Incontinence and Ostomy Care Products Industry Overview

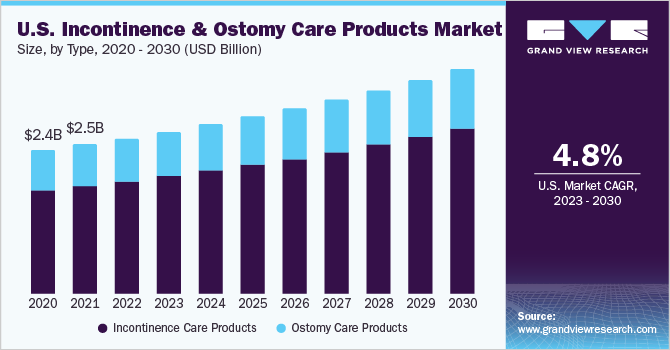

The global incontinence and ostomy care products market size is anticipated to reach USD 23.0 billion by 2028, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 5.1% from 2021 to 2028. The increasing incidence of colorectal cancer and urological diseases, such as Inflammatory Bowel Disease (IBD), urinary incontinence, and benign prostatic hyperplasia is anticipated to boost the market growth.

The growing risk of colorectal and urinary bladder cancer has increased the demand for ostomy care products. Increasing awareness initiatives by several market players to raise cognizance regarding these prosthetic medical devices globally is successfully breaking the stigma and taboo associated with the use of these products. For instance, Coloplast is a leading market player and has recently published Ostomy Life Study Review to raise awareness and improve the standard of ostomy care. This helps in effective patient care, building their confidence, and inspires them to live a quality life.

Moreover, the outbreak of COVID-19 has spurred the demand for incontinence products used in home settings. Since the majority of consumers are aged/seniors, there is a higher demand for these products. Restrictions on movement at international borders have created an opportunity for local players to enter the market and meet the unmet demands of the end-users. In November 2020, NorthShore Care Supply announced a free trial of 2 bags of adult diapers and a discount on all absorbents for ICU Nurses or other COVID first responders.

Incontinence and Ostomy Care Products Market Segmentation

Grand View Research has segmented the global incontinence and ostomy care products market on the basis of type and region:

Based on the Type Insights, the market is segmented into Incontinence Care Products and Ostomy Care Products.

- The adsorbents segment dominated the market for incontinence and ostomy care products and accounted for a revenue share of 74.9% in 2020.

- The segment is expected to expand at the highest CAGR of 5.5% from 2021 to 2028. This is owing to high usage rates and the rising popularity of disposable adult diapers, as well as the growing geriatric population and increasing prevalence of bladder-related conditions.

- Moreover, the introduction of innovative and personalized products targeting the achievement of user-friendliness and comfort and the gradual de-stigmatization of products such as adult diapers are some of the factors justifying the growth of the segment over the forecast period.

- Whereas, the ostomy care segment covers a wide range of products, such as ostomy bags, deodorants, skin barriers, and irrigation products.

- Ostomy bags dominated the ostomy care products segment with a revenue share of over 24.7% in 2020.

- This segment is also expected to grow at the fastest rate during the forecast period on account of the high prevalence of diseases such as Crohn's disease, colorectal cancer, and Inflammatory Bowel Disease (IBD), a high number of colostomy surgeries, and rising patient awareness levels.

- Also, the introduction of user-friendly and skin-friendly ostomy bags is expected to drive the growth of the market for incontinence and ostomy care products.

Incontinence & Ostomy Care Products Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The key players are focused on launching new types of ostomy and incontinence care products and accessories, technological advancements, and growth strategies, such as mergers and acquisitions. For instance, in June 2020, B. Braun Melsungen AG launched virtual support services (Emerald Nursing Service) during the COVID-19 crisis to help weak patients at home with acute bladder problems. This service delivers incontinence and ostomy care products to patients at home by providing facetime video tutorials and advice on usage.

Moreover, major players are adopting various strategies to gain higher market share such as new product launches, mergers and acquisitions, and geographic expansion. For instance, in April 2020, Essity acquired Novioscan—a Dutch-based company that designs and manufactures wearable ultrasound technology—for approximately USD 8.0 million in cash. This device helps monitor the bladder and enables continence control. Thus, such developments are expected to significantly influence market growth over the forecast period.

Some of the prominent players in the incontinence and ostomy care products market include:

- Coloplast Corp.

- Essity (Svenska Cellulosa Aktiebolaget)

- KCWW (Kimberly-Clark Corporation)

- Braun Melsungen AG

- Hollister Incorporated

- Unicharm Corporation

- ConvaTec Group Plc

- Welland Medical Ltd.

- Domtar Corporation

- Salts Healthcare Ltd.

Order a free sample PDF of the Incontinence & Ostomy Care Products Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment