U.S. E-cigarette & Vape Industry Overview

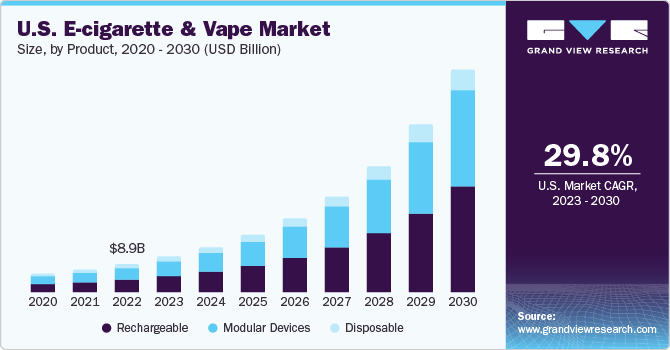

The U.S. e-cigarette & vape market size is expected to reach USD 40.25 billion by 2028, according to a new report by Grand View Research, Inc. It is projected to register a CAGR of 27.3% from 2021 to 2028. Various factors, such as the rapid growth of vape shops in the U.S. and the increasing popularity of e-cigarettes among the youth population, is expected to drive the market growth over the forecast period. E-cigarettes and vape mods are being increasingly used by users as a substitute for smoking traditional cigarettes.

Due to the increasing health concern over the usage of conventional tobacco cigarettes, the market is expected to witness significant growth. The U.S. owns the widest e-cigarette and vape mod distribution network for sale. However, the new taxation rules among the states of the country are expected to act as potential threats to market growth during the forecast period.

U.S. E-cigarette & Vape Market Segmentation

Grand View Research has segmented the U.S. e-cigarette and vape market based on product, component, and distribution channel:

Based on the Product Insights, the market is segmented into Disposable, Rechargeable, and Modular Devices.

- The rechargeable segment led the market and accounted for more than 45.0% share of the global revenue in 2020. The lower costs of rechargeable cigarettes are expected to drive the adoption of these devices among users. A rechargeable cigarette is a battery-powered vaping device, which can be reused and refilled.

- The modular devices segment is anticipated to register the highest growth over the forecast period. These devices are widely adopted by users as these devices have larger batteries and hold more e-liquid. These devices’ features include voltage control, wattage control, and temperature control, among others.

Based on the Component Insights, the market is segmented into Atomizer, Vape Mod, Cartomizer, and E-liquid.

- The vape mod segment dominated the market and accounted for more than a 51.0% share of the global revenue in 2020. Increasing demand for customized mods is expected to propel the segment growth over the forecast period. With these mods, customers can automatically control temperature levels.

- The e-liquid segment is anticipated to register the highest growth over the forecast period. The e-liquids are easily available in numerous flavors such as menthol, chocolate, fruit and nuts, and tobacco, which is expected to encourage the usage of e-l iquids.

Based on the Distribution Channel Insights, the market is segmented into Online, and Retail Store.

- The retail store segment led the market and accounted for more than 84.0% share of the global revenue in 2020. Retail stores allow customers to try out numerous e-liquid flavors and check the various kinds of vaporizers available in the market. Users choose to visit these retail stores to make these purchases.

- The online segment is anticipated to register the fastest over the forecast period. Numerous vendors in the U.S. are opting for online channels as their preferred distribution channel over the retail stores due to stringent regulations about the sale and distribution of e-cigarettes.

Key Companies Profile & Market Share Insights

Prominent players in the market are adopting various strategies, such as product innovation, strategic joint ventures, partnerships, mergers and acquisitions, geographical expansion, research and development initiatives, to strengthen their foothold in the market. Moreover, players are focusing on offering their products through retail stores as well as online platforms. Players are also focusing on customizing their products, considering various factors into consideration, such as design and battery power. Also, e-liquid manufacturers are focusing on producing a variety of flavors of e-liquid and in different strengths.

Players are focusing on using lithium-ion rechargeable battery in electronic smoking devices. Moreover, vendors are focusing on launching a new product. For instance, in October 2018, Philip Morris International launched the next generation of IQOS-heated tobacco products. Through this initiative, the company aims at encouraging a large number of smokers to switch to e-cigarettes.

Some of the prominent players in the U.S. e-cigarette & vape market include:

- Reynolds American Inc.

- Imperial Brands

- Altria Group, Inc.

- Japan Tobacco Inc.

- Philip Morris International

- International Vapor Group

- British American Tobacco

- NicQuid

- Shenzhen IVPS Technology Co., Ltd.

- Shenzhen KangerTech Technology Co., Ltd.

Order a free sample PDF of the U.S. E-cigarette & Vape Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment