MEA Aluminum Extrusion Industry Overview

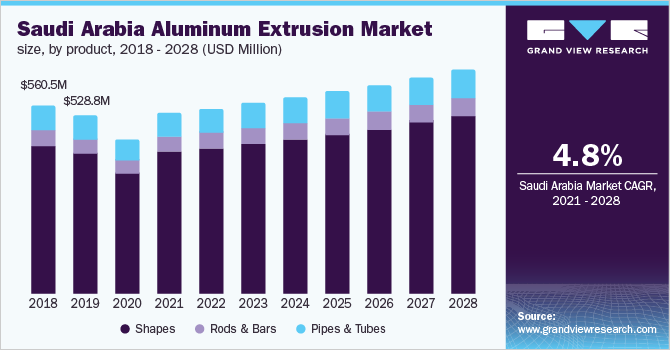

The MEA aluminum extrusion market size is expected to reach USD 2.23 billion by 2028, according to a new report by Grand View Research, Inc., expanding at a CAGR of 4.0% over the forecast period. The demand for aluminum extrusion products in UAE and Saudi Arabia is expected to drive market growth over the long term.

The increasing use of aluminum products in vehicles is projected to drive market growth over the forecast period. Aluminum extrusions are used in the automobile industry for various applications, such as rear subframes, door instruction beams, seat cross members, stiffeners, front bumper beams, brake, suspension, and steering components. These different applications of aluminum can significantly reduce the weight of vehicles. Hence, the share of automotive applications in the aluminum extrusion market is likely to witness strong growth over the forecast period.

MEA Aluminum Extrusion Market Segmentation

Grand View Research has segmented the MEA aluminum extrusion market on the basis of product, application, and region:

Based on the Application Insights, the market is segmented into Building & Construction, Automotive & Transportation, Consumer Goods, Electrical & Energy, and Others.

- Building & construction was the largest application segment in 2020 with a revenue share of over 72%. This trend is expected to continue during the forecast period, considering the ongoing infrastructural developments in the construction industry in MEA.

- The automotive & transportation application segment is expected to grow at a significant CAGR during the forecast period.

- Aluminum extrusions have wide applications in cross rails, seat tracks, longitudinal beams, engine mounts, radiator beams, fuel distribution pipes, anti-intrusion beams, tailgate frames, and roof rails among others.

- Another prominent factor that is likely to fuel the growth of the regional market is the construction of new metro lines in Kuwait and Bahrain.

- In terms of volume, the electrical & energy segment depicts high growth and penetration in 2020. The growth is attributable to the upcoming renewable energy projects, which are being constructed to reduce carbon dioxide emissions in the region.

Based on the Product Insights, the market is segmented into Shapes, Rods & Bars, and Pipes & Tubes.

- The shapes product segment accounted for the largest volume share of over 79% in 2020. The segment is also expected to register the fastest CAGR over the forecast period owing to advantages, such as ease of fabrication and durability, of aluminum.

- Significant growth in infrastructural developments in the Middle East & Africa region is likely to augment the demand for aluminum extruded shapes over the forecast period.

- Aluminum extruded rods & bars are widely used in electrical transmission lines as aluminum transmits double the electric current per pound than copper, making it a cost-effective solution.

MEA Aluminum Extrusion Regional Outlook

- Saudi Arabia

- UAE

- Oman

- Qatar

- Bahrain

- Kuwait

Key Companies Profile & Market Share Insights

The market is fragmented due to the presence of small- and medium-sized players. Organic and inorganic growth strategies including new product innovation, capacity expansion, and joint ventures provide a competitive edge to these players. Some of the players are focusing on achieving economies of scale through optimization of operations and processes at manufacturing plants.

In the UAE, a large amount of manufactured aluminum extrusion is domestically consumed while Gulf Extrusions LLC, the largest player in the region, exports 30% of its total products internationally. Its plant in Jebel Ali has an annual production capacity of 60,000 tons.

Some of the prominent players operating in the MEA aluminum extrusion market are:

- Alupco

- Gulf Extrusions Co. LLC

- Taweelah Aluminum Extrusion Co. (TALEX) LLC

- National Aluminum Products Company SAOG (NAPCO)

- Balexco Bahrain Aluminium Extrusion Company

- Emirates Extrusion Factory LLC

Order a free sample PDF of the MEA Aluminum Extrusion Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment