Sparkling Water Industry Overview

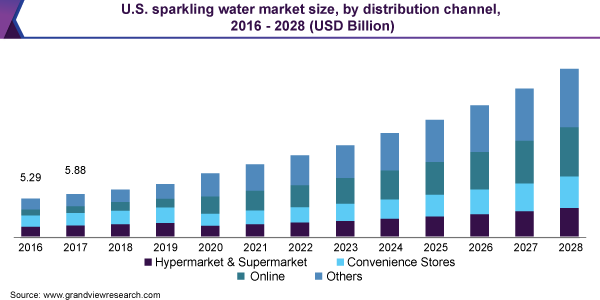

The global sparkling water market size is expected to reach USD 76.95 billion by 2028, according to a new report by Grand View Research, Inc. It is expected to expand at a CAGR of 12.6% from 2021 to 2028. Over the past few years, the demand for packaged water has significantly grown across the globe owing to the rising demand for healthy drinking water and the declining availability of fresh, clean, and hygienic water.

The growing consumer preference for sparkling water over sodas and sugary carbonated drinks is projected to drive the market over the forecast period. During the initial months of the Covid-19 pandemic, a majority of public places and offices were shut, which led to a significant drop in the commercial demand for sparkling water. However, widespread home isolation orders have spurred the demand for bottled water of various kinds among households across the globe, including sparkling water.

Sparkling Water Market Segmentation

Grand View Research has segmented the global sparkling water market on the basis of product, distribution channel, and region:

Based on the Distribution Channel Insights, the market is segmented into Hypermarket & Supermarket, Convenience Stores, Online, and Others.

- The others segment dominated the market and held a share of 36.4% in 2020.

- The hypermarket and supermarket and convenience stores together held a significant share in 2020. Moreover, the wide availability of both premium and private label brands at these stores attract consumers to purchase products through these channels.

- The online distribution channel is expected to register the fastest CAGR of 13.3% from 2021 to 2028. The shift in consumers’ shopping behavior is one of the major factors driving sales through the online channel.

- Benefits offered by online platforms, including shopping from the comfort of one’s home, doorstep delivery, free shipping, subscription services, and discounts, are attracting millennials and the younger generation to opt for this channel.

Based on the Product Insights, the market is segmented into Natural/Mineral Sparkling Water and Caffeinated Sparkling Water.

- Natural/mineral sparkling water held the largest share of more than 60.0% in 2020. The growing demand for natural and healthy water among consumers is driving the segment.

- The flavored variants are increasingly preferred owing to their taste, dizziness, and health benefits.

- The caffeinated segment is projected to register the fastest CAGR of 12.6% from 2021 to 2028.

- Caffeinated sparkling water is calorie- and sugar-free but contains added caffeine to boost energy levels. These drinks are a good substitute for coffee drinks, sweetened teas, and conventional energy drinks.

- Flavored caffeinated sparkling water held the largest share of 85.4% in 2020. The growth of this segment is attributed to rising consumer demand for different flavors such as berry, orange, cucumber, and lemon.

Sparkling Water Regional Outlook

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

Mergers & acquisitions and product launches are among the key strategies taken up by the market players. For instance, in January 2020, Keurig Dr Pepper Inc. acquired Limitless, a U.S.-based caffeinated sparkling water company. This acquisition has widened Keurig Dr Pepper’s water portfolio and through this acquisition, the company entered the caffeinated sparkling water market.

Some prominent players in the global sparkling water market include:

- Nestlé

- PepsiCo, Inc.

- National Beverage Corp.

- Talking Rain

- Keurig Dr Pepper Inc.

- The Coca-Cola Company

- Danone S.A.

- SANPELLEGRINO S.P.A

Order a free sample PDF of the Sparkling Water Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment