buying more wine from California and other U.S. regions during the pandemic-induced lockdown, while 20% reported that they were buying less wine from France, Italy, and Spain.

Browse through Grand View Research's Consumer Goods Industry Related Reports

Wine Cooler Market - The global wine cooler market size was valued at USD 2.05 billion in 2018. Increasing consumption of wine across the world is one of the main factors fueling the product demand.

Retail Cooler Market - The global retail cooler market size was valued at USD 1.50 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.6% from 2022 to 2030.

U.S. Wine Cooler Industry Segmentation

Grand View Research has segmented the U.S. wine cooler market on the basis of product, application, distribution channel, and price range:

U.S. Wine Cooler Product Outlook (Revenue, USD Million, 2016 - 2028)

- Free-standing

- Countertop

- Built-in

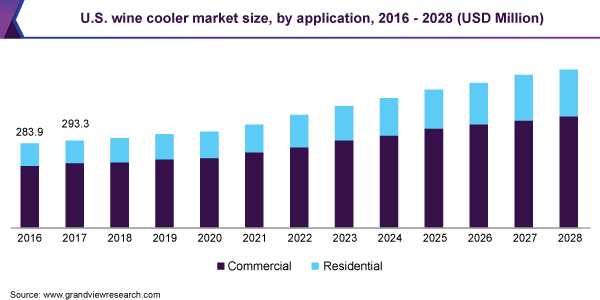

U.S. Wine Cooler Application Outlook (Revenue, USD Million, 2016 - 2028)

- Residential

- Commercial

U.S. Wine Cooler Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

- Supermarket/Hypermarket

- Specialty Stores/Homecare Shops

- Company-owned Outlets

- Online

U.S. Wine Cooler Price Range Outlook (Revenue, USD Million, 2016 - 2028)

- Less than USD 500

- Above USD 500 to 1,500

- Above USD 1500

Market Share Insights:

January 2020: Allavino introduced Tru-Vino Temperature Control technology

September 2018: Newair launched Dual Zone Wine and Beverage Refrigerator. The refrigerator offers two cooling zones, one for carbonated drinks and one for wines.

Key Companies profiled:

Some prominent players in the U.S. Wine Cooler Industry include

- Haier Group Corp.

- LG Electronics, Inc.

- Whirlpool Corp.

- Koolatron

- Newair

- Samsung Electronics Co. Ltd.

- EdgeStar

Order a free sample PDF of the U.S. Wine Cooler Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment