Mobile Phone Insurance Industry Overview

The global mobile phone insurance market size is expected to reach USD 59.97 billion by 2028, registering a CAGR of 12.6% from 2021 to 2028, according to a new study by Grand View Research, Inc. The growth is attributable to the increasing number of smartphone users across the globe. The market growth can also be ascribed to the growing demand for smartphones that are used for entertainment, education, news, and digital transactions.

Additionally, the growing usage of smartphones, as well as mobile applications, is expected to favor market growth. Convenient claim service is also expected to contribute to the overall market growth over the forecast period. Mobile phone insurance helps avoid expensive replacement costs incurred due to the loss or breakdown of mobile phones. Damages such as physical damage and electronic damage, theft protection, and cyber-threat protection are usually covered under a mobile phone insurance policy. This is anticipated to encourage customers to opt for such insurance policies over the forecast period.

Mobile Phone Insurance Market Segmentation

Grand View Research has segmented the global mobile phone insurance market based on coverage, phone type, and region:

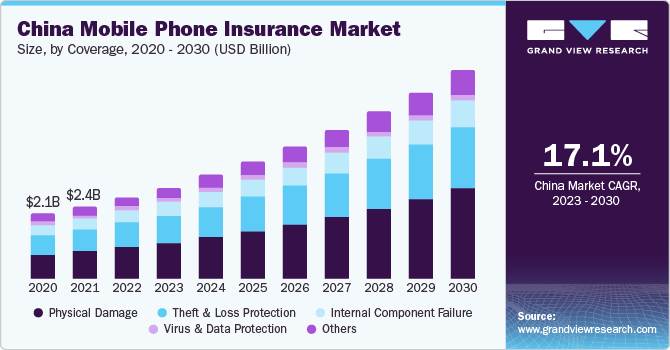

Based on the Coverage Insights, the market is segmented into Physical Damage, Internal Component Failure, Theft & Loss Protection, Virus & Data Protection, and Others.

- The physical damage segment accounted for the highest market share of more than 37% in 2020.

- Physical damage protection is the most prominent damage protection plan insured by maximum users since mobile phone devices are highly prone to physical damages such as cracks in the circuit board, screen damages, and so on.

- Loss and theft protection is expected to emerge as the second fastest-growing segment over the forecast period owing to the rapidly increasing incidences of smartphone theft.

- The internal coverage failure segment is anticipated to witness considerable growth over the forecast period. The electronic damages are caused by overcharging and voltage fluctuations, among others.

- The plans in this segment also offer protection against the gradual deterioration of electronic coverages, parts, and accessories.

- Potential cyberattack threats, such as trojans and botnets are compelling users to secure their devices, leading to considerable growth of the virus and protection segment.

Based on the Phone Type Insights, the market is segmented into Budget Phones, Mid & High-end Phones, and Premium Smartphones.

- The premium smartphone segment held a market share of over 60% in 2020.

- Though the premium smartphone segment witnessed the highest market share in 2020, the mid-end smartphone segment is anticipated to emerge as the fastest-growing segment over the forecast period owing to the growing penetration of mid-end smartphones globally.

- The rapid advancements in technology and decreasing costs of mid-end smartphones are encouraging users to opt for mid-end smartphones than premium smartphones. Thus, mobile phone insurance companies are now heavily capitalizing on insurance plans specific to mid and high-end smartphones. This is expected to drive the growth of the segment over the forecast period.

Mobile Phone Insurance Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

Mobile phone insurance providers are focusing on collaborating with telecommunication operators to increase their regional presence. For instance, in 2018, Assurant, Inc. announced its partnership with KDDI Corporation, a Japanese telecommunications operator. This partnership was undertaken to offer an improved mobile device support program for Apple customers through KDDI Corporation. The program was named Damage and Loss Support with AppleCare Services, which included loss and theft services that allowed the replacement of a customer’s phone with an Apple-certified device, along with next-day replacement service. The program is available to customers via shops or offline stores across the globe as well as via KDDI’s online channel.

Some prominent players operating in the global mobile phone insurance market are:

- Apple Inc.

- American International Group, Inc.

- Assurant, Inc.

- Asurion

- AT&T Inc.

- AmTrust Financial

- Brightstar Corp.

- GoCare Warranty Group

- SquareTrade, Inc.

- Taurus Insurance Services Limited

Order a free sample PDF of the Mobile Phone Insurance Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment