Military Personal Protective Equipment Industry Overview

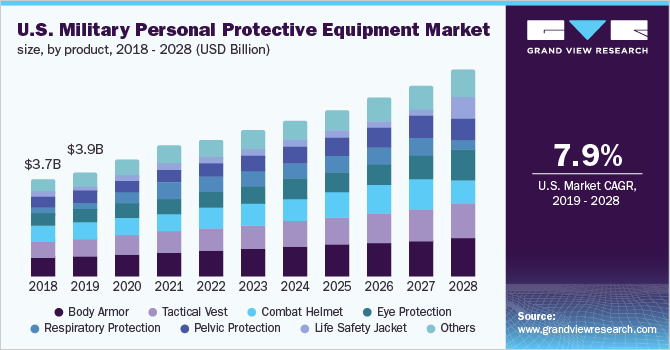

The global military personal protective equipment market size was valued at USD 13.47 billion in 2020 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.8% from 2019 to 2028. Body armor, eye protection, tactical vests, advanced combat helmets, breathing devices, gloves, and footwear are examples of military PPE worn by soldiers during battle or training. Personal Protective Equipment (PPE) is designed to protect soldiers from biological, chemical, physical, and radioactive threats. The rising focus of defense agencies on troop safety and security, as well as higher military budgets, are expected to fuel market growth over the forecast period. Despite the COVID-19 pandemic, global military spending has increased significantly as compared to 2019. This can be attributed to the growing geopolitical instability, internal conflicts, border disputes, rising terrorism, and increased spending on NATO. Thus, increased military spending is likely to boost the product demand in the coming years.

The COVID-19 pandemic has resulted in the increased adoption of Respiratory Protective Equipment (RPE) and PPE for eyes in the military to safeguard soldiers from coming in contact with the virus. RPE includes gas masks, filters, powered air respirators, and self-contained breathing equipment, among others. The growing demand for masks and eyewear is expected to boost market growth over the forecast period.

Gather more insights about the market drivers, restraints, and growth of the Global Military Personal Protective Equipment market

The U.S. is a major market for military PPE. In 2020, the U.S. was the world’s top country that spent around USD 778 billion on the military. The high spending in the U.S. is attributed to strong investments in R&D and modernization of equipment and nuclear arsenals The U.S Armed Forces are the world’s third-largest military force, and the country’s rising defense spending is expected to propel the product demand.

China’s increased military spending is attributed to the country’s economic prosperity and strong presence in the Indian Ocean region to execute its String of Pearls policy. The rising tensions between China and India along the Sino-India disputed border have resulted in a significant rise in military spending in both nations, thereby complementing the market growth.

Browse through Grand View Research's Smart Textiles Industry Research Reports.

Body Armor Market - The global body armor market size was valued at USD 2.3 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.6% from 2022 to 2030.

Personal Protective Equipment Market - The global personal protective equipment market size was valued at USD 77.36 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 7.3% from 2020 to 2028.

Military Personal Protective Equipment Market Segmentation

Grand View Research has segmented the global military personal protective equipment market on the basis of product, end-use, and region:

Military PPE Product Type Outlook (Revenue, USD Billion, 2017 - 2028)

- Body Armor

- Tactical Vest

- Eye Protection

- Combat Helmet

- Life Safety Jacket 4d

- Pelvic Protection

- Respiratory Protection

- Others

Military PPE End-use Outlook (Revenue, USD Billion, 2017 - 2028)

- Army

- Navy

- Air Force

Military PPE Regional Outlook (Revenue, USD Billion, 2017 - 2028)

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa

Key Companies profiled:

Some prominent players in the global Military Personal Protective Equipment market include

- 3M

- Honeywell International

- ArmorWorks

- Eagle Industries

- BAE Systems

- DuPont

- DSM

- Armorsource

- MSA Safety

- Revision Military

- Gentex Corp.

- Ansell

- MKU Ltd.

- Avon Protection Systems, Inc.

- Ballistic Body Armor Pty

Order a free sample PDF of the Military Personal Protective Equipment Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment