Aerial Work Platform Industry Overview

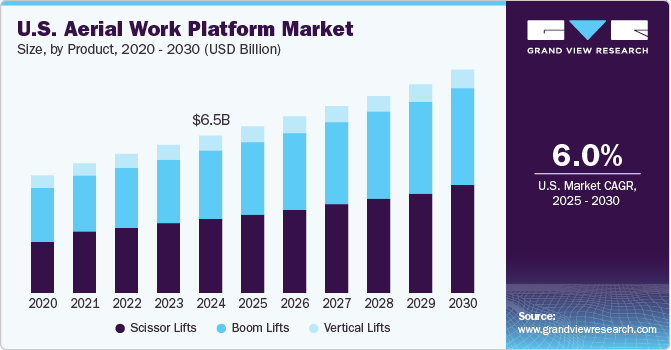

The global aerial work platform market size is anticipated to reach USD 25.91 billion by 2028, registering a CAGR of 6.5% over the forecast period, according to a new report by Grand View Research, Inc. The rising demand for aerial work platforms (AWPs) is attributed to their widespread utilization in end-use industries, such as construction, transportation & logistics, retail, storage, and warehouse. Increasing construction activities across the globe are expected to open new growth avenues for the market. Rising government investments in the construction of residential buildings, commercial complexes, and public transport infrastructure, are expected to propel the demand for aerial lifts over the forecast period.

Recent years have witnessed a positive trend in the demand for different types of AWPs, especially boom lifts and scissor lifts, in various end-use industries, such as construction, retail stores & warehouses, and transportation & logistics. These aerial platforms reduce human efforts to a large extent and help reach inaccessible heights with comfort. The global market exhibits the dominance of well-established players, such as Terex Corp., MEC, Aichi Corp., Haulotte Group, and Linamar Corp. The established players in the industry exhibit higher sales and a broader distribution network along with a wider product line.

Aerial Work Platform Market Segmentation

Grand View Research has segmented the global aerial work platform market on the basis of engine type, product type, end use, and region

Based on the Product Type Insights, the market is segmented into Scissor Lifts, Boom Lifts, Vehicle-mounted Platforms, and Others.

- Boom lifts led the market and accounted for 63.5% of the global revenue share in 2020. Boom lifts provide greater flexibility compared to scissor lifts. They use hydraulic arms that are capable of maneuvering around obstacles leading to higher flexibility.

- Scissor lifts have low cost and a higher operating efficiency owing to the compact design and ability to perform repetitive loading tasks with high speed.

- Vehicle-mounted platforms include scissor as well as boom lifts, which are mounted on the vehicles. The segment is expected to grow at a CAGR of 5.8% over the forecast period.

Based on the Engine Type Insights, the market is segmented into Electric and Engine-powered.

- The electric AWP led the market and accounted for 71.7% of the global revenue share in 2020. Electric AWP is primarily used for indoor applications as they have a lower turning radius.

- Electric aerial lifts are expected to witness a high growth rate over the forecast period owing to their high capacity and zero emission.

- The engine-powered AWP segment is expected to witness a CAGR of 5.7% over the forecast period, which is driven by the higher demand for diesel engine-operated lifts used for outdoor applications with a heavy load.

Based on the End-use Insights, the market is segmented into Rental, Construction & Mining, Transportation &Logistics, and Others.

- The rental end-use segment led the market and accounted for 92.6% of the global revenue share in 2020.

- Construction sites involve accessing higher heights and majorly use rough terrain aerial platforms. Increasing construction activities in developing countries, such as China, India, and Brazil, are expected to drive the demand for AWPs.

- The demand for AWPs in the transportation and logistics sector is projected to register a CAGR of 8.0% over the forecast period. A rising number of supermarkets and the growing e-commerce industry have increased the number of warehouses and logistic centers around the globe.

- Growing e-commerce business and rapid globalization have boosted the trade activities around the globe, which are expected to drive the demand for AWPs.

AWP Regional Outlook

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

Key manufacturers focus majorly upon offering quality-certified equipment to ensure the safety and protection of workers. In addition, companies are investing in the research & development of advanced quality AWPs. Moreover, the companies, such as Galmon (Singapore), EdmoLift AB, Haulotte Group, and Shandong Qiyun Group Co., Ltd., offer customized solutions to meet the needs of the application industries.The companies operating in the market are also involved in mergers & acquisitions to diversify their presence and gain higher market shares. For instance, in August 2020, Zhejiang Dingli Machinery Co., Ltd. acquired 24% of Trupen’s stock rights. Trupen is one of the leading players engaged in the design, research, development, manufacturing, and sales of spider AWPs.

Some prominent players in the global aerial work platform market include:

- Terex Corp.

- MEC

- JLG Industries

- Galmon (Singapore)

- Aichi Corp.

- EdmoLift AB

- Wiese USA

- Linamar Corp.

- Advance Lifts, Inc.

- Haulotte Group

Order a free sample PDF of the AWP Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment