Carrageenan Industry Overview

The global carrageenan market size is expected to reach USD 1.25 billion by 2028, according to a new report by Grand View Research, Inc. It is expected to expand at a CAGR of 6.0% from 2020 to 2028. The rising demand for plant-based thickeners and stabilizers for replacing synthetic and animal-derived ingredients in food and beverage applications is expected to drive the product demand.

Increasing product penetration in dairy and processed meat products on account of carrageenan’s mouth feel characteristics to imitate fatty feeling is expected to boost the market growth over the forecast period. The primary factor contributing to the wide usage of carrageenan in the food industry is its capability to bind with water and enhance the properties of food ingredients. A rising preference for food and pharmaceutical products with ingredients derived from plant sources instead of animal-derived ingredients, such as gelatin, is likely to increase the product demand.

Carrageenan Market Segmentation

Grand View Research has segmented the global carrageenan market on the basis of processing technology, function, product type, application, and region:

Based on the Product Type Insights, the market is segmented into Kappa, Iota, and Lambda.

- The kappa segment accounted for the largest revenue share of 67.8% in 2020. It is the most used product type in ice creams, cheese, puddings, and chocolates.

- Lambda held a relatively lower revenue share in 2020 and is majorly prepared by the alcohol precipitation method.

Based on the Processing Technology Insights, the market is segmented into Alcohol Precipitation, Gel Press, and Semi-refined.

- Semi-refined technology dominated the market with a revenue share of more than 50.0% in 2020.

- The advent in technology has led to the emergence of food-grade semi-refined carrageenan, increasing its application in food products, thereby boosting its demand.

- In the majority of the countries across the globe, semi-refined carrageenan has been tested safe for human consumption and thus can be used in food applications.

- Alcohol precipitation is traditionally used for carrageenan extraction from seaweed, which gives a refined and purified form of the product.

- However, multiple steps involved in the alcohol precipitation method increase the cost of overall processing, which is expected to hamper the segment growth.

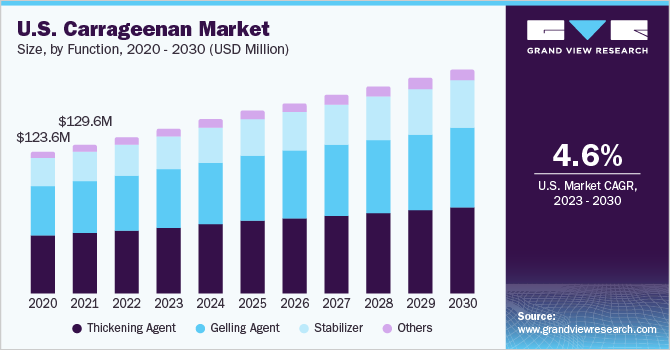

Based on the Function Insights, the market is segmented into Thickening Agent, Gelling Agent, Stabilizer, and Others.

- The thickening agent segment held the largest revenue share of 39.2% in 2020. This can be attributed to the rising demand for clean-label thickeners in the food and pharmaceutical industry.

- The gelling agent segment held a significant revenue share in 2020 owing to the increasing demand for plant-derived gelling additives that can be readily used in vegan products.

- The stabilizer segment is expected to grow rapidly with a surge in demand from the bakery, confectionery, and beverage applications. Stabilizers are used to prevent the formation of undesirable ice crystals and improve the texture properties of the product.

- For instance, a carrageenan stabilizer can improve the mouthfeel of beverages, such as kombucha and coconut water.

Based on the Application Insights, the market is segmented into Food & Beverage, Pharmaceutical, Personal Care & Cosmetics, and Others.

- The food and beverage segment dominated the market with a value share of 72.1% in 2020. Carrageenan finds application in bakery, dairy, and meat products and beverages.

- The personal care and cosmetics segment is expected to expand at the highest revenue-based CAGR over the projected period on account of the rising applications of the product in the end-use market.

Carrageenan Regional Outlook

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The companies active in the market are focusing on partnerships with small-sized companies having a strong foothold in the local markets. For instance, in August 2020, CP Kelco and Biesterfeld announced an expansion of their partnership in the food and nutrition segment in Europe. As a part of this partnership, Biesterfeld is expected to distribute the former’s carrageenan products in European countries.

Major players engaged in the manufacturing of carrageenan have a global reach owing to their wide geographical presence with several manufacturing facilities and sales offices spread across the major continents.

Some prominent players in the global carrageenan market include:

- DuPont

- Ingredion Incorporated

- Ashland

- CP Kelco U.S., Inc.

- Cargill, Inc.

- Ceamsa

- W Hydrocolloids, Inc.

- Gelymar

- Caldic B.V.

- Ina Food Industry Co. Ltd.

- Gumindo Perkasa Industri

- ACCEL Carrageenan Corporation

Order a free sample PDF of the Carrageenan Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment