Brain Implants Industry Overview

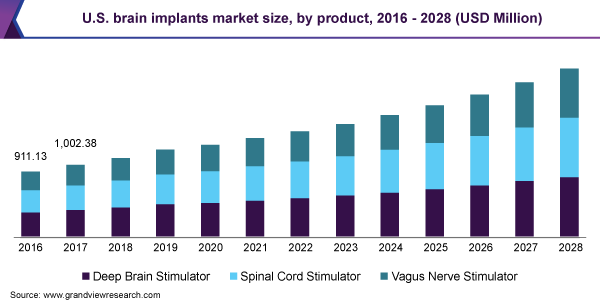

The global brain implants market size is anticipated to reach USD 9.2 billion by 2028, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 9.1% from 2021 to 2028. The rise in neurological disorders such as epilepsy, Parkinson’s disease, depression, and tremors as well as growing investments in R&D to develop cost-effective brain implants is attributing to the growth of the market.

The presence of a large population base suffering from various neurological and physiological disorders and conditions is expected to boost the demand for implants during the forecast period. For instance, as per the Parkinson’s Foundation 2016 report, over 10 million people globally are living with Parkinson’s disease (PD). Thus, the increasing cases of PD are expected to drive the market. However, the outbreak of the COVID-19 pandemic is restricting the growth of the market. For instance, as per the Neuromodulation Society of the U.K. and Ireland, in the U.K. all the NHS hospitals were instructed to suspend all the non-urgent elective surgeries due to the pandemic from 15th April in 2020 for at least three months.

Brain Implants Market Segmentation

Grand View Research has segmented the global brain implants market on the basis of product, application, and region:

Based on the Product Insights, the market is segmented into Deep Brain Stimulator, Spinal Cord Stimulator, and Vagus Nerve Stimulator.

- The deep brain stimulators segment dominated the market for brain implants and accounted for the largest revenue share of 37.0% in 2020, owing to its use in various applications in neurological disorders.

- The growing adoption of DBS for the treatment of various neurological disorders including obsessive-compulsive disorder, Parkinson’s diseases, dystonia, essential tremor, epilepsy, and Alzheimer’s disease is a key growth driver of this segment.

- The vagus nerve stimulator segment is expected to grow at the highest compound annual growth rate (CAGR) of 9.5% from 2021 to 2028, owing to applications in the treatment of various disorders such as anxiety, migraines, fibromyalgia, tinnitus, and obesity. It is mainly used to deliver electrical impulses to the vagus nerve.

- In addition, product launches with advanced technology are enhancing the quality of therapy. For instance, in 2017 Neuro Science company launched the first non-invasive vagus nerve stimulation therapy product called GammaCore. This is also likely to bolster market growth.

Based on the Application Insights, the market is segmented into Chronic Pain, Epilepsy, Parkinson’s disease, Depression, Essential Tremor, and Alzheimer’s disease.

- The chronic pain segment dominated the market for brain implants and accounted for the largest revenue share of 58.8% in 2020. An increase in the incidence of chronic pain has created clinical urgency for incorporating long-term solutions.

- The Parkinson’s disease segment is expected to witness the highest CAGR of 10.1% from 2021 to 2028 owing to the increasing number of the geriatric population who are prone to conditions such as Parkinson’s and Alzheimer’s diseases.

Brain Implants Regional Outlook

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Key Companies Profile & Market Share Insights

Developing cost-efficient and technologically advanced brain implants is the key focus of the companies operating in this market. Market leaders are involved in extensive research for the development of advanced brain implant technologies. Subsequently, the introduction of new products is expected to provide this market with lucrative growth opportunities. For instance, Abbott secured the U.S. FDA approval in September 2019 for its Proclaim XR recharge-free SCS system for chronic pain management. This system operates by utilizing low doses of electrical pulses that help extend the system's battery life for up to ten years.

Moreover, emerging players such as NeuroPace, Inc. and Synapse Biomedical Inc., are considered innovators for the market. Products offered by these competitors have a good price-performance proposition, competitive functionality, and are technologically advanced. These emerging companies are continuously investing in research and development activities as well as product commercialization events. For instance, in October 2017, NeuroPace, Inc. closed a USD 74 million funding round initiated by OrbiMed Advisors and KCK Groups. The funding will support the company’s ongoing efforts for rapid expansion and commercialization of its FDA-approved DBS product, the NeuroPace RNS system.

Some of the prominent players in the brain implants market include:

- Medtronic

- Boston Scientific Corporation

- Jude Medical (Abbott)

- NeuroPace, Inc.

- Nevro Corporation

- Synapse Biomedical Inc.

- Aleva Neurotherapeutics SA

Order a free sample PDF of the Brain Implants Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment