5G Radio Access Network Industry Overview

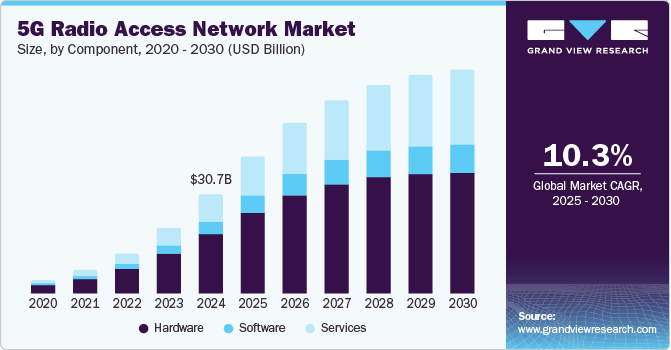

The global 5G Radio Access Networks Market reached a valuation of $30,650.2 million in 2024 and is projected to expand at an annual rate of 10.3% from 2025 to 2030. Factors such as the rising demand for low-latency bandwidth connections and an increased emphasis on research and development by key organizations are driving this market growth. Furthermore, the widespread deployment of 5G radio access networks (RAN) utilizing numerous small cells and macrocell base stations globally is propelling market growth.

Mobile network operators (MNOs) and network service providers are increasingly adopting centralized RAN and virtual RAN (VRAN) to lower overall infrastructure costs and network complexities. Additionally, the RAN enables enterprises and MNOs using private 4G or private 5G networks to offer network slicing solutions, allocating specific capacities to individual enterprises to segment network usage within a public mobile network. Technological innovations, combined with users' growing preference for 5G RAN solutions, are causing the industry to expand at a significant pace.

Detailed Segmentation:

- Component Insights

The services segment is anticipated to grow at a considerable CAGR of 13.9% throughout the forecast period. The services segment is further categorized into consulting, managed, and professional services. An increase in demand for consulting, maintenance services, design, and development due to the deployment of 5G radio access network telecom operators is anticipated to drive the growth of the market.

- Architecture Type Insights

The Open RAN (ORAN) is expected to grow at a highest CAGR of 19.7% during the forecast period. Open Radio Access Network (ORAN) technology allows the creation of multi-supplier RAN solutions enabling disaggregation or separation of hardware equipment and software platforms with virtualization and open interface. It hosts software to update and control network configurations in the cloud enabling 5G solution flexibility, new capabilities, and supply chain diversity. ORAN is crucial for enterprises employing private 5G in vendor-neutral hardware and software-defined technology for time-sensitive functions, such as load balancing and Quality of Services (QoS) management.

- Deployment Insights

In terms of deployment, the market is classified into indoor and outdoor. Among these, the outdoor segment is expected to dominate in 2023, gaining a market share of more than 58%. It is expected to grow at a CAGR of 8.7% throughout the forecast period. The increasing use cases of 5G, such as smart cities, industrial robotics, autonomous vehicles, smart factories & manufacturing, are propelling the demand for outdoor 5G RAN deployment. The outdoor segment offers extended 5G coverage range support for outdoor deployments at public places such as transport hubs, shopping centers, and stadiums is driving the growth of the market. With the rising deployment of public and private 5G, users can travel with high-speed data connectivity, which results in improved quality of calls and provides real-time traffic information to users.

- End-use Insights

The enterprise segment is anticipated to grow at a considerable CAGR of 16.9% throughout the forecast period. The enterprise segment comprises BFSI, healthcare, media & entertainment, smart city, government, retail, manufacturing, transportation & logistics, aerospace & defense. The increasing demand for 5G RAN from the aforementioned enterprise end use is propelling the growth of the market. The utilization of 5G has enabled industry automation, online consultations, streamlined operations, and immersive experiences, among others, in multiple enterprise End use with advanced technologies such as IoT, AR/VR, AI, big data, and machine learning.

- Regional Insights

The China 5G radio access network (RAN) market is expected to grow at a significant CAGR from 2025 to 2030. China has emerged as a global leader in 5G RAN deployment, showcasing rapid progress and extensive network coverage. The country's major telecom operators, such as China Mobile, China Telecom, and China Unicom, have made significant investments in 5G infrastructure, leveraging both domestic and international technologies. Huawei, a Chinese technology giant, has played a pivotal role in driving 5G development within China, providing end-to-end solutions and contributing to the country's technological advancements. While the US has imposed restrictions on Huawei's involvement in 5G networks, China has continued to expand its 5G footprint, focusing on domestic capabilities and alternative partnerships. The country's 5G deployment has paved the way for a wide range of applications and use cases, from smart cities and industrial automation to virtual reality and augmented reality experiences.

Gather more insights about the market drivers, restraints, and growth of the 5G Radio Access Network Market

Key Companies & Market Share Insights

The market is consolidated and is anticipated to witness increased competition due to several players' presence. Major players are spending heavily on research and development activities to integrate advanced technologies within 5G services and RAN has intensified the competition among these players.

Key 5G Radio Access Network Companies:

The following are the leading companies in the 5G radio access network market. These companies collectively hold the largest market share and dictate industry trends.

- Telefonaktiebolaget LM Ericsson

- Qualcomm Technologies, Inc.

- Nokia

- Rakuten Symphony Singapore Pte. Ltd

- Intel Corporation

- Samsung

- Verizon

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- VMware, Inc.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In October 2024, Du extended its contract with Nokia to expand its 5G network. The agreement will support Du in incorporating advanced 5G technologies like enhanced mobile broadband, network slicing, and edge computing. These capabilities will enable Du to provide future-ready network services to both consumer and enterprise customers.

- In October 2024, Software Radio Systems (SRS) launched srsRAN Enterprise 5G, a portable, full-stack software solution for private 5G networks. This Open RAN solution offers flexible deployment options and supports diverse user networks. srsRAN Enterprise 5G is designed for quick deployment using off-the-shelf hardware and is compatible with various compute platforms.

- In October 2024, Pegatron 5G, an O-RAN provider, launched the PR1450 O-RU and FHM, designed for indoor coverage in enterprise and public deployments. These solutions offer reliable connectivity, simplified network configurations, and flexibility for various 5G environments. The company is committed to supporting India's 5G infrastructure and "Make in India" policy.

No comments:

Post a Comment