5G Chipset Industry Overview

The global 5G chipset market size is expected to reach USD 66.45 billion by 2028, according to a new study by Grand View Research, Inc. It is expected to expand at a CAGR of 69.1% from 2021 to 2028. The rapidly rising demand for ultra-reliable and low-latency data networks capable of delivering seamless connectivity is estimated to boost market growth over the forecast period. As such, the 5G chipset is turning out to be an integral part of modern telecommunication equipment.

The growing popularity of 5G-enabled smartphones is emerging as a major factor that is estimated to propel market growth over the forecast period. Key smartphone manufacturers are responding to the growing demand for 5G smartphones by aggressively investing in vertical integration in order to diversify their businesses and augment revenues. 5G chipsets can be found in the latest smartphones, laptops, base stations, modems, and routers. These chipsets are also being installed in connected vehicles deployed as part of autonomous vehicle systems to provide improved Vehicle-to-Everything (V2X) connectivity.

5G Chipset Market Segmentation

Grand View Research has segmented the global 5G chipset market on the basis of frequency type, processing node type, deployment type, vertical, and region:

Based on the Deployment Type Insights, the market is segmented into Telecom Base Station Equipment, Smartphones/Tablets, Connected Vehicles, Connected Devices, Broadband Access Gateway Devices, and Others.

- The smartphones/tablets segment dominated the market with a share of nearly 55.0% in 2020. This is attributed to the growing demand for 5G-enabled smartphones for online gaming, watching Ultra High Definition (UHD) videos, and video calling applications.

- The growing need to support multi-carrier frequencies is anticipated to drive the multi-mode segment over the forecast period. At the same time, the need to ensure ultra-reliable connectivity for the increasing number of connected devices being deployed continuously across the energy and utility, healthcare, and manufacturing industries is also growing.

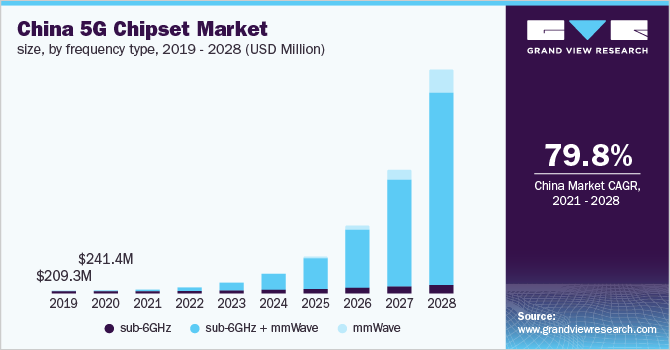

Based on the Frequency Type Insights, the market is segmented into sub-6GHz, mmWave, and sub-6GHz + mmWave.

- The sub-6GHz segment dominated the market with a share of more than 65.0% in 2020. This is attributed to the initial offerings of 5G chipset components supporting the sub-6GHz band by key market players for smartphones, connected cars, and laptops.

- The sub-6GHz + mmWave segment is expected to register a noticeable CAGR over the forecast period owing to the continued introduction of the modern chipset components supporting both the sub-6GHz and mmWave bands in a single module.

- The continued rollout of the Industrial Internet of Things(IIoT) and the growing popularity of autonomous cars have triggered the necessity for higher bandwidth and faster data networks. As a result, the chipset demand for supporting the mmWave band is expected to grow over the forecast period.

Based on the Node Type Insights, the market is segmented into 7 nm, 10 nm, and others.

- The 7 nm segment dominated the market with a share of 64.2% in 2020. This is attributed to the initial focus on developing 5G chipset components with a 7nm processing node by key players.

- The 10 nm segment is expected to register a significant CAGR over the forecast period. Furthermore, as autonomous cars become more common, the need to maintain seamless connectivity between vehicles would also grow and higher processing nodes would have to be adopted to develop 5G chipset components.

Based on the Vertical Insights, the market is segmented into Manufacturing, Energy & Utilities, Media & Entertainment, IT & Telecom, Transportation & Logistics, Healthcare, and Others.

- The IT and telecom segment dominated the market with a share of over 35.0% in 2020. This is attributed to the significant investments being made by the prominent players in developing 5G chipset modules for telecom base stations, broadband gateway devices, and other communication devices.

- The need to establish seamless wireless communication between various robots, sensors, and actuators, which form an integral part of the manufacturing process, is also growing. As a consequence, the manufacturing segment is expected to exhibit the highest CAGR over the forecast period.

5G Chipset Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

Key players are adopting various strategies, including new product development and strategic collaborations, to strengthen their foothold in the market for 5G chipsets. At the same time, key smartphone manufacturers, such as Apple Inc., are focusing on vertical integration in order to enhance their product portfolios with 5G-enabled devices. The market incumbents are aggressively focusing on developing new and innovative products, expanding the overall product portfolios, and gaining a significant market share.

For instance, in February 2019, Qualcomm Incorporated introduced the Snapdragon X55 5G modem. The new modem supports sub-6GHz as well as mmWave bands. Major players are also investing in research and development to develop new multi-mode 5G chipset components. For instance, in 2018, Intel Corporation infused USD 28.7 billion in R&D to develop new and innovative technologies. The company also expected these investments to help in strengthening its competitive position in the market.

Some prominent players in the global 5G chipset market include:

- Qualcomm Incorporated

- Intel Corporation

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- MediaTek Inc.

- Infineon Technologies AG

- Unisoc Communications, Inc.

- Xilinx Inc.

- Qorvo, Inc.

Order a free sample PDF of the 5G Chipset Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment