Barite Industry Overview

The global barite market size is expected to reach USD 1.59 billion by 2028, according to a new report by Grand View Research, Inc. It is expected to expand at a CAGR of 3.7% from 2021 to 2028. Rising investments in increasing offshore explorations in the oil and gas industry are anticipated to augment the market growth over the forecast period.

An increase in global oil and gas production is anticipated to augment the market growth as barite is widely used as a weighting agent in drilling operations. The COVID-19 pandemic affected the product demand in 2020, which was reflected in the decline of the market growth. However, with vaccine roll-out and safety precautions being adhered to by oil and gas producers, the production is gaining pace and with the upcoming investments, the demand for barite is expected to flourish.

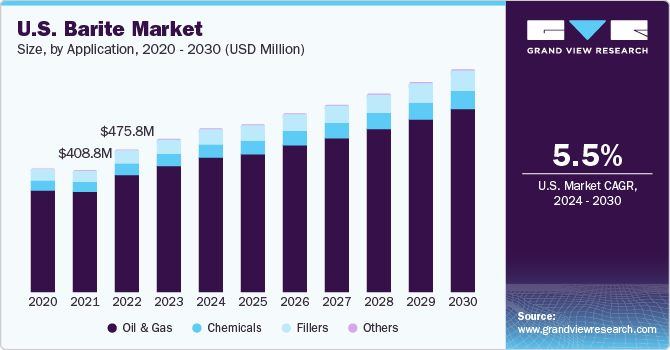

The U.S. is amongst the leading consumers of barite. The country mainly utilizes the product as a weighting agent in fluids that are used in the drilling of oil and gas. It is also used as an extender and filler in plastic, rubber, and paints. The country consumed around 3 million tons of barite in 2019, of which the majority of the portion was imported.

Barite Market Segmentation

Grand View Research has segmented the global barite market on the basis of application and region:

Based on the Application Insights, the market is segmented into Oil & Gas, Chemicals, Fillers, and Others.

- The oil and gas segment accounted for the largest revenue share of over 77.0% in 2020 and this trend is expected to continue over the forecast period. In the oil and gas industry, the product is employed as a weighing agent in the formulation of drilling mud.

- The chemicals segment held the second-largest revenue share in 2020.

- Barite is used as a feedstock for manufacturing barium-containing compounds, which are widely employed in a variety of end-use sectors.

- The barite-derived compounds find application in industries, such as ceramics, glass, and construction.

- The characteristics of barite enhance the properties of the final product. This is anticipated to positively influence its usage in different chemicals over the forecast period.

- Barite is also preferred as a filler in various applications, including paints, plastic, coatings, and paper. In paints, it helps in adjusting thickness and increasing its stability and brightness. It also offers smoothness to undercoats along with chemical resistance to the walls.

- The paints and coatings industry is expected to witness high growth on account of the increased spending on the renovation and construction of new houses, which is expected to prove fruitful for the product demand.

Barite Regional Outlook

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa (MEA)

Key Companies & Market Share Insights

The market is competitive due to the presence of various players. According to the USGS, China and India are major barite producers in the world. Market players are engaged in mergers & acquisitions and capacity expansions to cater to the growing demand and widen their geographical footprints. For instance, in April 2021, CIMBAR Performance Minerals acquired the U.S. Barite and Alumina Trihydrate manufacturing assets and business of TOR Minerals. The acquisition aims at broadening CIMBAR’s portfolio and increasing its customer reach across multiple locations.

Some prominent players in the global barite market include:

- Andhra Pradesh Mineral Development Corporation Ltd.

- Ashapura Group

- Excalibur Minerals LLC

- P & S Barite Mining Co. Ltd.

- Schlumberger Limited

Order a free sample PDF of the Barite Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment