North America Sports Nutrition Industry Overview

The North America sports nutrition market size was valued at USD 12.6 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 8.4% from 2021 to 2028. Increasing awareness about the health benefits of consuming sports nutrition products among bodybuilders and athletes is driving the market growth. Moreover, the increasing number of gym-goers and active lifestyle consumers’ adoption of sports nutrition products is further supporting market growth potential. Demand for sports nutrition products is growing rapidly from core users and active lifestyle consumers in North America. Light users consumed sports nutrition products specifically targeting muscle support, energy, weight management, and healthy snacking. Core users or heavy users are focused on sports supplements required for muscle building, strength performance, endurance, and recovery.

Consumers involved in strength training are major consumers of whey proteins, branched-chain amino acids, essential amino acids, and protein products. According to a survey of the U.S. college athletes published by the National Institutes of Health in 2021, 41.7% of the users were consuming protein products, 28.6% were consuming shots and energy drinks, creatinine by 14%, amino acids by 12.1%, and caffeine-containing multivitamins by 5.7%. Moreover, women were less likely to consume performance-enhancing products according to the same survey. According to a youth risk behavior survey conducted among high school students in the U.S. by the Centers for Disease Control and Prevention, 11% of the high school students drank sports drinks at least one time a day in 2019 in the U.S.

Gather more insights about the market drivers, restraints and growth of the North America Sports Nutrition market

Awareness of health and fitness is increasing participation in sports and fitness activities. In addition, consumers are adopting various supplements to maintain health and wellbeing. The International Health, Racquet & Sportsclub Association (IHRSA), a Boston-based commercial health clubs trade association, reported a 27% rise in the number of health club members, from 58 million in 2010 to 73.6 million in 2019. According to the U.S. Bureau of Labor Statistics, 19.3% of the population in the U.S. was involved in exercise and sports activities each day in 2019. In addition, California, Georgia, Colorado, Illinois, Massachusetts, Maryland, Nebraska, Oregon, New York, South Carolina, Virginia, West Virginia, and Texas are some of the states where participation in sports and physical activity is increasing. All these parameters are fueling the growth of sports nutrition products in North America.

The spread of COVID-19 negatively impacted the sports nutrition market. Sales of sports nutrition products declined rapidly in 2020 as consumers were focused on buying essential products. Moreover, temporary closures of gyms & fitness centers owing COVID-19 associated lockdowns drastically declined consumption of sports nutrition products. However, the re-opening of gyms and fitness centers along with increasing consumer awareness on health is estimated to drive sales of sports nutrition products in 2020.

Browse through Grand View Research's Healthcare Industry Related Reports

Sports Nutrition Market - The global sports nutrition market size was valued at USD 40.0 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.5% from 2022 to 2030.

Sports Supplement Market - The global sports supplement market size was valued at USD 20.6 billion in 2018 and is expected to expand at a CAGR of 11.2% from 2018 to 2025.

North America Sports Nutrition Industry Segmentation

Grand View Research has segmented the North America sports nutrition market based on product type, application, formulation, consumer group, distribution channel, and country:

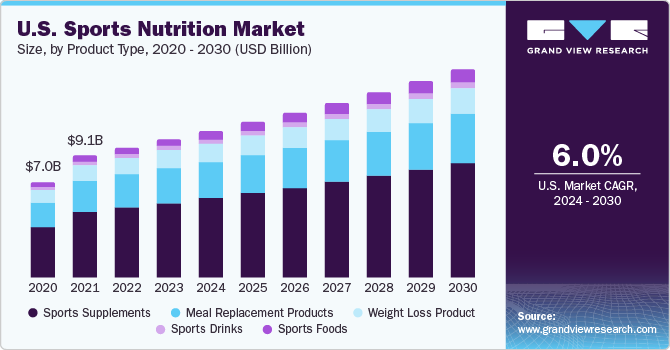

North America Sports Nutrition Product Type Outlook (Revenue, USD Million, 2016 - 2028)

- Sports Supplements

- Sports Drinks

- Sports Foods

- Meal Replacement Products

- Weight Loss Product

North America Sports Nutrition Application Outlook (Revenue, USD Million, 2016 - 2028)

- Pre-workout

- Post-workout

- Weight Loss

- Others

North America Sports Nutrition Formulation Outlook (Revenue, USD Million, 2016 - 2028)

- Tablets

- Capsules

- Powder

- Softgels

- Liquid

- Gummies

North America Sports Nutrition Consumer Group Outlook (Revenue, USD Million, 2016 - 2028)

- Children

- Adult

- Geriatric

North America Sports Nutrition Consumer Group by Activity Outlook (Revenue, USD Million, 2016 - 2028)

- Heavy Users

- Light Users

North America Sports Nutrition Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

- Bricks and mortar

- Ecommerce

Market Share Insights:

August 2021: Gelita AG presented its products for sports nutrition applications at SupplySide East and included gelatins for soft gel, hard-capsule, or gummy delivery systems.

March 2020: PepsiCo agreed to acquire Rockstar Energy Beverages for USD 3.9 billion. The acquisition was aimed at enhancing its presence in the fast-expanding beverage category.

Key Companies profiled:

Some prominent players in the North America Sports Nutrition Industry include

- Inovate Health Sciences

- Abbott

- Quest Nutrition

- PepsiCo; Clif Bar

- the Coca Cola Company

- MusclePharm

- The Bountiful Company

- Post Holdings

- BA Sports Nutrition

- Cardiff Sports Nutrition

Order a free sample PDF of the North America Sports Nutrition Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment