Carbonated Soft Drink Industry Overview

The global carbonated soft drink market size is expected to reach USD 320.1 billion by 2028, according to a new report by Grand View Research, Inc. It is expected to expand at a CAGR of 4.7% from 2021 to 2028. The demand for carbonated soft drinks is influenced by an increased disposable income, customer preferences, and a growing population. The industry has numerous prominent players who are similar in size and product offerings. Many of these leaders create new product lines and actively participate in advertising wars. As numerous competitors are equally balanced, competitor rivalry is intense.

Carbonated soft drinks are being innovated in terms of taste, appearance, texture, and ingredients depending upon the target age group. Soft drinks, specially designed for children and the elderly, are usually tailored to the appropriate needs of these consumer groups and an increasing number of players catering to these two segments can be seen mushrooming in the market.

Carbonated Soft Drink Market Segmentation

Grand View Research has segmented the global carbonated soft drink market on the basis of flavor, distribution channel, and region:

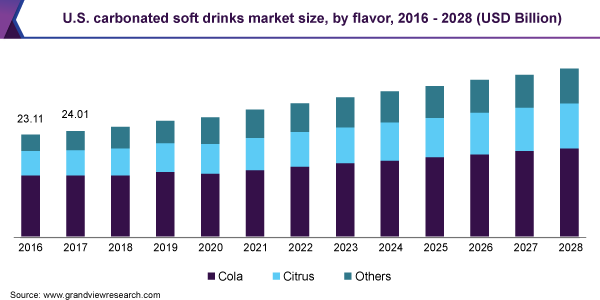

Based on the Flavor Insights, the market is segmented into Cola, Citrus, and Others.

- Cola flavor accounted for the largest share of more than 50.0% in 2020. Cola flavored carbonated Soft Drinks enjoy the dominance owing to the first mover’s advantage.

- The citrus segment is expected to expand at the fastest CAGR of 4.9% from 2021 to 2028.

- The industry participants are expected to increase spending on developing carbonated soft drinks fortified with citrus flavors in order to expand their reach

Based on the Distribution Channel Insights, the market is segmented into Hypermarkets, Supermarkets & Mass Merchandisers, Convenience Stores & Gas Stations, Food Service Outlets, Online Stores & D2C, and Others.

- Hypermarkets, supermarkets & mass merchandisers accounted for the largest share of over 20.0% in 2020. Many consumers prefer buying soft drinks from supermarkets and general merchandisers due to the shopping experience offered by these stores.

- With the rising income levels and increasing urbanization, modern supermarkets and hypermarkets have emerged across the globe.

- The online stores and D2C segment is expected to register the fastest CAGR of 6.1% from 2021 to 2028. An increasing number of online retailers, who offer competitive pricing, are boosting the growth of this sales channel.

- The growth can also be attributed to the increasing familiarity/dependency of generation X, millennials, and generation Z with/on the Internet and e-commerce.

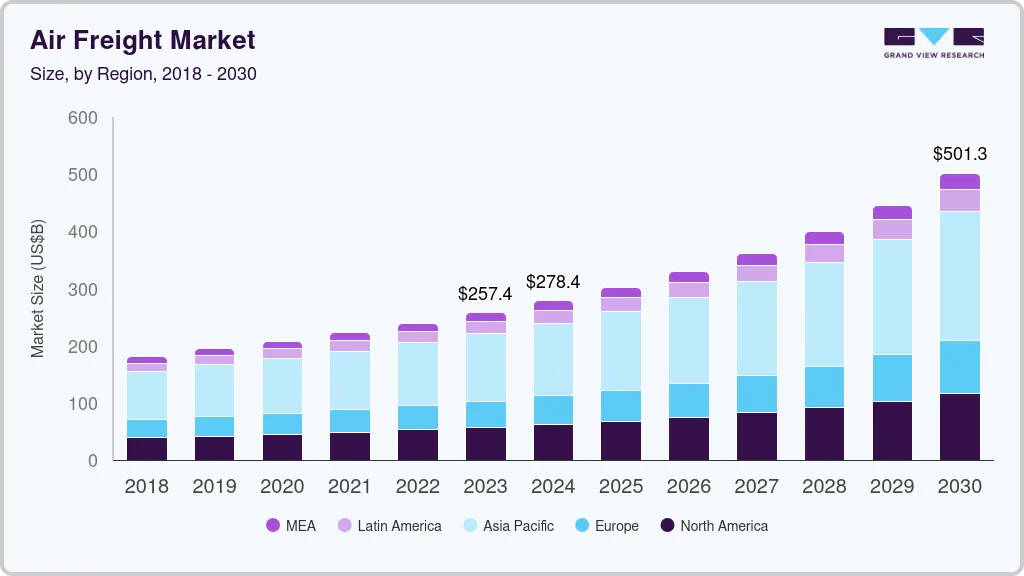

Carbonated Soft Drinks Regional Outlook

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

New product launches are expected to remain key strategies among the industry participants over the next few years. In January 2021, PepsiCo launched two new products under its carbonated soft drinks category, namely Major Melon Zero Sugar and Mtn Dew Major Melon. The company expects to offer a nostalgic taste to its consumers through this new carbonated soft drink product. It is available in 20-ounce bottles and 12-ounce bottles in a pack of 12.

Some prominent players in the global carbonated soft drink market include: -

- ANADOLU GRUBU A.Åž.

- COCA-COLA FEMSA

- Danone

- JONES SODA CO.

- Keurig Dr Pepper Inc.

- Monster Energy Company

- National Beverage Corp.

- PepsiCo

- Refresco Group

- SODASTREAM INTERNATIONAL LTD.

- SUNTORY BEVERAGE & FOOD LIMITED

- The Coca-Cola Company

Order a free sample PDF of the Carbonated Soft Drinks Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment