Surfing Equipment Industry Overview

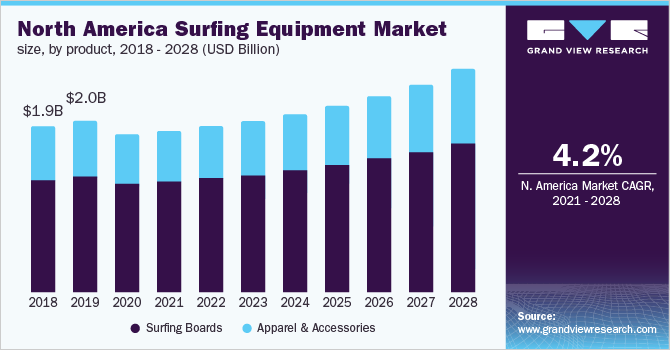

The global surfing equipment market size is anticipated to reach USD 5.47 billion by 2028, registering a CAGR of 4.4% over the forecast period, according to a new report by Grand View Research, Inc. The primary factor driving the market growth is the push by surfing equipment manufacturers, marketers, and associations to make surfing much more approachable than it has been in previous years. In addition, increased interest in surfing due to the growing focus of consumers on wellness and fitness will support the market growth. Over the years, surf tourism has had a considerable impact on the demand for surfing equipment and apparel.

In recent years, increased accessibility and affordability have attracted a large number of surfers from many demographic groups. Due to the use of wave pools for training, surfing has become more accessible to people who do not live near a beach. Surfers who can access these pools can train regardless of the weather and at any time of the day. Thus, an increasing number of wave pools has increased the demand for surfing equipment.

Surfing Equipment Market Segmentation

Grand View Research has segmented the global surfing equipment market on the basis of product, distribution channel, and region:

Based on the Product Insights, the market is segmented into Surfing Boards, and Apparels & Accessories.

- The surfing boards segment dominated the market with a revenue share of more than 68% in 2020. During the forecast period, sales of surfing boards will be boosted due to the rising engagement in surfing, growing surf tourism, and increasing disposable income levels.

- Single-fin, double-fin, quad, five-fin, and thruster settings are common fin types. Although short boards are favored due to their improved performance, professional surfers prefer long boards.

- The infusion of new surfers has been a major role in fueling market demand.

- With gyms and other outdoor gaming activities being shut due to the pandemic, young novices and adults alike turned to surfing as a socially isolated, entertaining activity.

Based on the Distribution Channel Insights, the market is segmented into Online and Offline.

- The offline distribution channel segment accounted for the largest revenue share of over 85% and will retain its leading position throughout the forecast period.

- However, the online segment is estimated to register the fastest CAGR from 2021 to 2028 due to technical improvements and the increasing importance given to online platforms for purchasing surfing equipment, particularly by consumers looking for bargains.

- The main target demographic for online platforms is customers who are comfortable purchasing things without physically inspecting them.

- To boost product sales and profit margins, most manufacturers have turned to the direct sales approach.

Surfing Equipment Regional Outlook

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

The market is fragmented owing to the presence of a large number of domestic as well as international players. However, a majority of the market share is captured by key players like Billabong, Quiksilver, Inc., and Hurley, Inc. These companies control a significant portion of the market and have a global presence. Small- and medium-sized local firms compete in the surfing gear and accessories industry, offering a limited selection of products at significantly lower prices to primarily target regional customers. Smaller players have a better grip and reach in the regional markets, thus, global brands face stiff competition from local players.

To boost their market position, most corporations are focusing on mergers and acquisitions, acquiring shares in regional companies to expand their geographical presence, broadening their product ranges, and expanding customer reach. The brands are also focusing on new product launches and mergers to expand their geographical reach. For example, Volcom, LLC, a California-based board-sports company, has teamed up with China Ting Group to increase its presence in China.

Some of the key companies in the global surfing equipment market are:

- Billabong

- Quiksilver, Inc.

- JS Industries

- Channel Islands Surfboards

- Nike, Inc.

- Firewire Surfboards, LLC

- Rusty Surfboards

- Rip Curl. Ltd.

- Cannibal Surfboards

- O’Neill

Order a free sample PDF of the Surfing Equipment Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment