U.S. Range Cooker Industry Overview

The U.S. range cooker market size to be valued at USD 2.66 billion by 2028 and is expected to grow at a compound annual growth rate (CAGR) of 7.7% during the forecast period. The rising preference for modular kitchens, coupled with improving living standards, is driving the product demand in the commercial as well as the residential sector in the U.S. Also, the increasing trend of remodeling homes to build and accommodate modular kitchens is resulting in fast-paced product adoption in the U.S. The e-commerce distribution channel witnessed considerable popularity during the pandemic. Owing to lockdowns and social distancing practices, customers are increasingly opting for online purchases. Online sites provide convenience and are working on reducing delivery time.

Furthermore, the online platforms offer products at low prices and promote their products through the digital network by offering huge discounts. The growing trend of food-at-home cooking and the influence of social media, magazines, & TV shows regarding cooking tips & recipes have raised awareness regarding different cooking techniques. Which, in turn, likely to drive the market growth over the forecast period. Increased spending on home improvement or remodeling projects is also boosting the product demand.

Gather more insights about the market drivers, restraints and growth of the U.S. Range Cooker market

Total homeowner equity has nearly doubled in the past five years since 2019, indicating a surge in spending capacity toward home improvement. According to a blog published by KBR Kitchen & Bath in March 2021, the average cost of kitchen remodeling in an American household is currently USD 22,134, according to homeowners, and could go as high as USD 50,000. Minor projects or remodeling jobs in smaller kitchens could cost as low as USD 10,000, which could include painting, replacing the sink, installing a tile backsplash, and changing the facade of the cabinets.

According to the National Association of Realtors (NAR), existing home sales rose by 10.5% y-o-y to a seasonally adjusted annual rate of 6 million units in August 2020. Moreover, manufacturers are partnering with contractors and builders for home construction with appropriate range cookers in the kitchen. Technological advancements, along with the rising usage of IoT, in kitchen appliances are expected to be the key factors boosting the market growth. Manufacturers are focusing on developing innovative devices owing to the rising demand for products with smart features.

On the other hand, range cookers are bulky and take up a lot of space in a kitchen, and can break up a clean & seamless look. Also, they are installed as a freestanding unit on the floor, which means bending and stooping to place/view food inside the oven. These factors may hamper the product demand, thereby affecting the overall market growth.

Browse through Grand View Research's Consumer Goods Industry Related Reports

Cookers & Ovens Market - The global cookers & ovens market size was valued at USD 153.05 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2022 to 2028.

Small Kitchen Appliances Market - The global small kitchen appliances market size was valued at USD 16.66 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.2% from 2022 to 2028.

U.S. Range Cooker Industry Segmentation

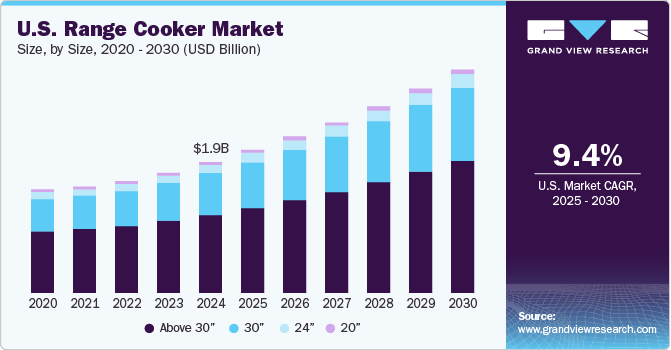

Grand View Research has segmented the U.S. range cooker market on the basis of size, price range, application, and distribution channel:

U.S. Range Cooker Size Outlook (Revenue, USD Million, 2016 - 2028)

- 20”

- 24”

- 30”

- Above 30”

U.S. Range Cooker Price Range Outlook (Revenue, USD Million, 2016 - 2028)

- USD 1,000 & Below

- USD 1,001 - USD 3,000

- USD 3,001 - USD 5,000

- Above USD 5,000

U.S. Range Cooker Application Outlook (Revenue, USD Million, 2016 - 2028)

- Residential

- Commercial

U.S. Range Cooker Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

- Online

- Offline

Market Share Insights:

March 2020: Whirlpool Corporation announced the official opening of its new state-of-the-art Factory Distribution Center (FDC) adjacent to its existing manufacturing plant in Tulsa, Oklahoma. The existing plant produces freestanding and slide-in ranges under the Whirlpool, Amana, Maytag, KitchenAid, and JennAir brands.

Key Companies profiled:

Some prominent players in the U.S. Range Cooker Industry include

- Amana

- GE Appliances

- Samsung

- Premier

- Monogram

- LG KitchenAid

- Frigidaire

- Viking

- Thermador

- Dacor

- Whirlpool

Order a free sample PDF of the U.S. Range Cooker Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment